Accounts receivable automation software is a technological solution that streamlines and simplifies the process of managing and collecting payments. It involves the use of software applications and tools to automate tasks that were traditionally done manually. This software is designed to improve efficiency, reduce errors, save time and ultimately enhance cash flow for businesses.

- Automates the payment collection process by providing various options for customers to pay electronically. These options can include credit card payments, electronic funds transfer (EFT), and online payment gateways. By automating payment collection, businesses can accelerate the receipt of funds, reduce the chances of payment delays or disputes, and improve overall collection rates.

- Accuracy and transparency are improved through automation. With electronic invoicing and real-time tracking of outstanding invoices, businesses can easily identify and address discrepancies or errors. This leads to better customer satisfaction and relationships, as companies can respond promptly to customer queries and concerns.

- Accounts receivable automation software provides valuable data and analytics that can drive strategic decision-making. By analyzing payment trends, customer behavior, and credit risks, businesses can make informed decisions about credit policies, pricing, and collection strategies. This data-driven approach can lead to improved profitability and growth.

Accounts receivable automation software revolutionizes the way businesses manage and collect their payments. By automating tasks such as invoicing, payment collection, credit management, and reporting, businesses can streamline processes, improve efficiency, and enhance cash flow. With its numerous benefits, accounts receivable automation software is increasingly becoming an essential tool for businesses of all sizes and industries.

Discover the top 15 accounts receivable automation software

BLACKLINE

BlackLine – optimize accounts receivable performance, create team capacity by removing manual processes, and gain critical decision intelligence to drive value.

- Optimize business performance

- Maximize AR team capacity and efficiency

- Elevate AR intelligence and data-driven decisions

- Improve customer and business relationships

CORCENTRIC

Corcentric is your complete end-to-end accounts payable, accounts receivable procurement solutions company.

- Corcentric Electronic Invoice Presentment and Payment (EIPP)

- Managed AR

- Reduce costs

- Improve efficiency

- Increase accuracy

- Improve working capital

BILL

BILL accounts receivable software, you can get paid up to 2x faster, choose ACH and credit card to receive payment.

- Create professional invoices

- Send with flexibility

- Simplify tracking and follow-up

- Get paid 2X faster

- Stay in sync

VERSAPAY

Versapay – automate accounts receivable, reduce errors, and get paid faster, all while collaborating with customers over the cloud, in one AR automation software.

- Create superior customer experiences

- Get paid quickly and securely

- Make automated invoicing effortless

- Take the work out of accounts receivable collections

- Match payments to transactions with AI and machine learning

BLUESNAP

Get paid faster, gain efficiencies and reduce DSO with Accounts Receivable Automation software and integrated global payments from BlueSnap.

- AR Automation Helps You Get Paid Faster While Reducing Costs

- Boost Your Business with Accounts Receivable Automation

- Integrate with the Software You Already Use, No Coding Needed

- Global Payment Functionality Integrated into Your AR Automation

- Automate Your Entire AR Process

- Seamless Integrations with Your Existing Systems

SAGE

Sage has innovative software to manage your accounting, people, payroll, payments, and more.

- Automate AR

- Get paid faster

- Full view of cash flow

- Integrate seamlessly

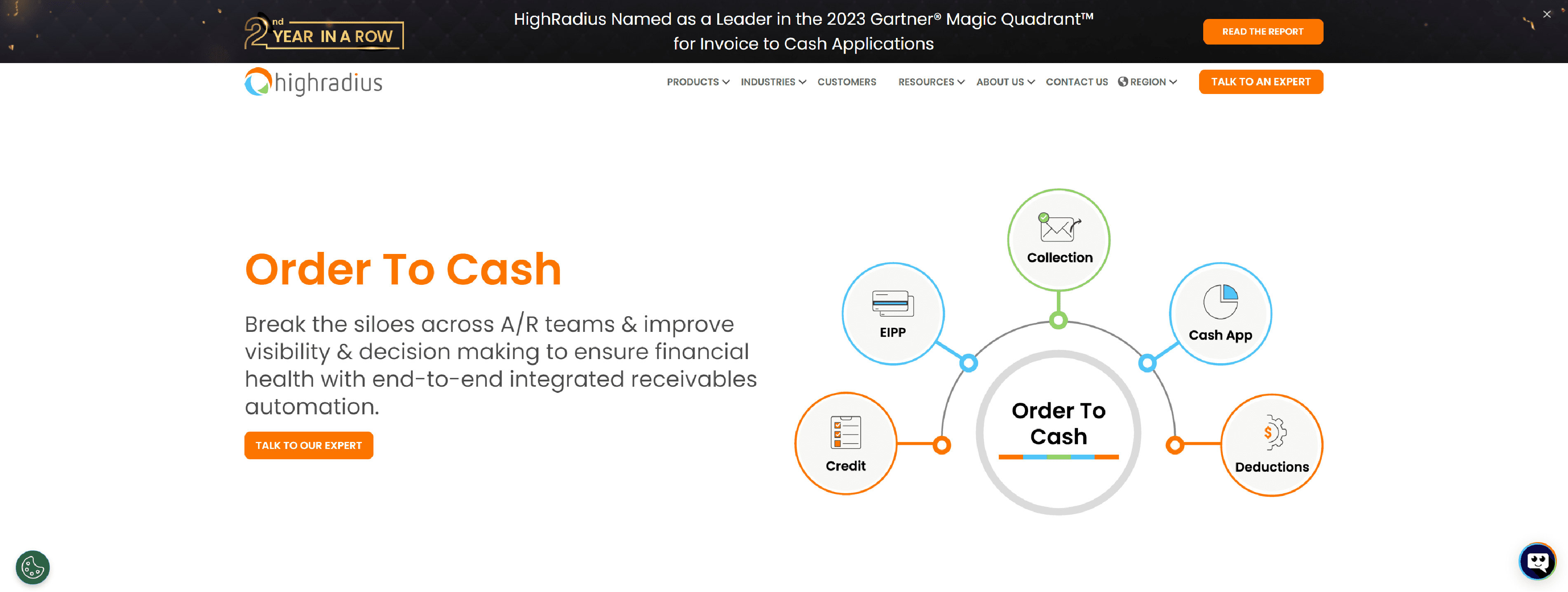

HIGHRADIUS

HighRadius – integrated automated accounts receivable solution that automates your end-to-end order to cash process to help you lower DSO and bad debt.

- Order To Cash Teams Are Operating in Siloes

- Having Multiple ERPs Is Creating A Lack of Visibility

- Day-to-Day Operations Involve a Lot of Intervention

- Team Productivity is Getting Affected

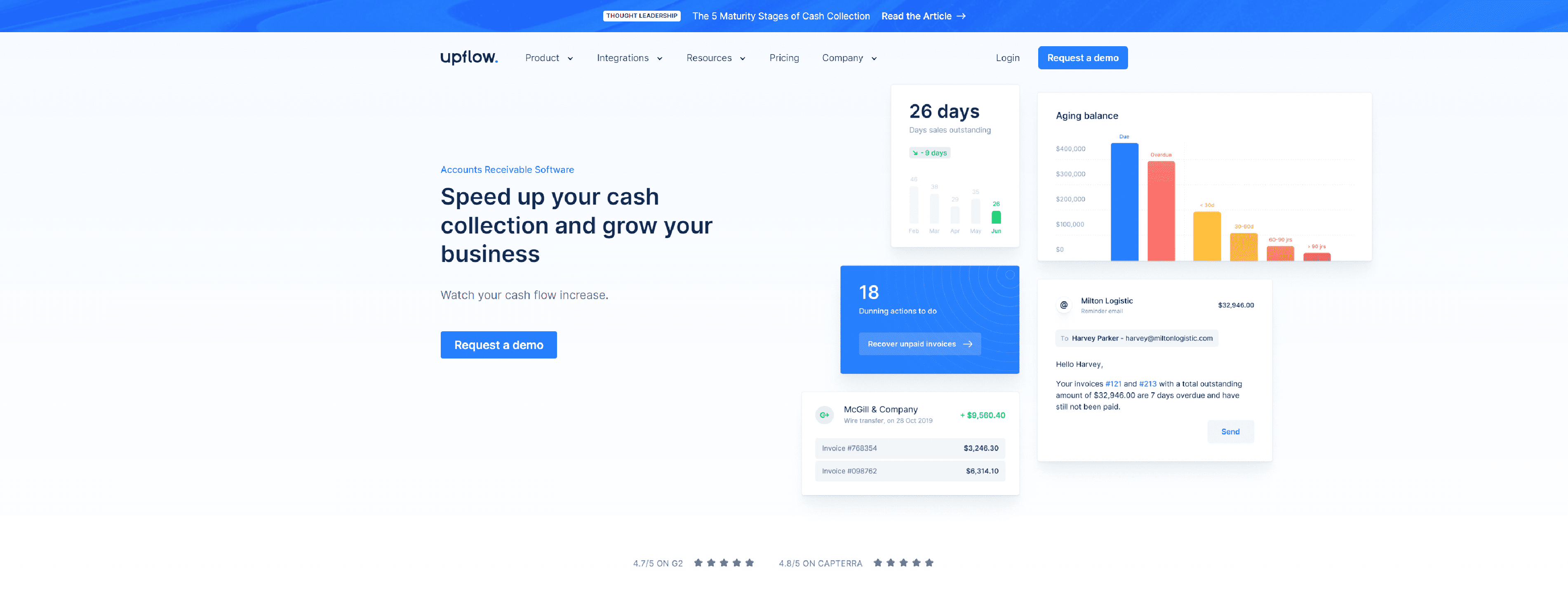

UPFLOW

Automate your accounts receivable process with Upflow and reduce unpaid invoices by 50%.

- Manage your Accounts Receivables

- Reduce your DSO

- Save time

- Gain visibility

- Keep payments simple for customers

- Increase collaboration

CENTIME

Centime AR automation software helps businesses improve collections effectiveness, reduce overdue payments and boost working capital.

- Predict cash inflows with streamlined AR

- Streamline your collections processes to reduce past due invoices

- Get paid faster and mitigate fraud risk with the Customer Portal

- Track and improve collections performance with industry-standard reports

QUADIENT

Quadient AR powered by YayPay is accounting automation software that helps businesses collect faster and improve their accounts receivable payment process.

- Effortless Accounts Receivable Starts With Quadient AR

- Streamline B2B Payments With A Secure Global Payment Portal

- Think Strategically. Act Efficiently. Only With Intelligent Dashboards

EZYCOLLECT

ezyCollect automates accounts receivables, debtor management and credit risk tools to speed up the cash conversion cycle & debtor management.

- Get paid faster with a seamless AR automation software

- Get your business paid faster with integrated payments

- Protect your business from unpaid invoices

ESKER

Esker accounts receivable automation software provides relevant data to monitor performance, adjust strategies and make the best possible business decisions.

- Rethink receivables management

- Enhance every action & interaction impacting cash collection

- Make collections a truly collaborative team effort

- Elevate your decision making with data-driven insights

INVOICED

Invoiced’s accounts receivable software help B2B finance teams enhance billing, payment, collection, and reporting.

- Automated invoicing and collections

- Fast, easy payments built right in

- Custom performance data at your fingertips

- Painless accounting system integration

CHARGEBEE

Chargebee as your accounts receivable automation software, enable a seamless receivables management workflow for improved collections and uninterrupted cash flow.

- Outstanding recovery for outstanding receivables

- Recover Revenue Faster with Smart Dunning

- Sync your finance and subscription tech stack

- Improve Collections with Receivables Analytics & Net D

EMAGIA

Emagia AI-powered Accounts Receivable Automation Software simplifies workflows for AR processionals, boosts touchless collections with digital assistants, automates dispute resolution, and enhances customer experience.

- Intelligent AR Management is the Key

- Emagia Edge in AI-Powered Accounts Receivable Automation

- Intelligent Cash Flow Forecasting

- Multi-site Multi-organizational Hierarchy

Read More: Top 20 Best Accounts Payable Automation (AP) Software

Q: What is accounts receivable automation software?

A: Accounts receivable automation software is a software solution designed to streamline and automate the process of managing and tracking accounts receivable. It helps businesses in efficiently managing and collecting payments from their customers, reducing manual work, improving accuracy, and accelerating cash flow.

Q: How does accounts receivable automation software work?

A: Accounts receivable automation software works by integrating with the organization’s accounting system and capturing data related to invoices, payments, and customer information. It automates processes such as invoice generation, sending reminders for overdue payments, and reconciling payments. It may also include features like electronic payment options and reporting capabilities.

Q: What are the benefits of using accounts receivable automation software?

A: The benefits of using accounts receivable automation software include:

- Improved efficiency: Automation reduces the need for manual data entry, saving time and reducing errors.

- Faster payments: Automated reminders and online payment options can improve the speed of collections.

- Enhanced accuracy: Automation minimizes human error and ensures accuracy in invoicing and payment records.

- Improved cash flow: Faster and more efficient collections can significantly improve cash flow for businesses.

- Better customer relationships: Automated reminders and streamlined processes can enhance customer experience and satisfaction.

Q: What features should I look for in accounts receivable automation software?

A: Some key features to look for in accounts receivable automation software are:

- Payment tracking: Tracking and reconciling payments from customers.

- Reminder automation: Automatic reminder generation and delivery for overdue payments.

- Integration capabilities: Compatibility with your existing accounting system.

- Online payment options: Ability to accept electronic payments from customers.

- Reporting and analytics: Robust reporting capabilities for tracking and analyzing accounts receivable data.

Q: Is accounts receivable automation software secure?

A: Yes, accounts receivable automation software prioritizes security to protect sensitive financial data. Look for software that offers encryption, secure data transmission, and compliance with industry regulations like PCI-DSS (Payment Card Industry Data Security Standard) to ensure the security of your financial information.

Q: Are there any limitations or potential challenges with accounts receivable automation software?

A: While accounts receivable automation software can greatly improve efficiency and accuracy, challenges can arise if the software is not properly integrated or if there are errors in data entry. It is also essential to ensure that customer information is up-to-date and accurate in the system for effective automation. Additionally, training employees on how to use the software and managing any implementation issues can be potential challenges.