If you own a business that generates a significant amount of tax income every year, then you must certainly have heard of the term bank reconciliation. Perhaps your accountant is already coaxing you to reconcile your accounts or is already doing it for you. People who handle accounts know very well how important it is to reconcile records with banks and it is high time that you understood its importance and took care of it too.

So what is bank reconciliation after all? In simple layperson’s terms, this is a system to create a similarity between the records you keep, such as those in your cashbooks, and the records that your bank keeps.

You must have observed that several times, all the time actually, the records kept by you at your end do not match with the records that your bank churns out. This is especially true in the case of cash payments and receipts. When you are dealing with something such as VAT, it becomes very important to ensure that the records are on par. If you are especially taking care of reconciling your account, this is what you are actually doing, i.e. making your records and the bank records come in accordance with each other.

When reconciling records with banks, it becomes important to include all transactions. A common problem with most entrepreneurs is that they forget to mention small payments or receipts. These can create a discrepancy with the bank records later on. Bank reconciliation must take care of even the apparently small payments. This should also include all the automated payments which several businesses use to make their functioning more streamlined. Some such payments are the demand drafts and standing orders. You must ensure that these records are reconciled as well.

Another problem that might crop up is regarding the outstanding (or postdated) checks. These checks are supposed to clear at a later time. If you have issued these checks in the middle of the month and they are supposed to clear after the month is over, then they are not going to reflect in the bank statement. Also, checks that are returned to the bank will probably show in your record books as a payment, but your bank records won’t reflect that.

Proper bank reconciliation is very necessary if you want to be one up on the finances of your organization. These are the true accounts which show which direction your business is heading.

In present times, bank reconciliation has become simpler with the advent of bank reconciliation software. These applications take all records that you maintain and keep continuously updating them with your bank records. As a result, both records become perfectly aligned and the bank reconciliation statement that you get looks exactly like the records you have kept.

If you are looking for bank reconciliation software, you need to make sure you are looking for accuracy and an easy to use interface. Buy from vendors who are known for the quality of their business accounting software; these are the people who know what a bank reconciliation system truly needs.

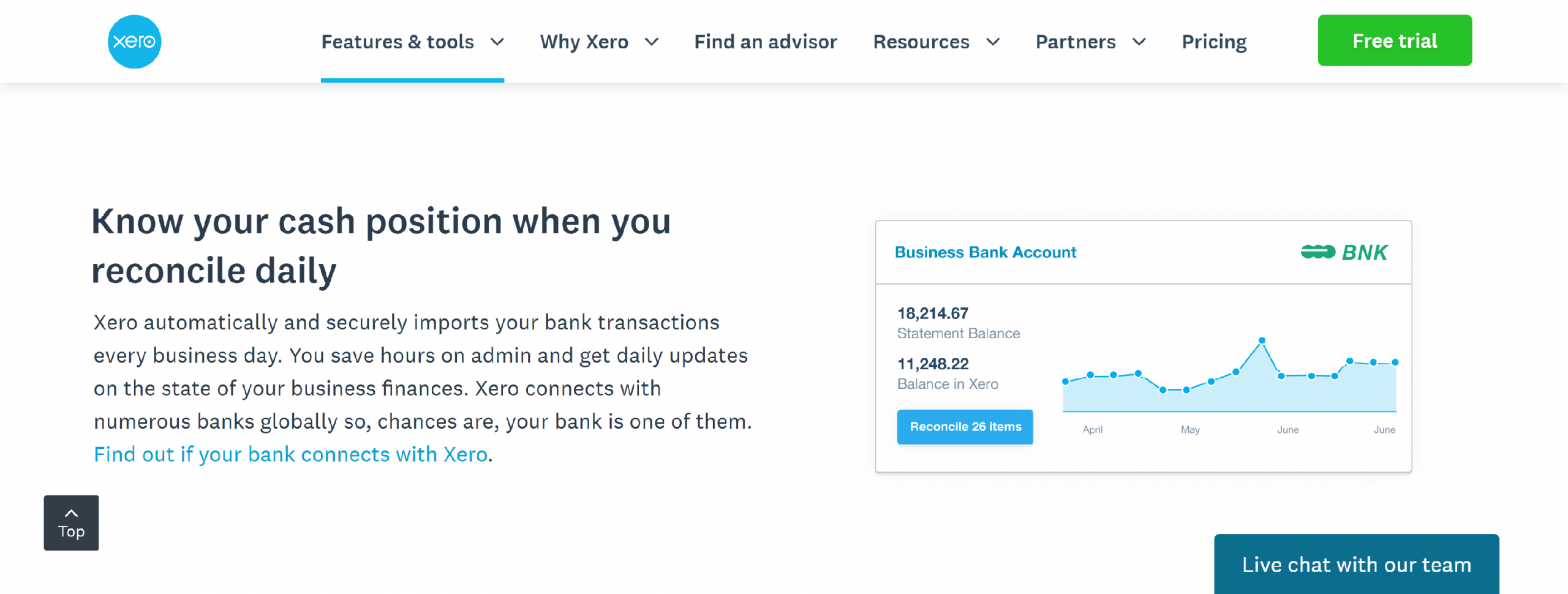

XERO

Speed up bank reconciliation for your business. Connect your bank accounts to Xero for automatic daily imports, simple transaction matching and cash flow updates.

- Know your cash position when you reconcile daily

- Reconcile easily with coding suggestions

- Make it your morning routine

- Reconcile large numbers of transactions quickly

CASHBOOK

Achieve unprecedented levels of automation for accounts receivable, accounts payable & bank reconciliation processes with Cashbook cash management software.

- Data from your general ledger files is compared directly to your bank statements and auto-matching takes place

- The reconciliation software module has a powerful matching engine which is based upon rules defined by your finance department

- Allows users to automate the process of reconciling transactions

RECONART

Cloud based reconciliation software that automates bank, credit card, payments, AP and AR, intercompany, trades, positions and balance sheet reconciliations.

- High volume matching between any bank statement and GL

- Out of the box support for typical bank formats

- Automation of data import. matching, and reporting

- Fully configurable matching rules

- Ready-to-go reconciliation reports

OSAS

Achieve the most out of your cash with Bank Reconciliation Software by Open Systems. Reduce errors, save time, and get your checks cleared quickly.

- Set up as many base and foreign currency bank accounts as you need, including routing codes for electronic payments, positive pay codes, check formats, and other ACH information

- Define information for processing ACH payments to vendors and from customers for streamlined, simplified processing (requires the Banking application)

- Adjustment and transfer transactions create entries in General Ledger

- Use an unlimited number of bank accounts

- Enter recurring adjustments only once

- Enter a transaction in any currency if you use the multicurrency option

- Void a check before you send it or stop the payment of a check before it is cashed

- Define your own default descriptions and references

- Use inter-account transfers and manual adjustments

- Post transactions for multiple years

- Reprint prior posting logs

- And More.

QUICKBOOKS

QuickBooks organizes your data for you, making bank reconciliation easy. Reconcile accounts with bank statements in minutes.

- Bank reconciliations

- Import transactions

- Reconcile accounts

- Reconciliation reports

- Easily identify discrepancies

- Work with your accountant

- Accept payments

- Pay employees

- Access financial statements

BLACKLINE

BlackLine automates complex, manual and repetitive accounting processes and enables companies to move beyond the legacy record-to-report process.

- Dramatically Enhance Internal Controls

- Standardize and Optimize Process

- Streamline the Reconciliation Process

SUNACCOUNTS

Infor SunSystems, the established, powerful financial management software supplied by SunAccounts.

- Eliminates manual tasks

- Improves data integrity

- Automation can make a monthly task a daily task

- Improved auditability

- Saves time and frustration

KHAOSCONTROL

Save time by completing a bank reconciliation in a few simple steps with our solution, and get back to what you do best – running your business.

- Flexible working – operate your business from anywhere, at any time of the day. No limits

- Scalable – solid foundation provided for you to grow; the system will scale as you do

- Monthly subscription – affordable, monthly subscription with no hidden fees. We promise we won’t guilt you into staying if the system isn’t for you – our plan is completely flexible, so you can pay-as-you-go without having to worry about exit fees or lost data if you decide to leave

- Integrations – integrations with all the key players, including Amazon, eBay, Shopify, EKM, Xero and Despatch Bay

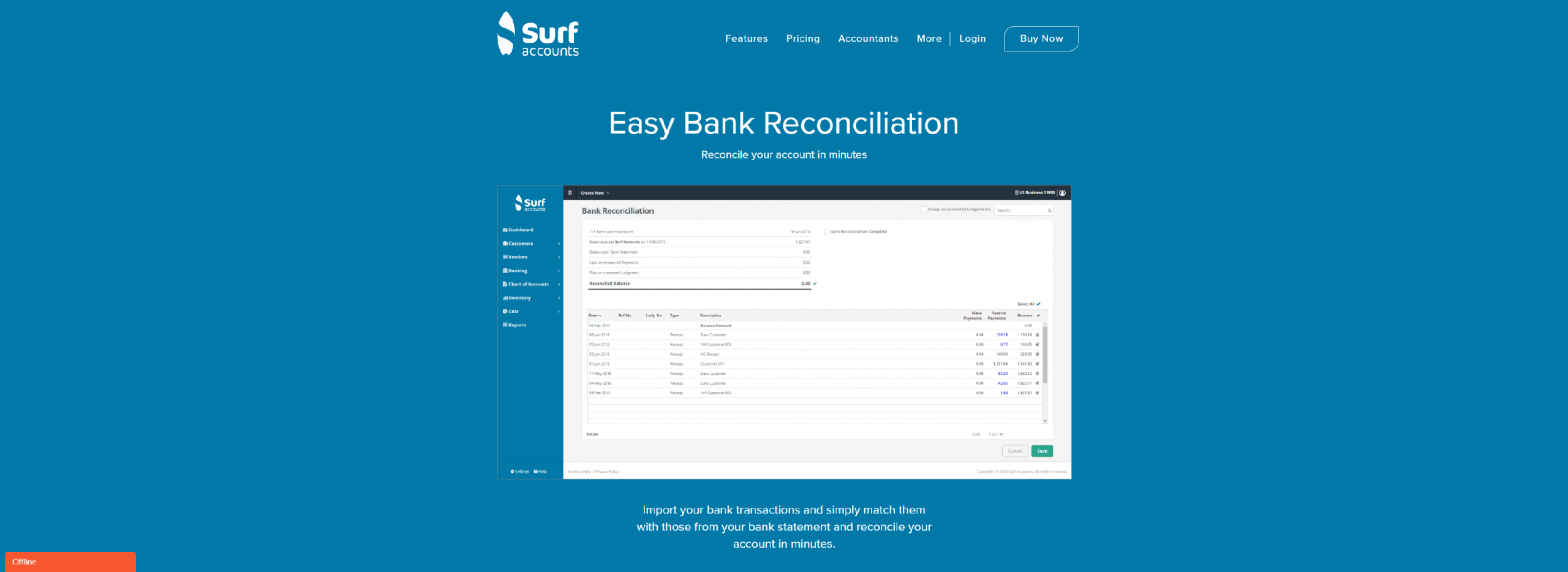

SURFACCOUNTS

Surf Accounts Bank Reconciliation Software can help you save time on transactions and bank reconciliation.

- Reconciliation your account in minutes

- Surf Accounts automatically imports your bank transactions

- Reconcile on the go with Surf Accounts App. Available for iOS and Android

BULLETHQ

Awarding Winning Online Accounting Software. Free Invoicing Software, Free Accounting Software, Free Mileage Software.

- Is it secure

- What about Credit Cards

- Scrape information like Xero

- What if my bank isn’t there

- Support multi currency

- Can I reconcile the bank feeds

- Does it cost extra

- Does it take long to set-up

- Are there limits