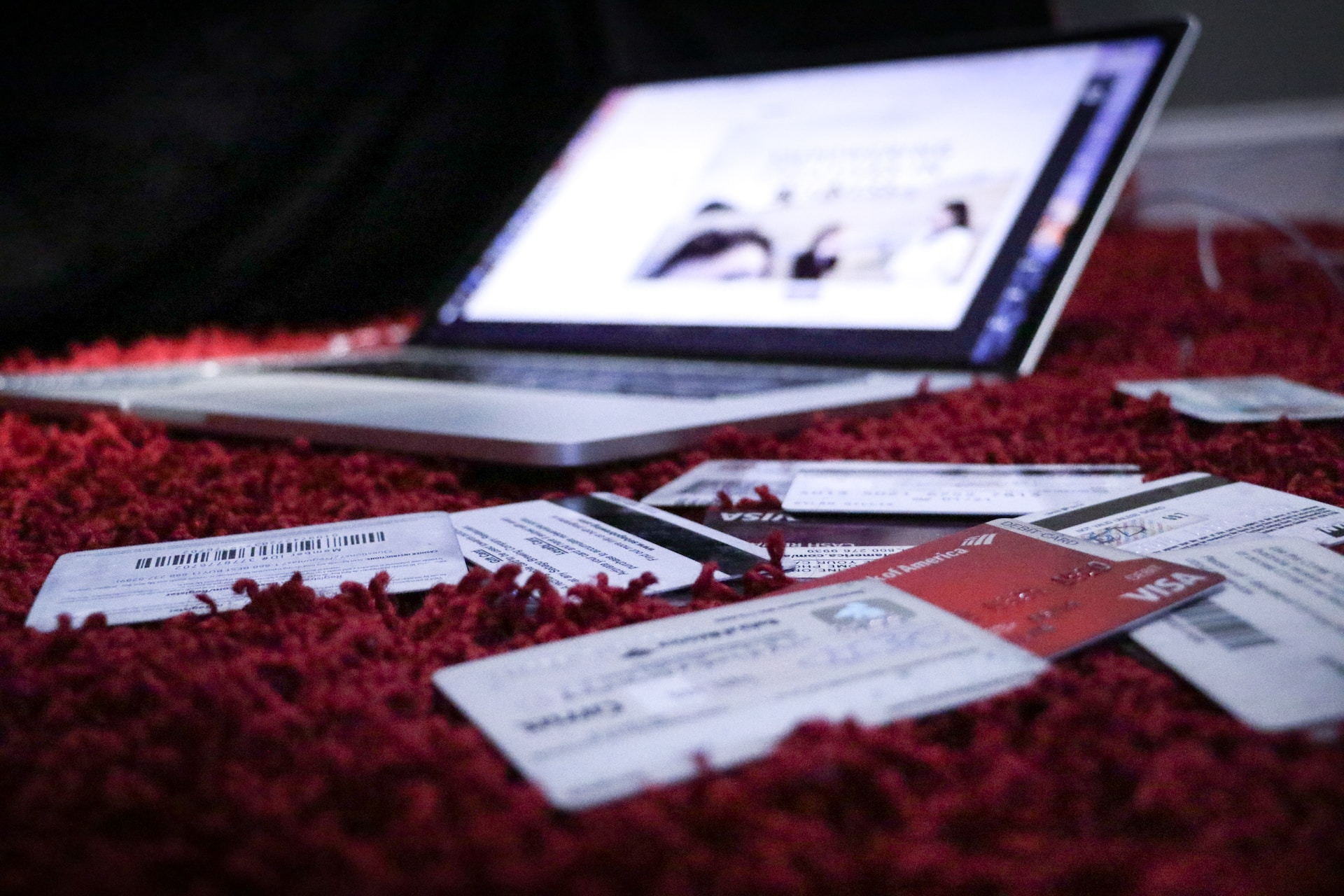

Credit card debt can be a stressful burden, especially if you’re on a limited budget. However, with careful planning and a commitment to making a change, it’s possible to pay off your credit card debt and take control of your finances. In this article, we’ll explore some steps you can take to pay off credit card debt while on a limited budget and improve your financial situation. Debt settlement services can be an excellent option for those looking to pay off their credit card debt on a limited budget. They can help you negotiate with creditors, and provide support and resources to help you stay on track.

Assess Your Debt Situation:

- Be Aware Of The Total Amount of Debt: Take stock of all your credit card debts, including balances, interest rates, and minimum payments. This will help you understand how much you owe and what you need to pay off.

- Know The Simple Interest Rate: This is the interest charged on the principal amount. The interest rate is applied only to the principal amount.

- Know The Compound Interest Rate: This is the interest charged on the principal amount plus the accrued interest. The interest rate is applied to the total amount owed.

- Be Aware of The Minimum Payments: This is the amount you’re required to pay each month to keep your account in good standing. It’s usually a small percentage of your total balance.

Evaluate Your Budget:

- Income and Expenses: Take a look at your income and expenses. Determine how much money you have coming in and going out each month. This will help you determine how much money you can allocate toward paying off your credit card debt.

- Prioritize Expenses: Once you’ve evaluated your income and expenses, prioritize your expenses. Determine which expenses are necessary and which ones can be reduced or eliminated. This will help you free up more money to put toward paying off your credit card debt.

Create a Debt Repayment Plan:

- The Debt Snowball Method: This involves paying off your smallest credit card balance first and then moving on to the next smallest balance until all your credit card debts are paid off.

- The Debt Avalanche Method: This involves paying off your credit card with the highest interest rate first and then moving on to the next highest interest rate until all your credit card debts are paid off.

Debt Settlement:

If you’re struggling to pay off your credit card debt through the debt snowball or debt avalanche methods, debt settlement may be an option. Debt settlement involves negotiating with your creditors to settle your debt for less than what you owe. This could be a great option for you if you’re feeling overwhelmed by your debt and are struggling to make your minimum payments each month. When considering debt settlement, it’s important to choose a reputable debt settlement company. Look for a company that’s transparent about their fees and process, and that has a track record of success in negotiating debt settlements.

Tips for Living on a Tight Budget:

In addition to creating a debt repayment plan, there are other steps you can take to live on a tight budget. This includes:

- Focus on Long-Term Financial Goals: Keep your long-term financial goals in mind, such as paying off debt, building an emergency fund, and saving for retirement. This will help you stay motivated and committed to your budget.

- Create a Savings Plan: Set aside a portion of your income each month for savings. This will help you build an emergency fund and work toward your long-term financial goals.

- Build an Emergency Fund: Having an emergency fund can help you avoid going into debt in the event of an unexpected expense, such as a car repair or medical bill.

- Invest in Retirement: Even if you’re on a limited budget, it’s important to invest in your future by saving for retirement. Consider setting up a 401(k) or IRA and contributing what you can each month.

How Debt Settlement Companies Can Help?

A debt settlement company is a third-party service provider that works with creditors on your behalf to reduce the amount of debt you owe. These companies typically negotiate with your creditors to reduce your debt, and they may be able to help you settle your debt for less than what you owe. They have experience dealing with creditors and know how to negotiate to get the best possible settlement for you.

Conclusion

Paying off credit card debt on a limited budget requires careful planning and discipline. It’s important to assess your debt situation, evaluate your budget, and create a debt repayment plan that works for you. Consider reaching out to a debt settlement company if you need help negotiating with your creditors. Debt settlement companies can also provide you with valuable resources and support. They can offer financial education and counseling services to help you manage your finances and develop a plan to avoid getting into debt in the future. They can also provide you with support and guidance throughout the debt settlement process, which can be a significant source of comfort and relief for those struggling with debt.