Suppose you fall under a huge debt payment, what strategy will you take to clear the loan amounts? You feel you will manage your budget, increase your savings, cut of your expenses and so on. But if these strategies fail, do you have any other options left? Well, don’t get confused as you still have one more option of debt payment, i.e., a debt consolidation plan.

What is Debt Consolidation?

Debt consolidation plan is a debt payment plan which is offered by debt consolidation companies. The debt consolidation companies help borrowers in paying off huge debts with high interest. These consolidation companies make it much easier to manage and pay debts quicker. The debt consolidators negotiate with the creditors in lowering monthly payments and rates of interest. Debt consolidation process works by combing all the unsecured debts into a single one. The debt consolidation company not only helps in paying off the debts, but also provides education on the ways of avoiding debt in future. Debt consolidation company aims in managing and relieving debts of the borrowers.

Before approaching a debt consolidation company for any kind of debt settlement, it is necessary to understand the type of debt consolidation companies. Following are the types of debt consolidation companies:

Debt Settlement – Debt settlement companies help in paying off your debts through negotiation process. The negotiation is on the balance debt amount. This service is carried under fees and conditions framed under legal procedures. The fees are paid after reducing and settling the debts. Debt settlement programs help in reducing debt balance and is a great way of debt relief. The debt settlement program is to help borrowers in getting relieved of unsecured debts.

Debt Consolidation – Debt consolidation program provides the facilities of combining the entire debt amount to a single payment. This debt payment plan offers opportunity of deducting the payment amount. The credit counselor works on the negotiation process with the creditors. This program is effective when the debt amount becomes too high to pay. Debt consolidation becomes effective when the creditors feel that repayment is not possible without debt consolidation. In the debt consolidation program, the consolidator handles the complete repayment process. It helps debtors to avoid harassing calls from the creditors.

Do-it-Yourself Debt Management – This debt management plan is a self help debt settlement program where the debtor takes initiatives in overall financial decisions. The debt consultants offer financial advice and debt management tips that help in full debt payment. This program does not have any score in reducing the credit amount. The debt management resources help in planning and managing a realistic budget that helps in a long run. Do-it-Yourself Debt Management enables debtors to come up with a realistic debt payoff plan that helps in debt payments.

Credit Counseling – Credit counseling is ideal for debtors or borrowers without proper knowledge of financial planning and budget management. The certified credit counselors and debt management specialists develop an individual financial plan by reviewing the annual income and expenses of the individual. It also provides free education of credit card management and budget planning. The goal of the credit counseling is to help debtors in solving financial problems. Debt counseling is not only a way to get debt relief, but it is also a program where debtors can know more on savings and balancing of expenses and income.

Debt consolidation companies provide various solutions in dealing with large and small debts. It’s good to know when you should approach the debt consolidation companies for debt settlement. Few points to consider include:

- If the rates of interest you pay go higher than the capital amount, then rush to the consolidation companies before the debt amount overwhelms you.

- If you are struck with the payment of credit card balances and large amount of unpaid loans, the debt consolidation companies will help to avoid payment of varying interest rates.

- If the interest of home loan starts increasing and has reached a point where it becomes hard for you to repay

- If you fail to pay the minimum monthly payment of credit card and loans

Debt consolidation companies provide certain benefits and advantages. They help debtors in saving money, paying off debt quickly and avoiding bankruptcy. Debt consolidation companies enable debtors to manage debts and monthly payments. It also educates on the way of avoiding the debts in future. Whenever you feel that your debts are going above your payment limits, the best is to consult with the debt consolidation companies.

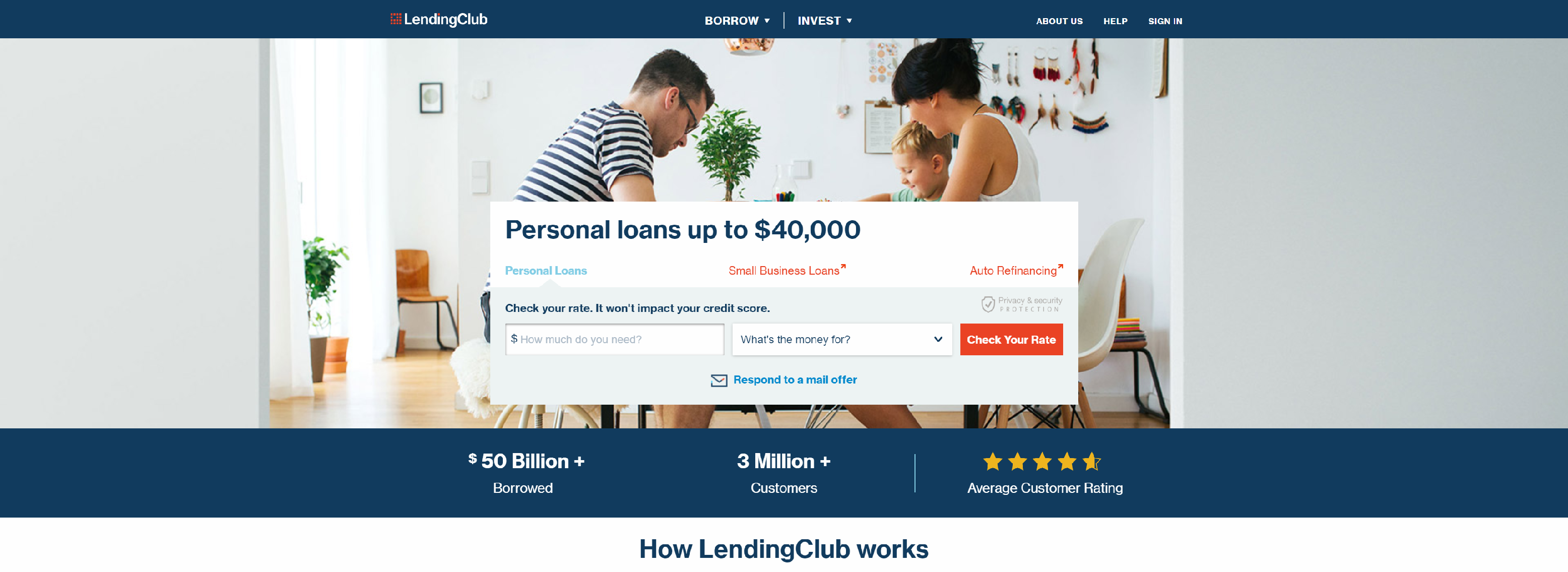

LENDINGCLUB

Through personal loans, auto refinancing loans, business loans, and medical financing LendingClub offers the borrowing and investing solution right for you.

- Refinance your credit cards with a personal loan – and circle the date you could be debt free

- Save time and money with a balance transfer loan—just tell us who to pay and how much

- Simplify your debt – and your life – with a single monthly payment on an affordable, fixed-rate loan

- Start your home improvement project now, without waiting for a home equity loan or line of credit

AVANT

Change the way you borrow with personal loans through Avant. Checking loan options is quick, easy, and does not affect your credit score.

- Fast Decisions

- 600,000 Customers Helped

- No Prepayment Fees

PERSONALLOANS

Find a personal loan that can work for you through our secure network of lenders and lending partners.

- Financial Implications (Interest and Finance Charges)

- Implication of Non-Payment

- Potential Impact To Credit Score

- Collection Practices

- Loan Renewal Policy

UPSTART

Loans from $1,000 to $50,000. Check your rate in minutes for free without hurting your credit score.

- Our borrowers save an estimated 23% compared to their credit card rates**

- Refreshingly fast process

- Pay your loan off at any time

- We take the safety of your information seriously

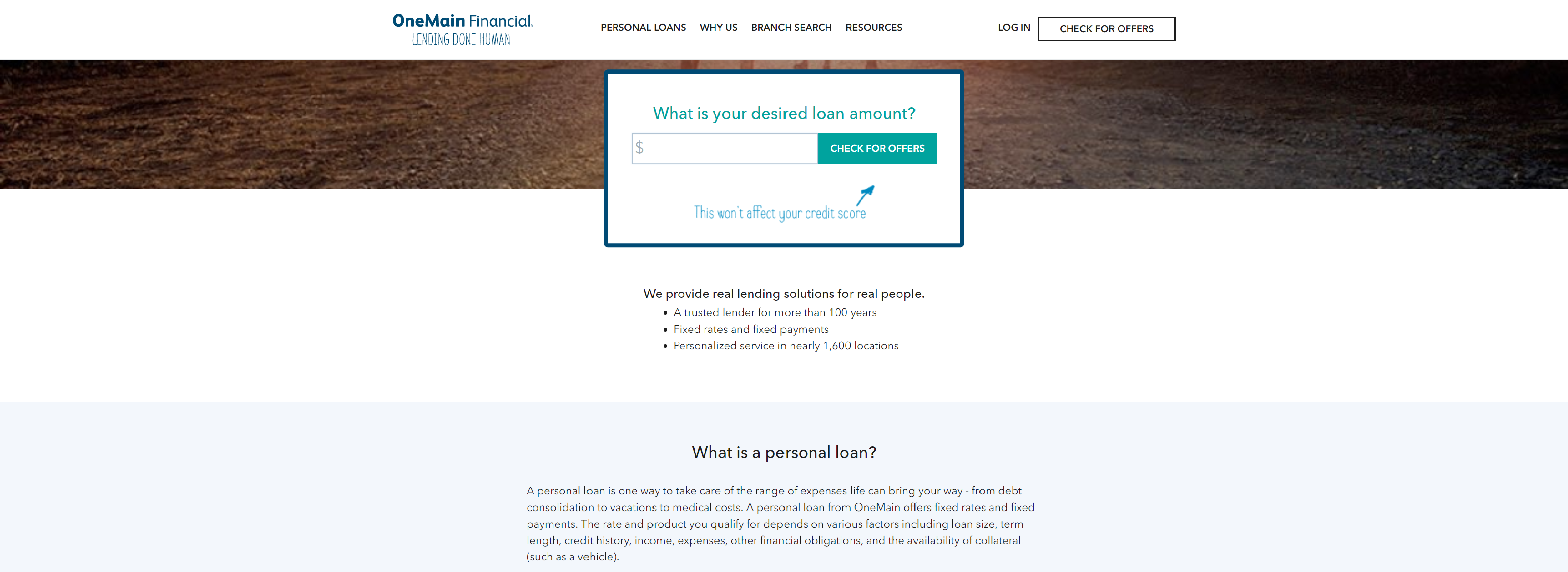

ONEMAINFINANCIAL

Personal loans for debt consolidation, home improvement, major purchases, and more. Applying online is quick and easy. And our personal loan specialists are here to help every step of the way.

- Our loans have fixed rates, fixed payments, and no prepayment fees

- With local branches nationwide, you can meet one-on-one to discuss your options

- Our loan specialists work with you to find out your needs and help you understand your loan options

- You could get your money as soon as the same day if you’re approved by noon

Debt consolidation – the best option for avoiding bankruptcy

It is not uncommon to find some people deep in debt, resulting out of their ever-burgeoning credit card borrowings or other loans that they may have undertaken. More often than not, such people are in deepest of misery and they cannot find any option in sight that can bail them out of this. Not to worry now, for there is a great solution for them-; welcome to the world of debt consolidation – an option that will see you being able to pay off all your debts, effectively. Debt consolidation entails consolidating all the current debts of a person, into one loan that has a lower rate of interest.

How is this a superior way of paying out?

There are several advantages associated with debt consolidation. One, all your debts are clubbed into one big heap and so you are not required to remember the payout dates of all the debts that you have taken on. You’ve got to remember the payout date of one loan only. Moreover, all your debts under debt consolidation are merged into the debt that has the lowest rate of interest, and so you end up saving a lot of money in the process. Not only that, this also speeds up the process of paying, and you pay up much before you would have paid otherwise.

What should I do for opting for debt consolidation?

Simply approach the companies that would help you out with debt consolidation. There are several companies in the fray that would help you out in this endeavor. They will charge a fee for their efforts though. In fact, such companies may also offer certain discounts to people who are on the verge of bankruptcy.

How do I approach the various creditors?

The credit counseling company that you have hired to look into your debt consolidation process is the one that will contact your lenders and work out the modalities. These companies not only do such an exercise but also provide credit counseling. All the modalities regarding the clubbing all your debts and talking it out with the lenders is the job of the company that you have entrusted. With debt consolidation, you make the payment to such a company that in turn makes the payment to your various creditors.

In what all cases, does this program work best?

A debt consolidation program works best in case of credit card loans because these are the loans that carry one of the highest rates of interest. Debt consolidation may entail clubbing the unsecured loans into another unsecured one, but generally herein collateral like a house is secured against the loan.

Debt consolidation is by far the best program one can adhere to, in case he is finding himself unable to pay off the various debts that he has taken upon. The last word though rests with the lenders, who’ve got to show the faith in the ability of the debtor to pay back the loans. In case you too are finding your debts spiraling out of control, opt for debt consolidation today.

How to find a legit debt consolidation company?

There is a huge demand for loan consolidation and debt management with global bankruptcy rate is all time high. This demand has attracted a lot of scams and people have become suspicious about the legitimacy of every debt counseling company. Nevertheless, there are many genuine counselors that offer inexpensive, honest and direct debt management advice. Yet, the basic need is to know your symptoms and what you need from such counseling companies.

Steps to find the right company

- Initially, you must make a list of companies and verify whether the companies are recognized by Better Business Bureau. This will clear all your doubts and from the customer care section you can clear all your doubts. On the other hand, you can evaluate the goodwill of the company as well and market reputation as well.

- Even the Better Business Bureau will not help you in identifying which company precisely offers your remedy. Hence, you must get in touch with agents and investigate a bit more about the company. Investigation must include reading newspapers and reviews over the net and definitely talk to someone, who belongs to the same industry.

The verdict

You will need to employ an agent or need to talk to an agency in order to get the services you want. This is a tedious process and might take months before you identify a legitimate company. So, my advice will be to get in touch with your friends and with your relatives as they can offer great assistances. Use all your resources, get in touch with people and talk to someone, who is looking for the same remedy. Anything can click anytime, you never know.

If you can take the pain then you will definitely save a lot of many which will enable you to clear your debt much sooner.

Unsecured debt consolidation loans are the best alternative to Bankruptcy

If you are troubled with debts and willing to get rid of your financial burdens, you should think about consolidating your loans. However, if you are not intending to provide security for the loans, you should perhaps try to focus on the unsecured loans. In short, the unsecured consolidation loans allow the consumers to get out of financial mess without any collateral.

These loans are usually applied by those consumers who are staying as tenants and do not have a house of their own. However, this does not imply that the other consumers cannot apply for the same. The home owners are able to qualify for the unsecured consolidation loans only when they are not willing to compromise with their home. With the help of these loans, the consumers will be able to merge their debts at a much lower rate of interest, however this is not always followed by the lenders while they are offering these loans to the lenders simply because they are not having any security against which the loan is provided. In other words, the rates of interest for the unsecured consolidation loans are usually higher but the consumers should not only get trapped with this idea while seeking these loans rather they should try to compare different lenders and try to fix te best deal that will offer them respite from the pangs of high interest rates.

As a matter of fact, if the unsecured loans are not able to offer lower rates of interest, it will not remain in the favor of the borrower and therefore you must pay lesser interest rates than the combination of the interest rates that are associated with the outstanding amount. On the other hand, unsecured loans do not imply that you should pay lesser amount s each month. For instance, if you are able to pay more in one month, it will only expedite the process of paying off the loans. In fact, paying smaller amounts actually mean that you will end up paying more in the long run and the best way is to pay off the loan within a period of ten years.

The consumers can also try to get free quotes from different lenders in order to understand the entire expenses of this loan and it is also a good way to compare the interest rates that are offered by different lenders. Basically, the unsecured loans provide coverage for household debts, personal loans or any other debts related to the family. A consumer will be able to borrow five thousand pounds to twenty five thousand pounds through these loans. In addition to this, the unsecured loans can be used to pay for medical emergencies, or any requirements of your vehicles.

If you are having a reasonably good credit, it will be easier for you to secure these loans but those consumers who are having bad credit will perhaps get these loans but with a much higher rate of interest. However, the consumer should not try to waste the convenience of these loans by not repaying them in time, instead should make the best use of them to become free of their financial obligations in the due course of time. Although, there are no apparent risks that are associated with these loans but the consumers should always be determined top pay off their debts on time failing which, the consumer will again become affected with bad credit ratings. In conclusion, it can be said that the opportunities of these debts should be properly utilized by the borrower.

Debt Consolidation – savior from bankruptcy

Once a person gets trapped into the hole of depth, it keeps getting deeper and deeper. Debt consolidation refers to combining a number of debts that a person has incurred and combining them into one debt with a low interest rate. Debt consolidation helps one in avoiding the situation of bankruptcy. It reduces the monthly payment that the person has to make and thus helps in saving some amount of money. Debt consolidation is like a doctor to the problem of debts. It offers the debtor a new start and helps achieve a better credit score. Debt problems are of a number of types like personal debt, liabilities of the company or credit card debts.

A proper debt management plan will help you get rid of your debts and pull you out of the trap. Before you start a debt consolidation program for yourself you must consult a debt counselor. Debt counselors listen to your problem and analyze it and then offer you the best possible solution. Debt counselors are experts and so have great knowledge in the field of debt management. A counselor deals every problem individually as every individual problem requires a different approach.

Debt management programs aim towards reducing the monthly payment that has to be made. They try to either reduce or freeze the interest rates. These steps help a person in eliminating the debt within months. Debt consolidation can be done in three ways, i.e. – loan consolidation, mortgage and debt consolidation, remortgage debt consolidation. Thought there are other ways such as individual voluntary arrangements (IVA) but these are considered to add bad credit to ones credit scores. Numerous debts can cause great trouble to a person and might result in bankruptcy if a person is unable to pay them off. In such a situation a debt consolidation programs helps in consolidating all these debts and dealing with only one lender.

Every way of debt consolidation might not suit every individual’s problem. One must select the best method which suits their need and they find best for their requirements. Blindly going for debt consolidation programs might not prove beneficial and instead cause problems for the debtor. One needs to judiciously choose the best method. A debt counselor can offer great help in such a situation and offer the best advice. One must not panic and deal debts intelligently and following the advice of the debt counselor always helps.

Debt consolidation is an effective tool

Debt consolidation is a wonderful and very beneficial tool for anyone who is perturbed with a number of debts. It proves to be very beneficial when one is trying to settle credit card debts. People who have high credit card debts or have numerous debts across a number of cards can use debt consolidation as a great way to manage their debts. Debt consolidation helps in potentially reducing the playback. But debt consolidation needs to be done judiciously. In every case it cannot be generalized that debt consolidation is the best way. Trying to consolidate debts in a haphazard manner can cause more problems. Consolidation is a very powerful tool but you should keep in mind a few things before you try to consolidate your debts.

- Firstly, find the best company to help you. There are numerous companies which offer this service but they are not equally skilled. You need to look for a company which can meet your individual needs. Ensure that you can trust them. A lot of scams and fraudulent companies are present in the field of debt settlement. So you need to find the best and the trusted company to get your job done.

- You need to clearly understand your own debt. A debt consolidation loan mostly comes with a low interest rate, but sometimes the rate of the loan can be more than many of your debts. This is very often the case with student loans, as student loans have a very low interest rate. When you try consolidating your debts check if you have any loans with interest rates lower than some of your loans. In such a case ignore the loans with lower interest rates and consolidate the other debts.

- After you have considered the interest rates, you need to consider your outstanding balance. First of all try consolidating the loans with higher outstanding balances. A higher balance always amount to a higher interest rate. Before you tackle low balances get rid of all high balances.

- If you have a number of credit cards. Then continue using only those which have lower interest rates and do away with the rest of them. Your debt settlement company will surely advise you for the same. A wrong credit card in hand can cause trouble and make your problems even more severe. So immediately get rid of any credit cards that have high interest rates.

With these tips you will surely be able to manage your debts properly and yourself out of the trouble.

4 Pros of Debt Consolidation

The biggest burden of debt is the hassle of figuring out how much you have paid, how much you need to pay, at what interest rate you are paying, when will you be debt free or have I paid or not. Since almost everyone is in debt these days a new era of handling debts has started called the debt consolidation. There are number of companies that offer this service both offline and online.

Debt consolidation is an organization that will manage your debts. There are two main types of debt consolidations – debt consolidation program and debt loan. Debt consolidation program is when the company organizes your debts and gives you a plan of how you can pay out your debts. The company will also negotiate with the money lenders and try to reduce the interest rate. Debt loan is when the debt consolidation company will pay out all of your debts and then you will have to only pay the debt consolidation company at a low interest rate.

In a nutshell here are 4 major pros of debt consolidation:

One monthly payment: If you have many different debts, then it is hard to keep track of all the monthly cheques especially when they are at different interest rates. Through debt consolidation all your debts will be combined and you only have to make a single cheque and at a fixed rate.

Lower Interest Rate: The debt consolidation company will negotiate with the money lenders and will try to reduce the interest rate most of the time they do so successfully, hence now you have to pay off lesser money. If you have taken a debt loan then the reduction in interest rate may become even lower.

Better Debt Management: The debt consolidation company will provide you with better management for your debts, by organizing the way to pay off debts. They will develop a plan that is suitable to you, and give you the ins and outs of where your money is flowing.

Stress Reduction: Once all your debts are organized it will be easier for you to understand how your debt is being paid off. A fixed cheque and a fixed lowered interest rate will reduce the stress of handling many different pay outs. After all the main stress when handling debts is the confusion of how and where your money is going.

Debt Consolidation to Get rid of your debt without any hassles

Gone are the days when dealing with multiple debts was a critical problem, but debt consolidation is the perfect solution to all the problems. With this, your multiple debts will be combined into a single payment which is to be paid monthly. Nobody wants to go bankrupt, it is pretty obvious and the best way to deal with debt is debt consolidation. For all these tasks, you must opt for a good plan which fulfils your requirement. It is very easy to get into a debt as a lot of debt plans are offered by banks and you easily get trapped by those illusions. But when it comes to pay the debt, it usually becomes a head ace for you. If your debts have got out of control then you need a good advisor plus a plan which suits your needs at the first place. It is proven that debt problems can be solved simply by consolidation of your existing debts. Through consolidation of your existing debt, there is no need of mortgaging your valuables to pay your debt. But these plans are made in such a way that you can easily pay out your debt without any worry.

It makes your life a little easier by giving you one easy to manage repayment option. Consolidation will reduce your interest rate overall, and in this way you can save your money. It is a very effective way of having a check on your company’s economic status. If you have debt that is unmanageable then it is always advised that you must go for the best debt consolidation plan. It is one of the best methods to get rid of your debts effectively and it is practised widely by number of persons and companies.

Though there are many plans available at your rescue, but you must opt for a plan after doing thorough research if you are finding it inflexible to manage all your debts or you are being charged for delayed payment and non-payment of your debts. It is quite stressful to keep a record of each big and small debt. Undoubtedly, a good plan can give you the relief you had always wanted without affecting your expenditures entirely. So what can be more effective than that? Just go for your preferred plan and get rid of your debt problem.