When deciding to launch or scale a startup, one of the first questions that occur to entrepreneurs’ minds is “Where to find investment for a project idea?” In order to build a successful software product, it’s crucial to consider different startup funding sources to understand all the peculiarities of each financial type and what will suit the business best.

In this post, I will discuss what stages each tech startup should pass through to get investment for a custom mobile app development along with popular business funding sources such as crowdfunding, business incubators, bank loans, venture capital, and angel investors.

6 Startup Funding Phases

Pre-seed stage

This stage aims to give an idea of the initial push. Startup founders rely on their own capital or money from their friends, family, and other acquaintances. Here are some hints on how to receive funding for app development at this stage:

- Look for a reliable partner to develop a startup

- Launch a crowdfunding campaign

- Raise money on your own website

- Join funding contests

- Attract angel investors

Seed stage

At this stage, startup founders focus on angel investing (angel investors tend to finance early-stages startups). However, the sum submitted covers only primary business needs (e.g., business plan, rent, production start, etc.)

Series A

This stage implies business owners already have a decent customer base and start generating money, and now are looking for third-party investors for scaling up. Commonly, they cooperate with venture capitalists that require actual data to make a decision for further investment.

Series B

This stage implies startups’ transformation into enterprises. Entrepreneurs have already validated the business idea and now want to enter international markets.

Series C

This stage requires even more substantial results from companies. The business generates $100+ million in revenue, and companies intend to get equal funding.

IPO

IPO or initial public offering means that companies are ready to sell their private shares to the public. IPO is connected with promising funding opportunities and provides a higher level of transparency.

Tech Startup Financial Sources

Crowdfunding

Crowdfunding implies startup fundraising with the help of specific online platforms like Kickstarter or Indiegogo. Put it simply, users “pre-order” founders’ software products before actual development. Once funds are raised, business owners can start developing an application. The core disadvantage of this method is that there is a chance of ideas being stolen. However, crowdfunding is an excellent option to launch the concept fast.

Business Incubators

Business Incubators are the enterprises that take the role of advisors for early-stage startups. Apart from investment providing, they arrange lectures, meetings and provide business insights to founders. Besides, they introduce startups to venture capitalists after a while. But, the competition among candidates is high, and it requires some time to assist comp[anies in establishing solid business connections.

Bank Loans

Bank loans are connected with financing short-term operations. Financial establishments offer different loans to give startup companies complete control over their business activity. However, this method requires lots of business activity and regulatory compliance along with a detailed tech startup business plan.

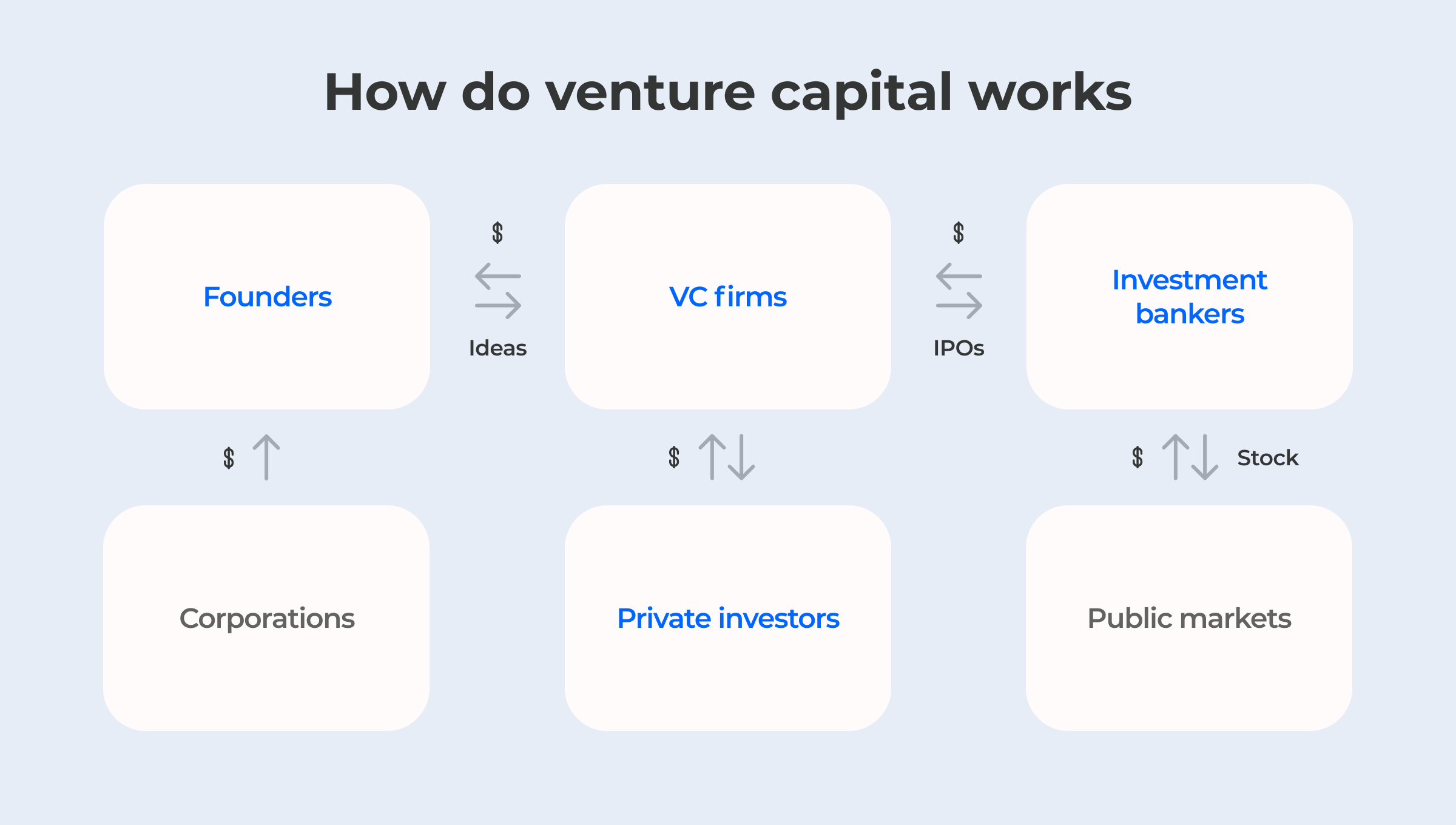

Venture Capital

Venture Capital or VC firms are the groups of organizations that invest large amounts of money in companies in order to provide them with funding to enhance the target company. A venture capitalist is a representative responsible for managing fund money and investing it into reliable projects. They deal with startups with a tested business plan, a dedicated team and generate money.

Angel Investors

Angel investors are individuals or groups that provide money to startup projects, even risky ones. They monitor potential IT unicorns and guide the business to refund the risk. They assess whether a product corresponds to the market needs, as well as the dedicated team and initial customers. Moreover, angel investors usually make decisions based on emotion. They can finance the business just because they love the project idea. That is because most “angels” are former startups and have experienced developing the business themselves, and they are ready to deal with possible risks. But before reaching the angel investors, founders have to ensure that they have an appealing presentation, good business plan, and testimony of the startup’s idea viability (MVP version of the product).

What Tech Startups Take Money For

You can’t just come and grab money. Before contacting the investors, it’s crucial to design a clickable prototype to persuade the stakeholders that a startup is worth money. So the first funding round is needed to develop an MVP (minimum viable product) of the future software. MVP development allows founders to launch the product fast and gather initial feedback to check the idea viability. A working, good structured product makes investors trust business owners. Now, let’s take a glimpse at the MVP development stages.

Conduct Market Research

First and foremost, the founders need to analyze the market to ensure their product will be in demand. There are many platforms that provide paid surveys allowing business owners to scrutinize their core competitors, see how they build MVP products, and what should be done to get an advantage.

Create Feature List

Before looking for an IT vendor, business owners need to write down the features they would like to implement into their software. Then, leave only those critical for building a minimum viable product. MVP concept means that there is no complicated functionality added.

Hire Software Developers

After determining the product’s requirements, entrepreneurs need to find an experienced tech partner to turn their idea into a working product. When selecting an IT provider, the following should be considered: number of successful projects, industry expertise, experience, clients’ review, and technology stack applied.

Product Development

After all software components are determined, it’s time to proceed to MVP development. It’s worth mentioning that MPV shouldn’t be overloaded. It has to include only core features needed to meet users’ needs and attract initial investment. The app development process itself consists of the following stages:

- Discovery phase. Business analysts scrutinize the project requirements and create a detailed project specification that encompasses features and tech stack information. Besides, UI/UX designers prepare wireframes for each app screen.

- UI/UX design. Designers make a product prototype based on the wireframes created in the initial stage.

- Development process. Programmers convert mockups into a well-balanced mobile app utilizing the appropriate tech stack.

- Quality assurance. QA engineers run multiple tests to ensure the app is bug-free and performs as expected.

- Release. The mobile application is transferred to the customer backed with all project documentation.

Analyze User Feedback

Once the application is built, it’s time to present it to investors. It’s essential to conduct beta testing before a meeting with stakeholders to avoid failure at the beginning. It’s also a great idea to validate the digital product on a real audience and make changes based on users’ feedback (if required). After getting an initial investment, business owners can implement more sophisticated features.

Summing Up

The startup fundraising process is long and tiring. In order to get investment for app development, it’s crucial to concentrate on building an eye-catching, well-architectured application and get ready for meeting with investors. For this purpose, a solid elevator pitch should be made. As a startup founder, it’s essential to persuade investors that you know your business inside and out and you have a profitable business idea.