Credit card processing is also known as payment processing. It is a system of accepting credit cards through merchant accounts. The entities that make up the credit card processing system are the credit card issuing bank, consumer, merchant services account, acquiring processor/acquiring bank, and the merchant. It is beneficial for your business to accept credit card payments because you will increase your sales by accepting another means of payment. You can lose a potential customer by not accepting credit cards.

Most businesses that accept credit cards have merchant accounts. Merchant accounts are obtained through banks or credit card processing providers. A merchant is a customer of a processor or acquirer that accepts credit cards. Merchant accounts are a type of bank account that allows businesses to accept payments by debit or credit cards. It is an agreement between a retailer and payment processor for the settlement of accredit/debit card transactions. There are many different types of credit card processing companies available to businesses.

A few points to consider when shopping for Credit Card Processing:

- By having a good credit card processing service you can increase your businesses sales.

- Flexibility to offer your customers many payment options.

- Remember that it is crucial for your processing company to demonstrate exceptional customer service in the event that your business comes across any problems or has any maintenance type questions.

Frequently asked questions about Credit Card Processing:

Q. Why does my business need a credit card processing service?

First and foremost it will increase sales for your business. With a credit card processing service you are allowing your business to accept more forms of payment which means your average customer will more than likely spend more.

Q. What key things should I consider when looking for a credit card processing service?

Key things to compare credit card processing vendors are: the cost per month, start-up costs, account set-up time, pos features and internet based features, average approval rating, and accessible customer service.

Q. What are the different types of credit card processing companies?

There are many companies available that offer credit card processing services including; banks, 3rd party merchant accounts (an independent processor that processes credit cards and distributes funds), Independent Sales Organizations (represents banks or third party processors and has an agreement to sell the services of the banks or third party processors and is permitted to mark up the fees and sign up merchants), an association, and a financial service provider.

Industry Jargon for Credit Card Processing:

Acquiring Financial Institution

An Acquiring Financial Institution contracts with the bank and merchants to enable credit card transactions. The acquirer deposits the daily credit card totals and debits the end-of-month processing fees from the merchants accounts.

Cardholder

Any individual who holds a payment card account and uses it to purchase goods and services is a cardholder.

Card Not Present

This occurs when the card is not present at the time of transaction (such as a mail order or telephone order). The credit card data must be manually entered into the terminal versus swiping a cards magnetic stripe through the terminal.

Chargeback

A credit card transaction that is billed back to the merchant after the sale has been settled. Chargebacks are initiated by the card issuer on behalf of the cardholder. Typical cardholder disputes entail product delivery failure or product/service dissatisfaction. Cardholders are encouraged to acquire satisfaction from the merchant before disputing the bill with the credit card issuer.

Discount Rate

A percentage of sales amounts or fees charged by the bank for processing credit card transactions.

Independent Sales Organization (ISO)

ISO is an Independent Sales Organization which represents banks or third party processors. The ISO has an agreement to sell the services of the banks or third party processors and is permitted to mark up the fees and sign up merchants.

Interchange

The standardized electronic exchange of financial and non-financial data associated with sale and credit data between merchant acquirers and card issuers on various types of MasterCard and Visa transactions.

Merchant

A merchant is a customer of a processor or acquirer that accepts credit cards.

Mail Order/Telephone Order (MOTO)

MOTO is a credit card transaction that is initiated by mail, e-mail, or telephone.

Non-Qualified Transaction Fees

Transactions that are processed at a higher interchange rate which do not meet Visa/MasterCard criteria for that particular merchant.

Secure Payment Gateway

Secure Payment Gateway companies which help other processors conduct secure business on the internet using Secure Socket Layer (SSL) technology.

Third Party Processor

A Third Party Processor is an independent processor that processes credit cards and distributes funds.

Value Added Reseller (VAR)

VAR is a third-party vendor which enhances or modifies existing hardware or software and in-turn adds value to the services provided by the processor or acquirer.

NATIONALPROCESSING

National Processing is a nationally regarded payment processing company. Best credit card processor 3 years in a row and counting. Payment processing services for small and large businesses. Start accepting credit cards today. Clover POS, clover credit card machines. Get the lowest rate credit card processing. ACH payment processing for all business types…

BLUEPAY

Accept credit cards, debit card and EMV payments from the Gold Stevie Award Winning payment provider, BluePay.

- Omni-Channel / Multi-Channel Processing

- Large Ticket Credit Card Processing

- Level 3 Credit Card Processing

- Batch Credit Card Processing

- Electronic Billing, Invoicing & Online Payment Software

- Reconciliation & Reporting

- Virtual Terminal Payment Processing

- E-commerce

- POS Systems

- Mobile Credit Card Processing & Payment Solutions

GBPAYMENTS

Super Fast & Secure sign up, with average savings up to 40% on your debit & credit card processing fees, backed by UK based customer support.

Countertop card machine:

- An easy to use, fast and reliable terminal, ideal for retail businesses

- Can be connected via your phone line, broadband or both

- Tough and sleek design, taking minimal space at your till area

Portable card machines:

- Take payments to your customer with this light and easy to carry portable machine

- Works up to 100m away, ideal for small and large premises

- Great battery life, avoiding the need to constantly charge

Mobile card machines:

- Lightweight, quick and highly reliable

- Utilising a roaming sim, working across all UK networks

- Super battery life

ALBERTAPAYMENTS

Alberta Payments LLC located in New Jersey USA, provides retail management solutions like point of sale, credit card processing and food processing kiosk with key features to enhance your sales and customer experience.

- Move lines quickly with instant payment processing

- Compatible with most point of sale systems.

- Secure payment platform with PCI compliant & EMV certified terminals

APSPAYMENTS

APS Payments is a gateway, processor, and integrator that is trusted by thousands of merchants daily to process payments.

- APSPAYS Vault

- EMV

- Level 3 Rates

- ClickToPay

- ClickToPay Direct

PLATPAY

Platinum Payment Systems is a registered ISO/MSP of Deutsche Bank Trust Company Americas, New York, New York.

- Competitive low rates

- Quality customer service

- Fraud and chargeback protection

- No Long-term Contracts

- No heavy cancellation fees

- No required high reserves

STERLINGCREDITCARDS

Sterling Merchant Solutions: Serving Madison through Milwaukee Wisconsin. Local & affordable Credit Card processing. Accept unlimited credit & debit card revenue for only $50/mo!

- 0% Processing Fees

- Unlimited Everything

- Local & Personable

- All For Only $50/mo.

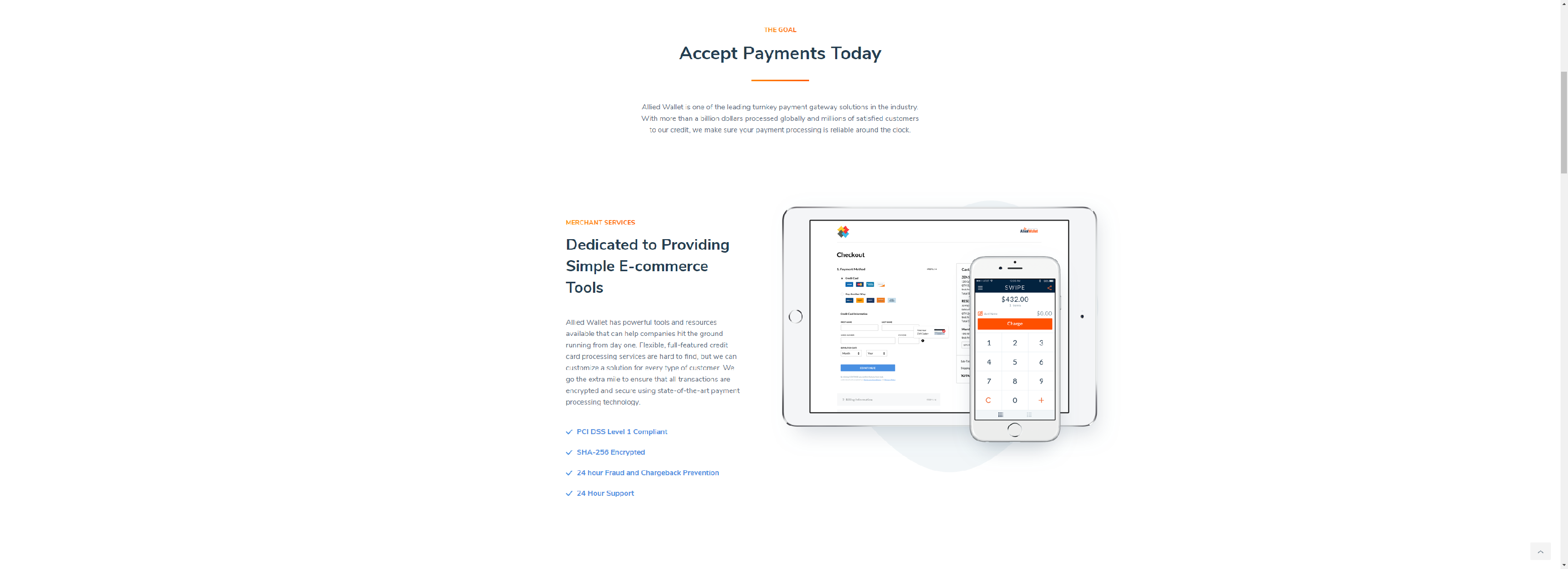

ALLIEDWALLET

The premier payment gateway for credit card processing & merchant services worldwide. Accept credit cards on your site with superior support & low rates.

- PCI DSS Level 1 Compliant

- SHA-256 Encrypted

- 24 hour Fraud and Chargeback Prevention

- 24 Hour Support

- Multi-Currency

- Ease of Use

- Safe Payments

- Don’t Settle for Less