Business Liability insurance safeguards small businesses from a lot of problems due to a lawsuit and also helps small businesses from being sued in the first place.

Most small business owners underestimate their need for liability insurance. Countless liabilities exist for most small businesses. You are liable when you have signed a personal guarantee to get an important loan, if you personally have injured someone, even by mistake, acted irresponsibly, or if you don’t operate your business as a separate entity. Every year customers, employees, vendors, lenders, and even government agencies sue small business for one reason or another.

There are numerous other possible situations that can arise in which you would need some type of business liability insurance. When purchasing liability, make sure to think of all of your needs or possible needs surrounding liability insurance. It is advisable to be covered in case.

“How much coverage do I really need,” is commonly the very first objective that comes to mind when any entrepreneur, lawyer, or CEO thinks about liability insurance and naturally the appropriate reply is, “Well, that depends,” because every business organization is distinct. That is not necessarily very helpful but it is the truth.

How Much Liability Insurance Do I Need?

There are a variety of things to take into consideration when purchasing liability insurance, but here are the most important questions:

1. Just how much insurance can you afford? Of course this is the basic issue of all insurance. No one can really afford to insure against all possible risk. How can you balance the competing needs of risk and the expense of protection? There isn’t any simple answer to that question. Insurance companies will toss out numbers, and accountants, attorneys, and your favorite bartender might be worth asking for an opinion, but ultimately you must make a decision based on the best information you can. There isn’t any perfect remedy. Well, unless you lack a sufficient amount of liability coverage in the event you require it. That is the problem.

2. How much can you mitigate your liability without adversely impacting your core business? You should consider every procedure that you or your personnel perform and see if you’re able to find a less dangerous way for you to accomplish exactly the same end goal.

Clearly, many risks are implicit to certain business, for instance fishermen always have to be concerned about drowning, and certain options are too expensive to really put into practice, but sometimes you will uncover a revolutionary idea that both minimizes your liability and raises your productivity. A risk management consultant will help you search for these ideal options, but be sure to select a risk management consultant with individual understanding of your industry.

3. Are there any physical risks involved in your business? There are a variety of forms of liability, for example economic liability, but none are more substantive than the liability that is caused when an employee, client, or, most unfortunate of all, a member of the general public is killed or injured, as a result of actions of you or your employees. In part, this is because of shock value that stories of maimed personnel or customers draw in the press, but also because the healthcare costs or worse survivor’s benefits are generally amazingly expensive.

4. How expensive are judgments in your business? Judgments vary greatly from industry to industry and among states, but a good insurance agent can give you some direction.

5. How large is your firm? Sure, it may not be be really fair, nevertheless the bigger your business the more insurance that you need comparable to smaller companies, because with far more activities there exists, all other things being equal, a higher chance of a accident. Moreover, a large, profitable corporation that appears to manage to pay a judgment is an infinitely more attractive focus for litigation than a tiny start-up business that apparently doesn’t have any other assets than a ’81 Jeep Cherokee and two hammers and a broken nail gun.

Avoiding Frivolous Lawsuits

We live in a litigious society.

People can and will sue for almost anything, even if it isn’t actually your fault. You can read about frivolous lawsuits every day. Some of these cases are idiotic, many are obviously ignorant about the realities of running a business, and some are almost childish, but no matter how baseless a lawsuit is on the merits if the court issues a judgment against your business you may be out thousands or even millions of dollars in a true judicial massacre.

You should have liability insurance to shield you from those sorts of miscarriages of justice where your company was not in any way at fault, but, even more importantly, you need good well thought out liability coverage for those ill-fated times when the incident it is your fault.

Nobody is perfect. That’s a uncomplicated fact – not an excuse.

Commentators often discuss frivolous lawsuits, but the simple truth is that courts have gotten a lot tougher on frivolous lawsuits in the last thirty years. Generally, frivolous lawsuits are at most a hassle.

What you ought to lose sleep about if you lack liability coverage is that day when everything that can go wrong does go wrong.

That’s what happened on the Titanic and that’s happened at Pearl Harbor also it can happen to your business. What’s the worst case scenario? Have you ever really thought about it?

Do you run a business where if your employees didn’t do their job correctly that a customer, or even worse a random citizen, could be injured or even killed? How often each and every day do your employees perform these potentially unsafe tasks?

If you do not have adequate liability coverage you are mindlessly trusting that those employees will deliver the results exactly right each and every time? Can you trust your employees that much?

Small Business Liability Insurance

There are a variety of varieties of liability coverage and commonly it is a specialty insurance that is made to match the specific needs of your business. However, your individual policy is developed from existing templates and there isn’t any reason to reinvent the wheel, because today if a risk can be insured against someone somewhere has almost definitely bought a policy to cover that risk.

So, whichever company you purchase your policy from will compare your company to other companies they cover and develop a policy or group of polices to handle the risks.

Considering that liability insurance is not a one size fits all product it is even more important that you should shop around than for car insurance or health insurance. You’ll want to get four or five or five quotes and be very careful about buying on price alone. Among the best technique is almost always to actually ask several insurance agents what risks they believe are most important in your given situation and compare the answers with your knowledge and what you are able to learn from other sources.

Types of Business Liability Insurance

There are a wide variety of business liability insurance policies and often policies that cover the same or nearly the same risks. For instance, malpractice insurance is often called professional liability insurance and it covers nearly the exact issues as errors and omissions insurance.

It is a little confusing. However, here are a few of the more common policies:

Product Liability Insurance

Product liability is another kind of insurance, but, unlike malpractice insurance, it covers tangible products; its objective is to protect businesses from claims on defective products they have manufactured.

The Ford Pinto was a infamous example of this when Ford knowingly produced a vehicle with a fuel tank that the giant auto company’s top executives knew was likely to burst if the car was rear ended. Ford ended up paying out tens of millions of dollars in awards to victims and the families of victims, and Ford’s product liability insurers probably covered the vast majority of the claims. However, it is worth mentioning, though this occurred in early 1970s, it is likely that today such cold blooded analysis of driver deaths would void product liability coverage, because Ford actually knew about the problem. Really, the Pinto was not defective; it performed exactly like it had been designed to perform – poorly.

From makers of toys and baby products to manufacturers cranes and bulldozers, many companies have benefited from the protection of product liability insurance. If you do business in an industry that even occasionally has products re-called you really need to consider product liability insurance.

General Liability Insurance

General liability insurance is frequently part of an insurance package. It provides coverage in the matter of lawsuits due to bodily injuries incurred by customers, employees, or guests while on your property or property damage caused by you or your employees. General liability is by far the most commonly seen type of liability insurance, but there are four other common policies that are more tailored to the unique needs of certain customers.

Employment Practices Liability Insurance

Employment practices liability insurance is a fairly new kind of liability insurance. This insurance defends employers from dissatisfied employees, former employees, and business partners who file claims accusing them of violations of legally required employment or business rights. Lawsuits claiming sexual harassment, racism, gender bias, and religious persecution, among other issues, have dramatically increased over the last thirty years, and employment practices liability insurance is intended to preserve your business from such suits.

Directors and Officers Liability

The newest sort of liability insurance, directors and officers (D&O) liability, has in recent years become an essential part of insurance in the corporate world. All Fortune 500 companies keep D&O insurance due to substantial rise in lawsuits against the officers and management of companies since the early ‘70s. Initially, directors and officers liability was created to shield the heads of companies from personal economic ruin for actions taken in their professional roles. However, these days D&O protects not only the directors and officers of a company, but the company itself.

Professional Liability Insurance

Professional liability insurance, particularly medical malpractice insurance, is probably the most widely known type of liability insurance. In general this type of insurance one variety of specialized policies aimed at a specific group of small business people. Professional liability insures professionals like lawyers and doctors from claims against them. One example of this sort of liability is malpractice insurance. Doctors in particular can testify to the rising amount of lawsuits filed against their profession.

Liability Insurance Companies

It is worth your trouble to shop carefully, because liability insurance comes in so many different varieties. Also, this is one area that even your most ferocious competitor will probably be willing to help you with, because most small businessmen simply hate the idea of being sued.

Things to remember

You need to make educated decisions so that you can gain better treatment and also at a much lower cost. You need to decide if you’re going to find a policy all by yourself or find an agent. You should also look at the legal fees. You can also search online liability insurance. But be careful when searching the Internet safe. There are many fraudulent websites that give wrong information and try misleading. So, you must be very careful when choosing a safe online.

So definitely can go for special liability insurance business so you can secure your business greatly. But you should always try to get the best deal possible so you do not have to spend much of their money.

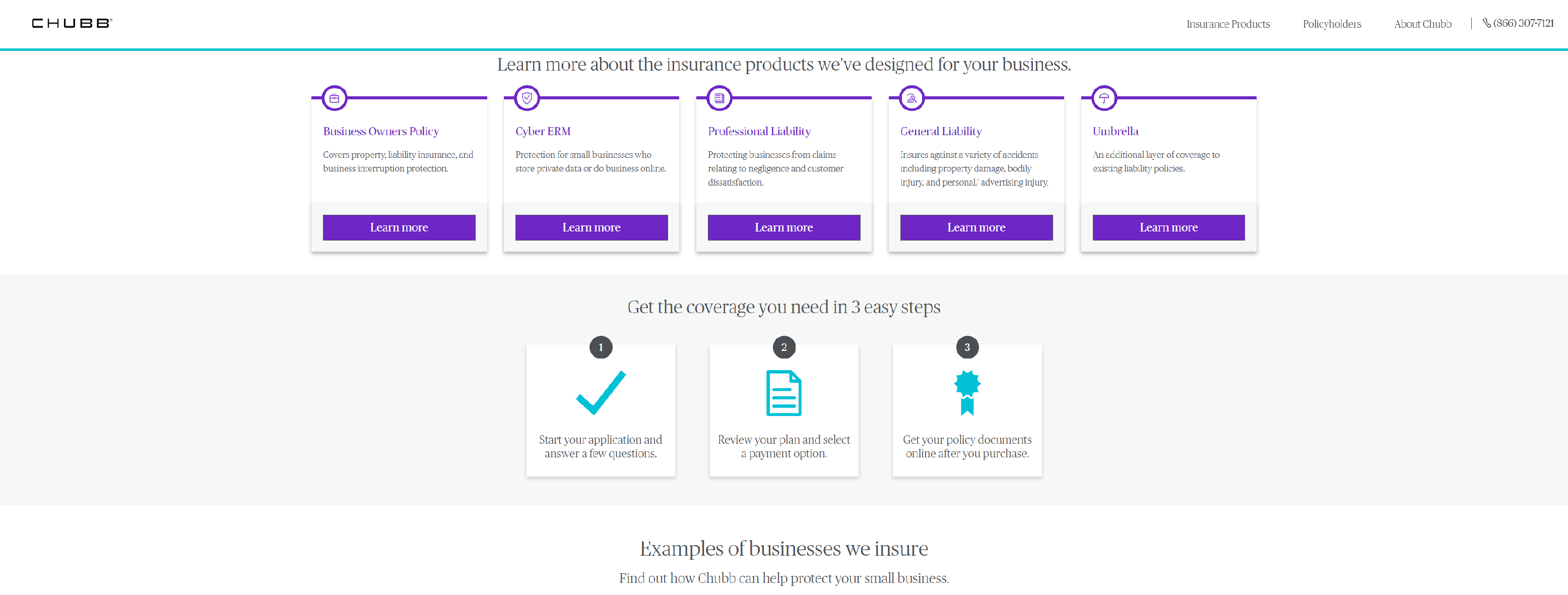

CHUBBSMALLBUSINESS

Chubb offers business insurance that is crafted to fit the needs of small business owners.

- Accidents happen. Chubb can work with you to provide specialized coverage for your business in the event of a workplace injury or illness.

- With broad protection for property and liability exposures, Chubb’s Business Owners Policy serves as the foundation for your insurance portfolio.

- Valuable insurance for today’s digital age. Chubb’s Cyber ERM provides insurance protection for your small business who store private data or do business online.

- Professional firms are constantly at risk of being sued for professional liability arising out of the professional services they perform. Even if the lawsuit is without merit, defense costs and the impact on your reputation can be costly.

- Your business faces liabilities every day. Protect your business assets with Chubb’s General Liability insurance.

- Chubb’s Umbrella insurance provides an additional layer of coverage to your existing liability policies.

HISCOX

Hiscox offers business insurance tailored to your specific business needs. Helping the courageous overcome the impossible through business insurance.

- General Liability Insurance

- Professional Liability Insurance

- Errors and Omissions Insurance

- Business Owners Policy

- Workers Compensation Insurance

- Cyber Security

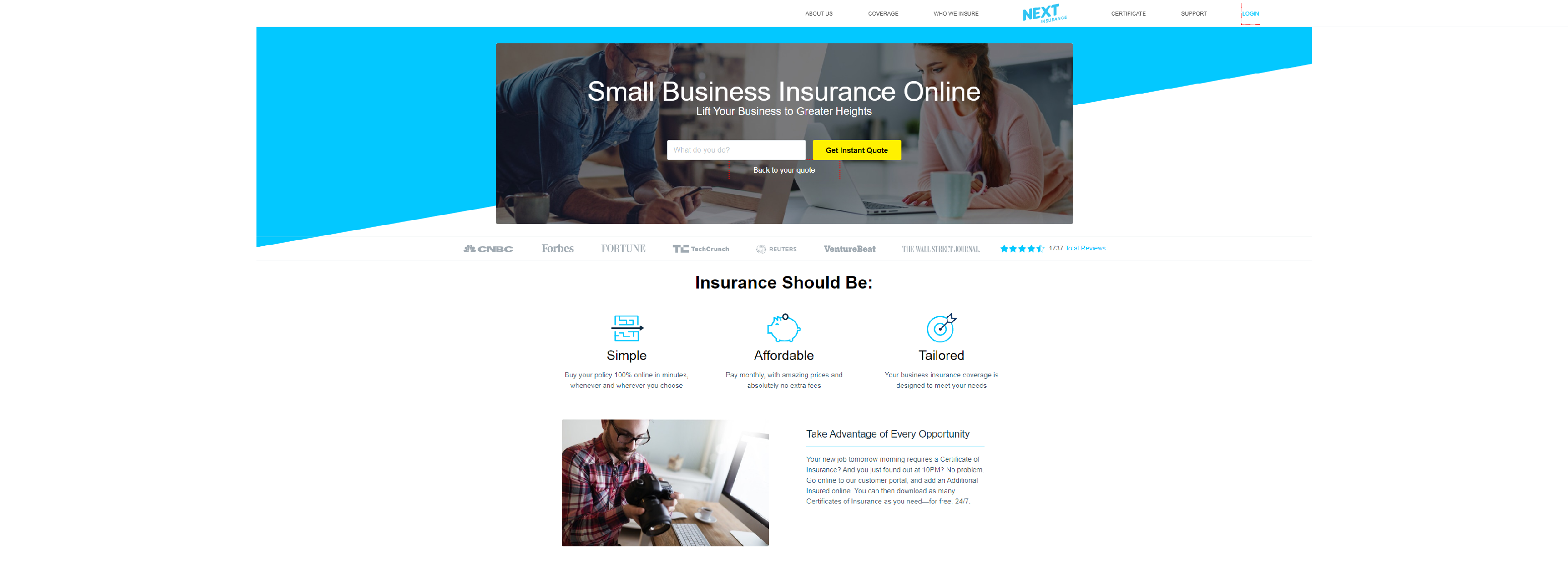

NEXT-INSURANCE

Next Insurance changing the face of Small Business Insurance by merging technology, design & good old-fashioned know-how.

- Buy your policy 100% online in minutes, whenever and wherever you choose

- Pay monthly, with amazing prices and absolutely no extra fees

- Your business insurance coverage is designed to meet your needs

GETCOVERLY

GetCoverly business is backed by Bibby Financial Services, an SME specialist trusted by over 10,000 businesses and the largest independent invoice finance company in the UK.

- Tweak your cover online any time your business changes

- Get covered in minutes by answering a few simple questions

- No admin fees. No jargon. Understand what you are buying

NATIONWIDE

Nationwide’s general liability insurance protects your business from unplanned accidents.

- Hired and non-owned auto liability

- Directors and officers liability

- Umbrella policy

- Liquor liability

- Product and completed operations liability

- Fire legal liability

- Employment-related practices liability