The banking industry is a far cry from other spheres of business. Its key business model is not based on transactions, it is closer to stewardship. The basic process taking place in the industry of finance is the direct exchange of payments for different goods or services. When it comes to providing loans, insurance, and investing, financial advisors and consultants are entrusted to take care of the clients’ financial savings. Therefore, it’s very important to build good relationship between the companies working in this sphere and their clients, proving the latter that they’ll have high personal gain and minimum of inconvenience. In order to meet this challenge, modern organizations apply to CRM solutions for banks, which let them close the gap between their employees and customers, increase the level of customer satisfaction, and thus boost up ROI. Let us have a look at four best bank CRM systems and their distinctive features.

Discover the top 4 best Banking CRM Software – Salesforce, Microsoft Dynamics, Sugar CRM, Netsuite

#1 Salesforce

It is a popular cloud-based banking CRM software, which can be easily synchronized with third-party platforms. The system lets companies strengthen relationships with corporate customers and capital investment organizations. Salesforce banking tools help financial enterprises create personalized marketing flows that are aimed at nurturing home-buying prospects and keeping their engagement throughout the complete process of interaction. With this platform, you will be able to create and customize a network in order to interact with your clients, brokers, employees, and so on. The advantages of this corporate banking CRM are the following:

- It helps companies consolidate their client information into the single place

- Having implemented Salesforce, you’ll be able to manage your data across teams and departments

- It is always accessible on computers and mobile devices

#2 Microsoft Dynamics

This bank CRM software can be deployed as on premise and on-cloud versions. It stands to reason that the platform is easily integrated with the rest of Microsoft products. The banking tools of Microsoft Dynamics serve as the solution to most common business challenges. They improve sales force automation, bring customer service to greater heights, and help enterprises choose the most profitable marketing modules, which would empower the stuff to focus on what’s really important. Look at the key benefits of this CRM software for banks:

- The platform lets financial advisors evaluate the customers’ household assets and liabilities

- With Microsoft Dynamics, companies easily identify and track relationships between their clients and households

- The platform can be customized in accordance with the user’s needs

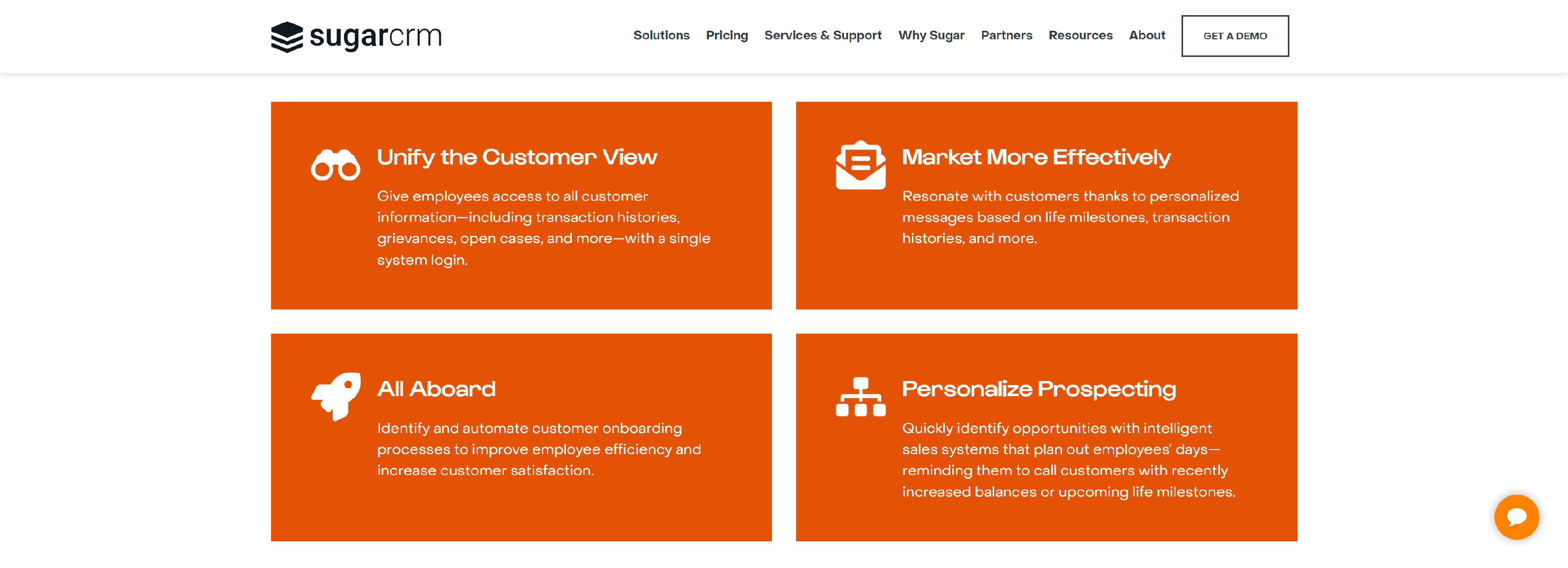

#3 Sugar CRM

It is a user-friendly CRM in banking industry, which helps investment companies communicate with their prospects and existing clients, share all the necessary data with the stuff, and keep their customers happy. Applying to Sugar CRM banking software, today’s enterprises get the opportunity to manage their sales, marketing, and client service processes as efficiently as possible. It is easily customized and adapted to meet the requirements of small and mid-sized companies, though many large enterprises implement this CRM for banks, too. Let us consider the key benefits of Sugar CRM:

- It feeds financial advisors with the right information at the right moment

- The system seamlessly guides every client through every phase of the pre-planned journey

- This banking CRM improves business efficiency and boosts up the level of customer satisfaction

- It can be deployed both on cloud and on-site

#4 Netsuite

This CRM in banking sector lets enterprises track the visitor information on their websites and then easily transfers all the necessary data into the software. The system offers multiple instruments for marketing management, prospect nurturing, lead tracking, and so on. With Netsuite banking tools you will be able to send personal or mass emails and monitor the results of every campaign. The database and functionality of this CRM in bank are sat on the company’s own IT architecture. As for the advantages of Netsuite for the finance industry, they are as follows:

- It lets companies instantly create financial statements and analyze their effectiveness

- This CRM in banking helps enterprises monitor and estimate their key business performance indicators

- The system supports 190 currencies and 20 languages, and can be used in more than 100 countries

How finance CRM improves retail banking

What is a key priority for innovations? The majority of financial institutions claim that major innovation focus lies in the customer interfaces and communication channels. There is also a high demand for customer’s buying needs and preferences identification, development of new products and core platforms of accounting system. Obviously, there is still a number of risks, like unstable economy and currency volatility, which considerably influence the financial system. Nevertheless, a lot of banking representatives reveal that especially now is the time to look at the optimization of business processes, as well as implementations of new technological solutions. The reason behind it is that when business stabilizes and starts growing, companies need to deliver high performance and compete for the market share rather than paying attention to the back-office processes.

It is worth noticing that financial sector is considered the least innovative area. Unlike telecom and retails that are perceived as early adaptors of the innovations, the banks used to be more conservative. However, the situation shifts. Recent studies reveal that 97% of interviewed banking CEOs (out of 1000 banking CEOs around the world) consider innovations as key priority for the growth. Nonetheless, only 10% see their companies as innovation leaders. Impressive statistics, isn’t it?

Let us take a closer look at the trends that are noticeable now and will have impact on the development of retail banking in the upcoming future. Instead of speaking about futuristic technologies, let’s consider the challenges in banking that financial organizations have to deal with on a daily basis and how suitable CRM products can benefit your firm.

High customer expectations and how CRM in finance can meet them

Nowadays, high-quality service, relevant offers, accessibility and simplicity of communication with the bank are the most important aspects for modern customers. Customer experience is what the fight to win customers over will be focused on and it’s already started. In addition, financial startups that are resilient and versatile keep popping up. They already possess a serious competitive edge to traditional banks, as these fintech startups offer clients instantaneous solutions online. The studies reveal that the duration of decision-making process on crediting solutions ranges from 5 to 15 minutes. The key players aim for 1-2 minute decision-making process. In order to achieve these ambitious goals, your firm is going to need a suitable automation solution that would help your employees to process huge volumes of information faster.

Why customers choose fintech companies over traditional banks?

The reason is that these financial startups meet the expectations of modern customers and form a unique customer experience. They plan and optimize a customer journey beforehand. What can a traditional bank do in this direction now? Can a bank offer a client such a unique experience? Yes, it can. However, oftentimes, the banks simply do not do it. Let’s have a look at a simple example and follow a customer journey to see how many opportunities for improvement a bank has. Obviously, the banks communicate with their customer using various communication channels, so this a rather simplified structure of a customer’s journey:

The customer journey starts with potential customer looking for required products and services on the website. Most probably, the customers is checking out the websites of other banks, as well. Potential clients evaluate and compare offered services. Eventually, the customer leaves a request, makes an inquiry and awaits for feedback. At this stage, the inquiry can easily get lost. It is worth noticing, that the absence of any reaction can seriously damage your business. But why does this happen at all? The reason behind it is that, oftentimes, the banks do not have a clearly defined business process to manage various types of cases. On the next stage, contact center steps in: the agent needs to potential customer. It is crucially important for the agent to provide an accurate and relevant information that would make your prospect dash to your local branch as soon as possible.

Unfortunately, the agents are not as proactive as you expect them to be. They simply answer the customer’s questions and do not make any visible effort to attract the customer. They simply do not have the tools for it. If the agent did manage to arrange a meeting in the bank, you could send a reminder via SMS. When the customer visits the branch, it is important for the representative to not ask the same questions as the agent previously did. The customer doesn’t have to duplicate the information while the manager needs to be aware of the customer’s previous interactions and buying preferences. Having the right tools that advanced CRMs, are equipped with, the rep will be able to tailor the products and services that would match customer’s needs. It is possible that the customer will not be able to make a decision on the spot, which means that you would need to maintain a constant dialog with the client to arrange more meetings until the customer will be finally ready to buy. Finally, you can up-sale and cross-sale using the most suitable communication channel. This is a rather simplified structure that already showcases how beneficial would business process automation be. With a finance CRM at your disposal, you can see the pitfalls of the customer journey they might result in lost opportunities. In addition, the system can suggest the next best steps to simplify the customer journey while meeting your business goals.