Hedge fund software refers to a range of specialized tools and platforms designed to help hedge funds manage their operations, investment strategies, trading activities, risk management, compliance, and reporting.

Discover Top 15 Best Hedge Fund Management Software for Public and Private Assets

Hedgeguard

Hedgeguard Hedge Fund Software offers a comprehensive, front-to-back portfolio management system that allows you to monitor trades, manage risk, and ensure compliance.

- Real-Time Price Feeds

- Portfolio Simulation & Modeling

- Order Entry

- Performance Contribution Analysis

- Cross-Asset Multi-Strategy Support

- Order Execution

- Exposure Calculation

- Pre-Trade Risk & Compliance

- Custodian & Administrator Connections

- Subscriptions & Redemptions

- Multi-Share Class & FX Hedging

- Trade Matching

- Cash Movement Management

- Series Accounting

- Trade Settlement

- Redemptions & Margin Calls

- Shadow NAV Calculation

- Multi-Portfolio Position Tracking

- Cash Reconciliation

- Official NAV Validation

- VaR & Stress Testing

- Risk Reporting

- Post-Trade Compliance

- Investor Reporting

- P&L Attribution

- Regulatory Reporting

- Pricing & Greek Analysis

- Custom Reporting

Broadridge

Broadridge offers a comprehensive hedge fund service with a unified multi-asset platform, seamlessly integrating order, portfolio, and risk management for both public and private markets.

- Portfolio Management & Trade Order Execution

- Quantitative Portfolio Risk & Analytics

- Client Reporting & Advanced Analytics

- Securities Lending

- Cash & Collateral Management

- Mortgage-Backed Securities Platform

- Integrated NYFIX Order Routing Network

- Reference Data: Price & Security

- Data Warehouse & Enterprise Reporting

- Collateral Management

- Securities Class Actions

- Portfolio Securities Proxy Voting, Disclosure & Insights

- SWIFT Services

- Corporate Actions

- NYFIX Matching for Trade Allocation & Confirmation

- Performance Reporting

- Regulatory Reporting (SEC Filings)

- Reconciliations

- Invoicing, Expense Validation & Budgeting

- Investment/Portfolio Accounting

Repool

Repool builds innovative solutions for hedge funds: fund-in-a-box, fund administration, digitial subscriptions, and more.

- Our flagship all-in-one solution for launch and ongoing operations, covering entity formation, fund documentation, administration, and compliance

- Expert administration powered by award-winning software that enhances fundraising efforts and provides an outstanding investor experience

- A unified software platform for fundraising, subscriptions, investor servicing, and fund administration

- Join the waitlist for exclusive private fund investment opportunities and marketplace access

Fundcount

Fundcount streamlines the investment process with a fully integrated accounting and reporting solution that enhances simplicity, efficiency, and accuracy.

- Precise, unified data

- Multi-currency accounting system

- Robust functionality

- Optimized efficiency

- Versatile performance monitoring

- Quick and simple reporting

- Enhanced investor support

- Confidently manage with transparency

Dynamosoftware

Dynamo’s flexible, cloud-based hedge fund software simplifies investor communication, fundraising, and performance analysis.

- Find new investors, raise capital, and enhance investor relations with targeted, personalized email campaigns and activity tracking

- Identify and engage potential investors while tracking pipeline progress throughout fund marketing and launch

- Gain insights into individual investor motivations, their connections within your network, and their interactions with your firm

- Elevate your firm’s marketing, branding, and investor communications through a secure, integrated investor portal

- Access consolidated, up-to-date data with real-time reporting, delivering the information you need when you need it

- Effortlessly import account balances and transactions from your fund administrator in just minutes

Linedata

Linedata helps you manage and grow your alternative business with efficiency. Its highly customizable portfolio management system (PMS) seamlessly integrates software, services, and data.

- Wide variety of securities, including equities, debt, derivatives, FX, bank debt, repurchase agreements, swaps, fixed income, and cash events

- Distinct data structure for generating reports at the fund, book, and strategy levels, with an intuitive drag-and-drop interface to customize and define custom fields

- Managed through a FIX-enabled, multi-class trade blotter with two-way integration to EMS systems and brokers, allowing real-time tracking of trading, positions, and exposures, with orders generated for multiple funds

- Pre- and post-trade support, along with data-driven rules for complex modeling

Indataipm

INDATA’s hedge fund software transforms investing by streamlining all investment management activities, enhancing efficiency, and cutting costs.

- Migrating to a cloud-native SaaS hedge fund management software ensures your systems are always up-to-date

- A comprehensive front-to-back-office system provides all the essential solutions for buy-side hedge fund management

- All the tools needed to manage hedge funds are seamlessly integrated within one connected ecosystem

- INDATA incorporates reference data into the system’s security master, easily accessible for clients

- INDATA solutions integrate automation and practical AI into their core functionality

- The INDATA iPM Cloud solution, combined with managed services for middle and back-office operations, enables hedge funds to outsource these functions to a team of INDATA experts

Altvia

Altvia enables your team with a platform that boosts performance and enhances your ability to quickly adapt to market changes, driving higher returns in a competitive environment.

- Attract and retain investors by showcasing strong performance and maintaining proactive communication

- Boost LP engagement with a personalized communication platform fueled by data-driven insights

- Keep communication transparent and provide full visibility into your fund’s operations

Alternativesoft

Alternativesoft leads the way in technology, equipping hedge fund professionals with advanced tools that deliver sophisticated analytics and insights to drive informed decision-making and enhance portfolio performance.

- Managing Complex Portfolios

- Data Integration Obstacles

- Difficulties with Manual Reporting

- Enhanced Asset Allocation

- Real-Time Monitoring of Performance

- Risk Management & Stress Testing

- Regulatory Compliance Reporting

- Automated Hedge Fund Analytics

- Customizable Dashboards & Insights

- Integration with Excel & Power BI

Finastra

Finastra is a leading global fintech company, providing the most extensive range of solutions for financial institutions of every size.

- Drive growth and diverse strategies to unleash the creativity of your front office

- Achieve optimal decision-making with real-time P&L and risk analytics, coupled with versatile simulation tools

- Maximize efficiency with a unified solution offering full STP and comprehensive third-party connectivity

- Select the model that best suits your needs, whether in-house, cloud-based, or managed service

- Customize pricers, analytics, and integration options to match the unique capabilities that set your hedge fund apart

Portfoliobi

Portfolio BI provides a comprehensive suite of hedge fund solutions that empowers your fund to generate innovative investment ideas, build portfolios, execute trades, analyze performance, and manage data across the front, middle, and back office.

- Simply ask your question, and Insights will provide clear, data-driven answers in either text or visual formats

- Insights serves as your dedicated assistant, offering instant support around the clock – no need for scheduled meetings, waiting for analysts, or delays caused by new customized reports

- Understanding the complexities of alternative investment data, Insights delivers contextually relevant and precise responses

- A state-of-the-art solution powered by advanced machine learning technologies and large language models (LLMs), Insights enables you to get answers to your business data questions via a conversational interface

Intapp

Streamline data management, gain valuable relationship insights, and keep a well-organized database of exposure and performance data with Intapp DealCloud’s hedge fund management software.

- Enhance relationships with AI-powered reporting, automated data capture, and centralized coverage

- Uncover new opportunities by tracking sponsor and intermediary relationships alongside market trends

- Speed up deal-making by consolidating due diligence checklists and approval workflows in a single hub

- Make more informed decisions by centralizing institutional knowledge on one platform

- Streamline investor outreach by creating, sending, and analyzing branded email campaigns

- Achieve improved outcomes by centralizing your target pipeline and optimizing resource allocation

- Boost efficiency in investor outreach, lead progression, and fundraising by synthesizing complex firm data

Opscheck

OpsCheck simplifies workflow management for finance teams by automating tasks, tracking compliance, and enabling real-time collaboration.

- Cloud-based control for hedge fund operations

- Robust, hedge fund-specific reporting and notifications

- Flexible workflow and task management solutions tailored for hedge fund managers

- Showcase operational excellence to auditors, regulators, and clients

- Ensure compliance with global regulations like FATCA, KYC, CRS, AIFMD, Form PF, and more

- Significantly enhance team efficiency and accountability

- Seamlessly coordinate across teams, offices, and time zones

- Easily integrate with third-party applications such as CRM and Capital Raising platforms

- Centralized communication hub for the entire organization

- Provide transparency to regulators and clients with a comprehensive audit trail

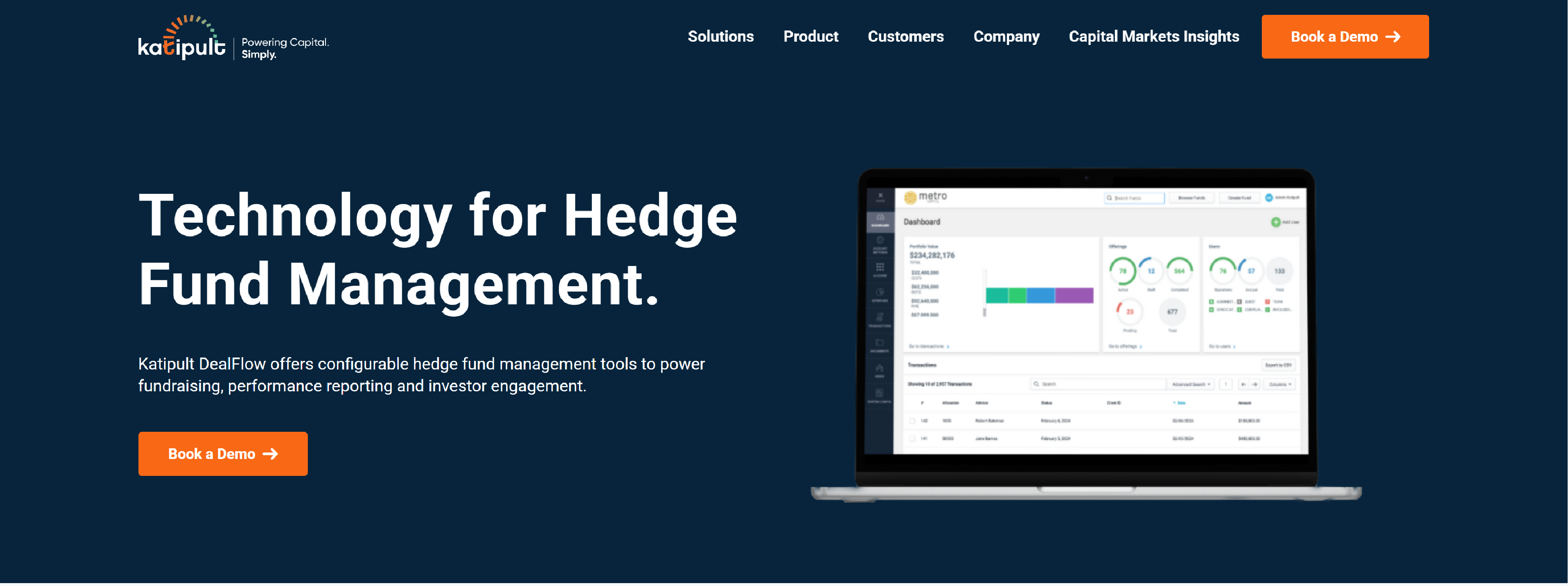

Katipult

Katipult revolutionizes your operations with advanced capital markets technology and software designed for private placements, private equity, and CIRO Investment Dealers.

- Facilitates PPM distribution and allocation management for large institutional investors in private deals

- Upgraded investor CRM to securely distribute and track detailed deal information for both individual and institutional investors

- A workflow engine designed to manage investor participation in private placements, Reg D or Reg S offerings, and Funds

Satuit

Satuit Asset Management CRM and Investor Portal solutions streamline sales, lead management, client service, compliance, and investor reporting.

- Effortlessly visualize KPIs, activity metrics, and marketing performance

- Track all activities at both the contact and entity levels

- Seamlessly import historical investor account data directly from your portfolio management system

- Capture and store documents in a centralized location for easy access and management

- Easily coordinate group conference calls, analyst briefings, and meetings

- Utilize email templates for both bulk and individual outreach

- Analyze complex investor relationships, including their advisors and activities, in one place, providing a comprehensive summary of all interactions

- Track critical investor-facing data for both open-ended and closed-ended funds, and gain insights into key information such as subscriptions, redemptions, various tranches, investment dates, and share classes