Chargeback management software is a tool or platform designed to help businesses and merchants manage and dispute chargebacks effectively. Chargebacks occur when a customer disputes a transaction with their bank or credit card company, and the merchant is required to provide evidence that the transaction was legitimate. Managing chargebacks can be a time-consuming and complex task involving gathering evidence and submitting it in a timely manner.

Chargeback management software automates the process and provides businesses with tools to manage disputes, track chargebacks, and reduce losses from fraud and disputes. Features may include chargeback alerts, analytics, dispute management, risk analysis, and reporting.

The following are some key features of chargeback management software that businesses may find useful:

1. Automated chargeback management: The software should be able to automatically identify and categorize chargebacks to streamline the dispute resolution process.

2. Integration with payment processing: It should integrate with existing payment processing systems to quickly resolve disputes and reduce the risk of fraudulent chargebacks.

3. Analytics and reporting: The software should provide detailed analytics and reporting regarding chargeback trends, customer behavior, and dispute resolution performance.

4. Collaboration tools: It should offer collaboration tools to allow efficient communication between merchants and payment processors to quickly resolve disputes.

5. Fraud detection and prevention: It should have built-in fraud detection and prevention tools to reduce the risk of chargebacks resulting from fraudulent transactions.

6. API integration: It should support API integration, which allows merchants to connect their payment gateway with third-party applications for better chargeback management.

7. Case management: It should manage chargebacks throughout the entire payment cycle, from transaction processing to the final resolution of disputes.

8. Alert notifications: It should send alert notifications to merchants when disputes are filed, ensuring they have complete knowledge of the dispute process and can respond promptly.

9. Chargeback prevention strategies: It should provide chargeback prevention strategies based on data analytics to help businesses minimize future chargebacks.

10. Compliance: It should meet all regulatory requirements, including PCI-DSS compliance to ensure the security of payment data.

SEON

SEON Fraud Prevention tools help organisations reduce the costs and resources lost to fraud. Spot fake accounts, slash manual reviews and cut chargebacks now.

- Automatically capture genuine payments and cancel (void/refund) fraudulent ones

- Plug & Play: easy to understand and work with. Frictionless customer experience

- Use 50+ social & digital profile scans to verify real and spot fake customers

- Customizable risk tolerance, rules, black- and whitelists to fit every business

- Unnoticeable fraud patterns flagged by AI & machine learning assisted engine

ACCERTIFY

Accertify dispute management integrates with most processors & can be used as a standalone product. Visit our site to learn about our chargeback management products.

- Over 50+ integrations to processors worldwide and a library of pre-built dispute templates to reduce manual effort

- Perform win-loss analysis to determine new rules for improving screening and provide regular operations and trend reports

- Accertify oversees chargeback operations or supports your in-house team by performing key functions to help improve productivity

- Platform automates receiving, managing and replying to chargebacks for all major networks: American Express, Visa, Mastercard, Discover, PayPal, etc.

CHARGEBACKS911

Chargebacks911 is the original chargeback management company with solutions to prevent chargebacks before they happen and fight chargebacks once they do.

- Credit Card Dispute Time Limit

- Credit Card Dispute

- Chargeback Disputes

- Visa Merchant Purchase Inquiry (VMPI)

- High-Risk Merchant Account

- Mastercard Reason Codes

- Chargebacks Explained

- Chargeback Management

KOUNT

Kount works with major card brands to help businesses act on and resolve customer disputes quickly to prevent chargebacks.

- Reduce chargebacks almost immediately

- Communicate refunds quickly

- Save the sale

- Manage disputes and chargebacks in one place

- Inform future fraud prevention

- Pay only for positive outcomes

MIDIGATOR

Midigator’s chargeback management software can help simplify your payment disputes with real time reporting and in-depth analytics.

- Intelligent Dispute Responses

- Chargeback Prevention Alerts

- In-Depth Analytics

- Custom Notifications

- Real-Time Account Reporting

- DisputeFlow

ELAVON

Provide first-rate experiences to customers by using Elavon merchant services. Accept payments securely and efficiently with our powerful payment processing solutions.

- Define custom work queues and activity views based on your business needs

- Create your own response templates that yield the best results for your business

- Upload supporting case documentation, such as receipts, in a variety of formats

- Export data to use in other enterprise systems

BLUESNAP

BlueSnap chargeback management software allows you to prevent, manage, and dispute chargebacks more effectively with our All-in-One Payment Orchestration. We take care of disputes, automate your response or retrieval requests, help you fight back against fraud, and recover lost revenue fast.

- Dispute Management Options

- Chargeback Prevention Notifications

- Specialized Support

QUAVO

Quavo experts developed a cloud-based chargeback management software that features automated workflows, assured compliance, seamless digital banking.

- Assured Compliance

- Improved Customer Experience

- Reduced Losses

- Increase Operational Efficiency

- Resolve Every Dispute

XCALIBER-SOLUTIONS

Xcaliber Solutions provides fraud management and chargeback resolution services to merchants. We specialize in high-risk e-commerce.

- Prevent Chargebacks

- Fight Chargebacks

- Recover Losses

MIDMETRICS

Reduce chargebacks and friendly fraud with MidMetrics solutions for merchants. We can help you navigate the chargeback process, reduce fraudulent activity, streamline chargeback disputes and improve customer service all with a single solution.

- Chargeback Prevention Alerts

- Concierge Service

- SOS & RECON

- DisputeGenius

- Chargeback Analytics

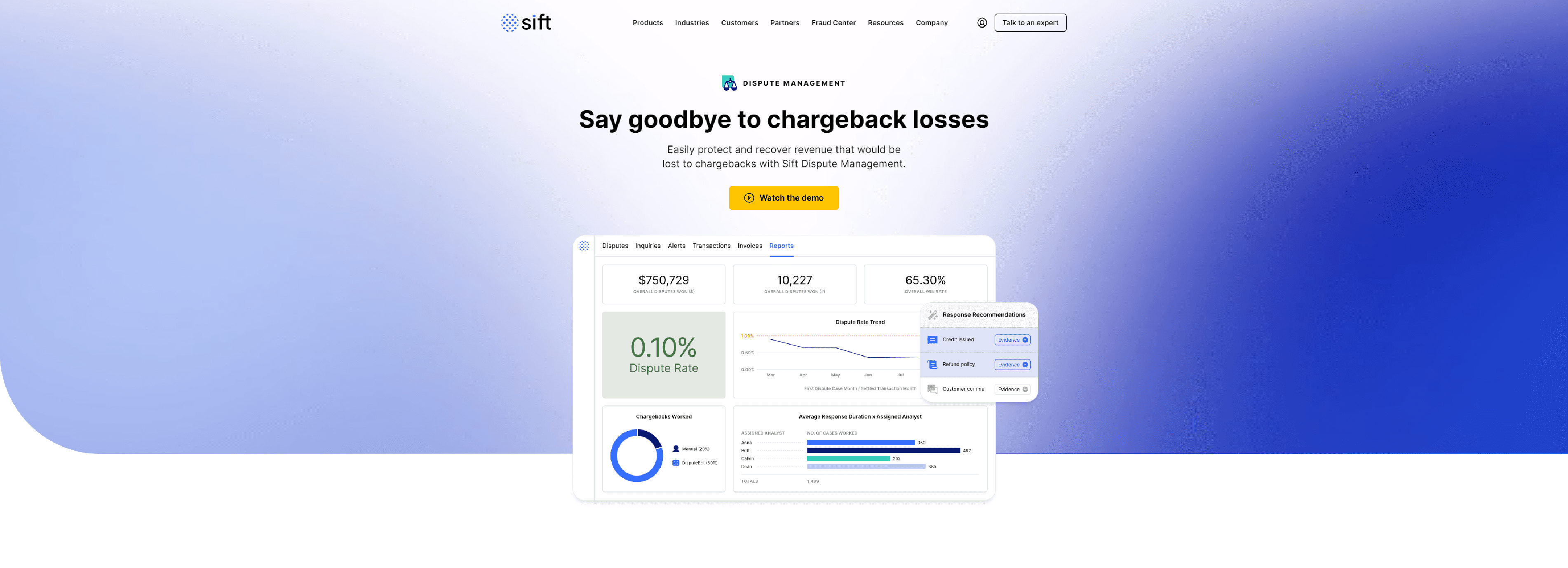

SIFT

Lower dispute rates, increase win rates, and reduce chargeback losses through the power of automation with Sift Dispute Management.

- Intelligent automation

- Customized solutions

- Industry expertise

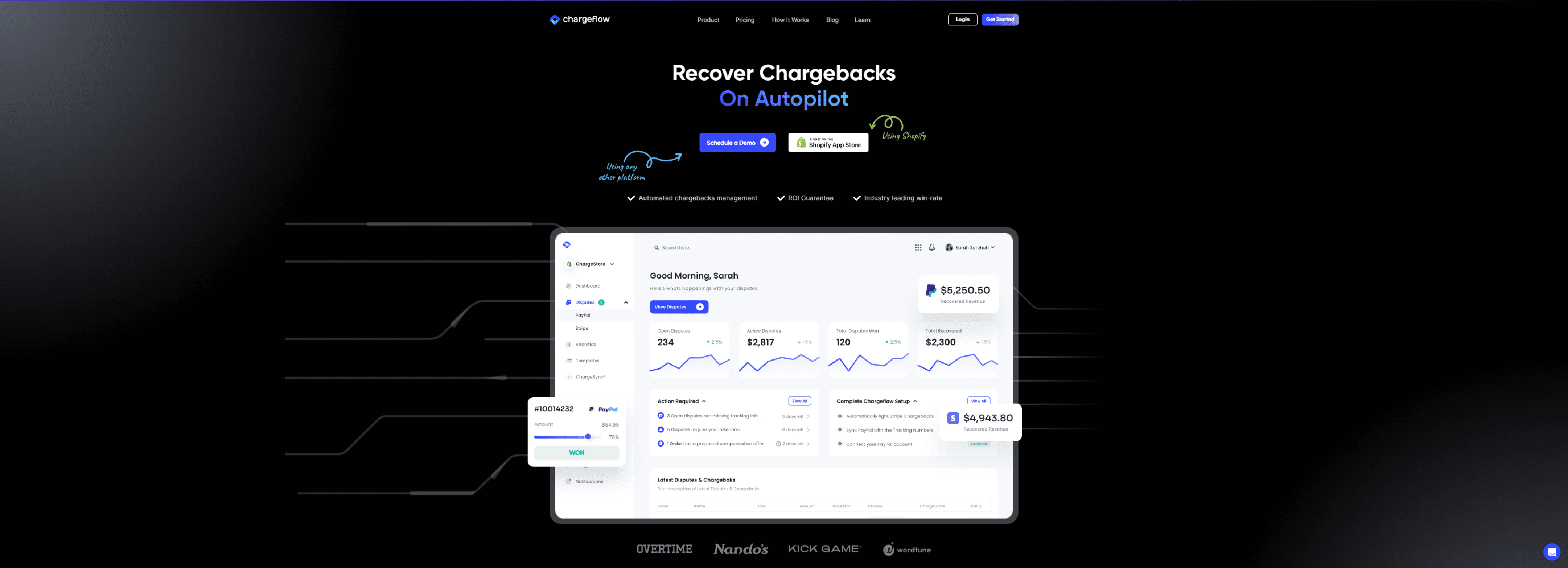

CHARGEFLOW

Turn lost revenue into profit with Chargeflow’s automated chargeback solution. Chargeflow is the most comprehensive chargeback platform with 80% recovery rates, 5x ROI guarantee and more.

- Fully Automated Chargebacks Solution

- All the wins, None of the work

- Science-Based Chargeback Response

NEX

Dispute helps sellers easily reclaim lost revenue from unfair chargebacks. Nexio Dispute pushes immediate chargeback alerts so sellers can take instant action and increase their chances of successful revenue recovery.

Top 10 questions when choosing Dispute and Chargeback Management Software:

1. What is the track record of the software in preventing chargebacks?

2. Does the software have a user-friendly interface, making it easy to use and navigate for staff?

3. Is the software secured with adequate encryption protocols and multi-factor authentication, preventing unauthorized access?

4. What kinds of reports and data analytics does the software offer? Can it provide real-time data and insights?

5. Does the software integrate with your existing payment gateway or financial system?

6. How customizable is the software to meet your unique business needs?

7. Does the software have a reliable customer support team to help resolve any issues you may encounter?

8. What is the cost of the software, and does it offer value for money compared to other options on the market?

9. Can the software help you streamline your chargeback management process and reduce your operational costs?

10. What kind of training and onboarding does the vendor offer for the software, and is it included in the purchase price?