Loan servicing software for private lenders refers to a specialized platform or tool designed to help manage and automate the entire process of servicing loans, from origination through repayment, for private lending institutions or individuals who lend capital outside of traditional financial institutions.

Private lenders typically lend money to individuals or businesses and may not have the same resources or infrastructure as large banks. Loan servicing software helps these lenders handle the administrative and operational aspects of their loan portfolios more efficiently.

Discover the top 10 best Loan Servicing Software For Private Lenders

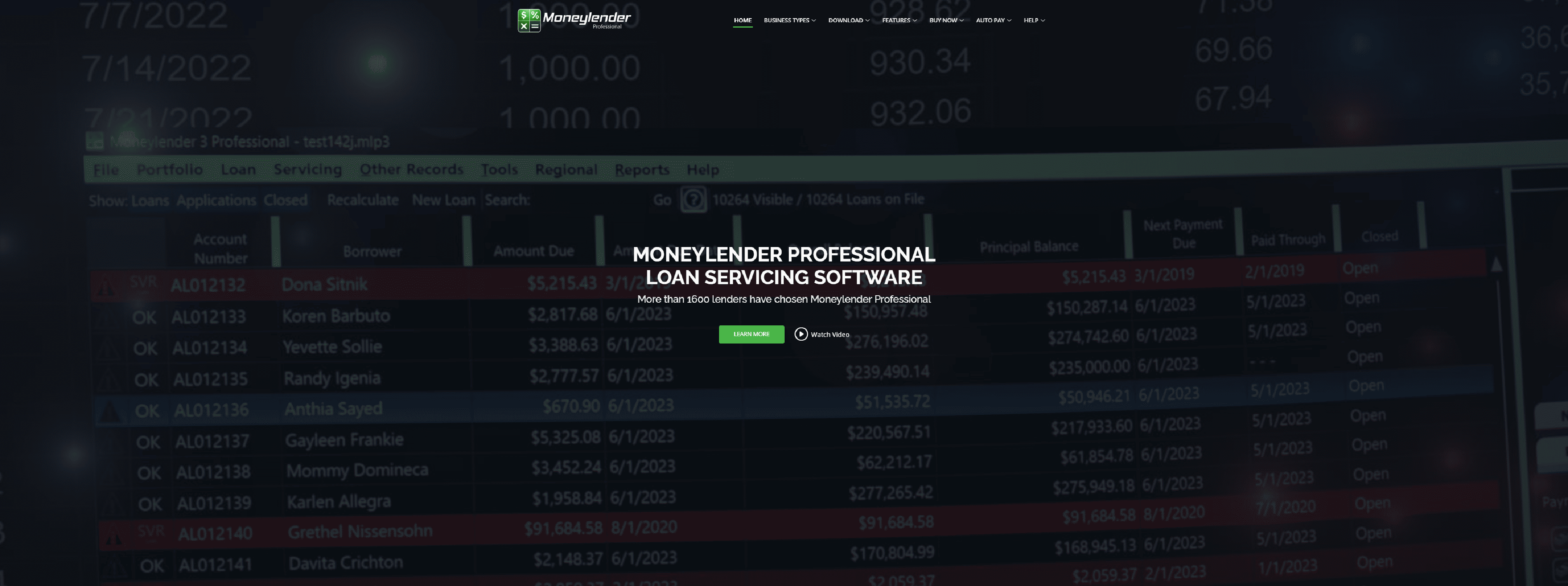

Moneylenderprofessional

Moneylenderprofessional – Reasonably priced loan servicing software gives you complete control over your loans without sacrificing anything.

- Automates all your calculations, eliminating errors

- Makes it easy to see who is paid current and who is getting behind

- Generates professional, high-quality statements, notices and letters

- The perfect solution for commercial loan software and real estate loan software

- Detailed accounting capabilities can adapt to virtually any business model

- Moneylender is powerful and can integrate as loan software for any business

- This cutting edge technology will even work for car dealers as car loan software or can replace any in-house financing software you already use

Vergentlms

Vergent’s loan servicing software for private lenders automates many of their most important tasks for greater efficiency.

- This commercial lending servicing software incorporates the most diverse range of loan products of any fintech solution

- Handle all of your loans from a single centralized module featuring the most intuitive management technology

- Our custom loan software comes with built-in features including customer portals, automated marketing funnels, ancillary products and much more

- Simplify even the most complex regulatory obligations with software built by those who know the lending industry as thoroughly as anyone

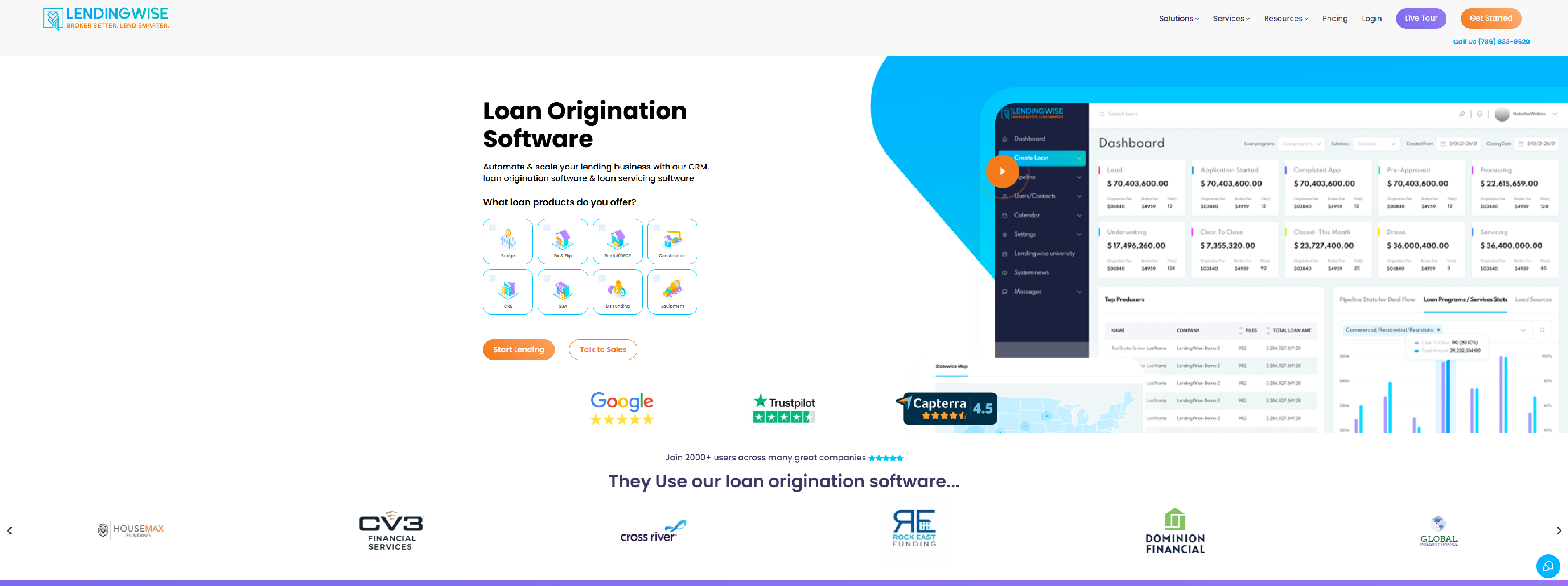

Lendingwise

Lendingwise – Automate & scale your lending business with our CRM, loan origination software & loan servicing software.

- A modern borrower experience with online, mobile friendly portals, customized workflows & paperless loan origination

- Keep your entire team, including brokers, borrowers & 3rd parties updated in real time on the loan status

- Integrate our quick & full app web forms on your site to fast track submissions & accurately collect required docs

- Our loan origination software sits 100% on AWS & is aligned with SOC 2, ISO 27001, & PCI compliance

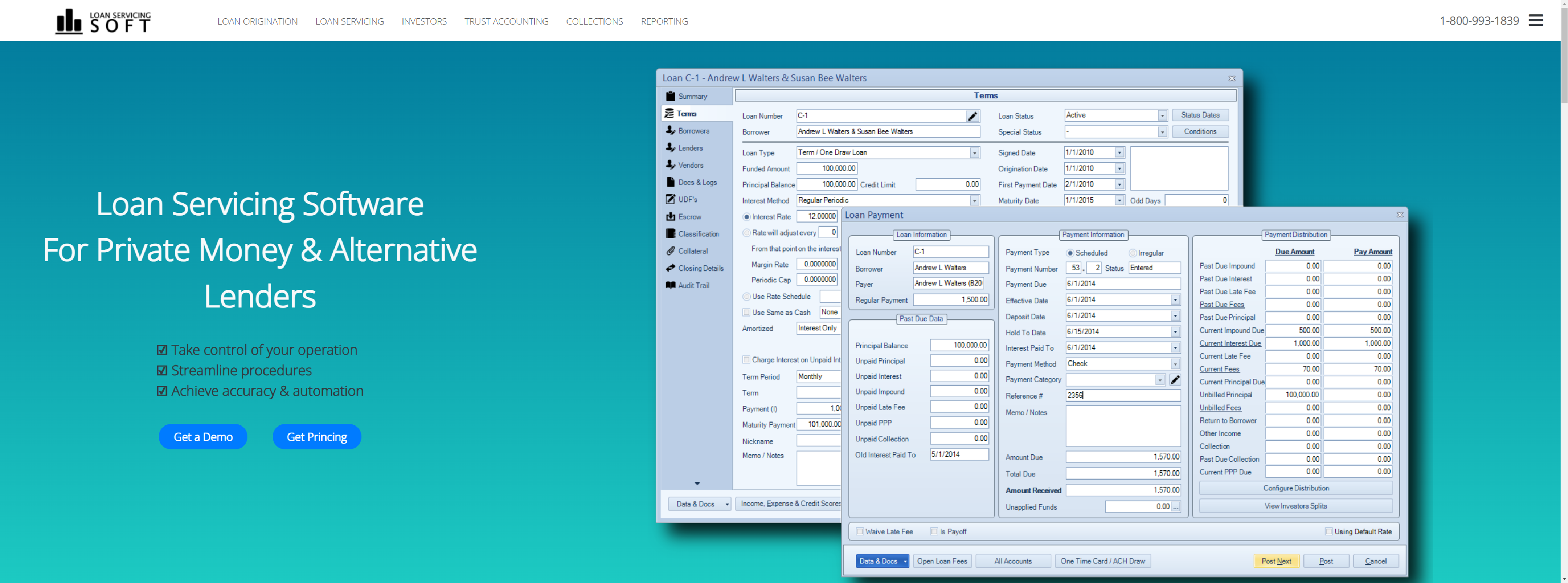

Loanservicingsoft

Loanservicingsoft – Take control and streamline your loan servicing with accuracy and automation with our loan servicing software.

- All Loan Types – Fixed, Step-Rate, ARM, Credit Lines, Multi-Draw

- Interest Methods – Simple Interest, Regular Periodic, Actual Days, Rule 78

- Investors – Multiple Investors or Funding Sources/Pools

- Private Money Features – Servicing Fees, Bought/Sold Rates

- RESPA, HMDA, CFPB compliance make LSS a perfect mortgage servicing software platform

- A perfect loan servicing software for private lenders

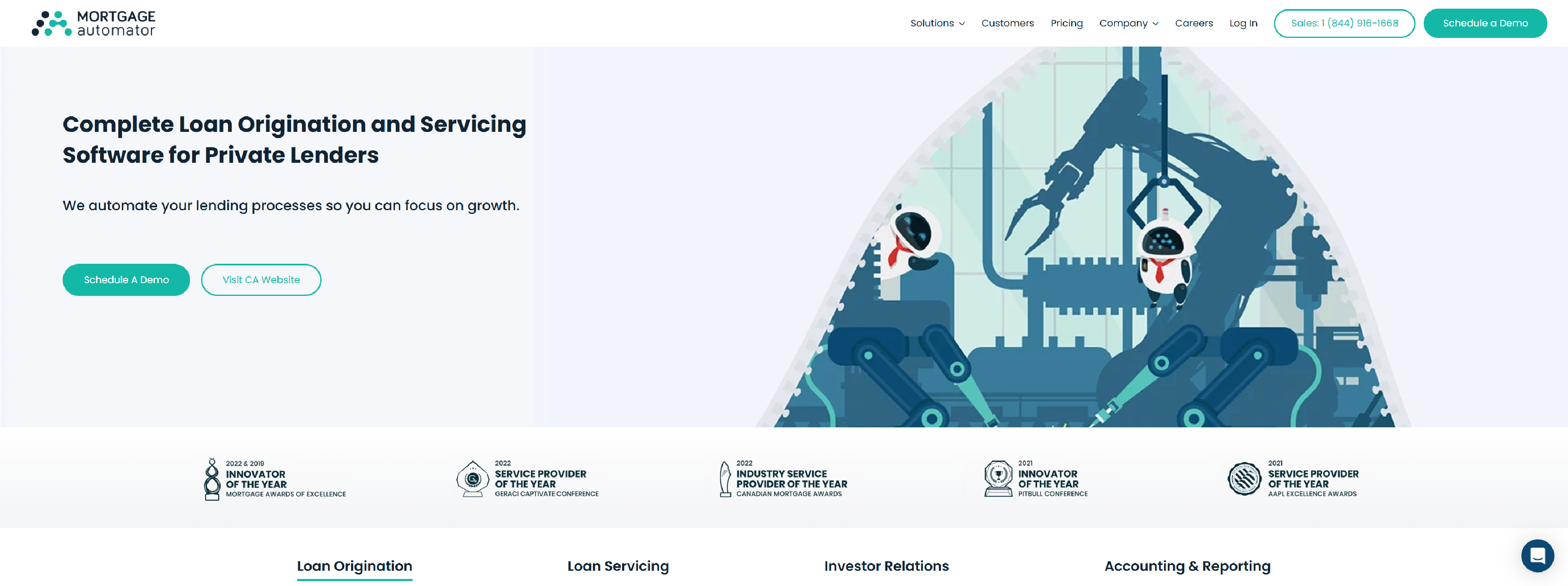

Mortgageautomator

Automator’s powerful features not only allow you to keep track of loan ledgers but also automate collection processes, tax payments, reserve tracking, and much more.

- Save time on documentation

- Streamline communication

- Do more with the same resources

Lendfoundry

LendFoundry offers the most advanced and best Loan Management Software(LMS)/Loan Servicing Software

- Loan Onboarding

- Accrual/Payment Processing

- Outstanding & Delay Management

- Modification and Closure

- Amortization and Transactions

- Borrower Communication

Baselinesoftware

Baseline is a modern loan origination software and servicing platform for private money lending.

- Manage all of your stakeholders in one easy-to-use tool

- Level the competitive playing field

- Eliminate workflow chaos

- Increase deal flow & velocity

Bizcore

Bizcore – An Australian made loan servicing software for private lenders. Streamline the loan process & manage your entire portfolio with a simple digital platform.

- Security

- Eliminate human error

- Easy Integration

- Improve organisation & consistency

- Data visualisation & daily reports

- Real-Time Control

Brytsoftware

Monitor all your loan processes in real-time with Bryt’s automated loan management software solution. Track relevant KPIs, make data-based loan management decisions, check your payment history, and simplify your loan processes with just a single click.

- Automated Loan Workflow

- Contact Relationship Management

- Omni-Channel Experience

- Advanced Loan Tracking

- Built-in Reporting & Documentation

- Pre-Populated Loan Notices

Themortgageoffic

Themortgageoffic flexible platform serves financial solutions companies and more.

- Escrow Administration

- Consumer Credit Reporting

- ACH Express

- Trust Accounting

- DRE Reporting

- Financial Calculator

- Lender/Borrower Portal

- Accounting Systems Integration

What is Loan Servicing

Loan servicing refers to the process of managing a loan throughout its life cycle, from the time it is originated (issued) to the time it is paid off. The loan servicing function includes a variety of tasks related to the administration and management of loans, such as collecting payments, managing the loan’s principal and interest, handling customer inquiries, and ensuring compliance with legal and regulatory requirements.

For both lenders and borrowers, loan servicing ensures that the terms of the loan are being met and that all parties stay informed about payment status, outstanding balances, and any issues that might arise.

Key Features of Loan Servicing Software for Private Lenders

1. Loan Origination and Setup

- Allows private lenders to create and customize loan terms, including interest rates, repayment schedules, and fees.

- Facilitates easy data entry for borrower information and loan agreements.

2. Payment Processing

- Automates the collection of payments (principal and interest) and applies them to the appropriate loan balances.

- Supports various payment methods, including bank transfers, checks, or credit card payments.

3. Amortization Calculations

- Automatically calculates loan amortization schedules, which include the breakdown of principal and interest for each payment.

- Can generate customized schedules for different loan types.

4. Late Fees and Penalties

- Tracks overdue payments and applies late fees or penalties as per the loan agreement.

- Sends automatic notifications to borrowers about missed payments.

5. Reporting and Analytics

- Provides real-time reporting on the loan portfolio, including outstanding balances, payment history, loan performance, and financial metrics.

- Generates reports on delinquency rates, collections, and other key performance indicators (KPIs).

6. Communication Tools

- Sends automated reminders, invoices, and updates to borrowers about upcoming payments, late fees, or changes in loan terms.

- Offers customer support features such as email, SMS, or in-app messaging for borrower inquiries.

7. Delinquency Management

- Tracks delinquent accounts and facilitates collection efforts, including automated reminders, calls, or setting up payment plans.

- Provides tools for managing loan workouts or modifications.

8. Document Management

- Stores important documents related to the loan, such as contracts, agreements, and payment receipts, in a secure, easily accessible digital format.

9. Integration Capabilities

- Many loan servicing platforms integrate with accounting software, banking systems, or third-party applications to ensure seamless data flow and financial management.

10. Compliance and Security

- Ensures compliance with relevant regulations (such as Truth in Lending Act or local state laws).

- Secures sensitive borrower information with encryption and other cybersecurity measures.

11. Portfolio Management

- Enables private lenders to track the overall performance of their loan portfolios, including profitability, risk assessment, and future cash flows.

Why Private Lenders Use Loan Servicing Software

- Efficiency: Automation of processes reduces the administrative burden and allows lenders to focus on scaling their business.

- Accuracy: Automated calculations and payment tracking ensure accurate records and reduce the risk of human error.

- Compliance: Helps lenders stay compliant with regulatory requirements, which is especially important for private lenders who might not have dedicated legal or compliance teams.

- Transparency: Both lenders and borrowers have access to up-to-date information on loan performance and payment histories.

- Scalability: As private lenders grow their portfolios, software helps them manage an increasing number of loans without a proportional increase in operational costs.

Q&A Loan Servicing Software For Private Lenders

Q: What exactly is loan servicing software for private lenders, and why would I need it?

A: Loan servicing software is a tool designed to help private lenders manage and automate the administration of loans from start to finish. It covers everything from payment collection and tracking loan balances to managing borrower communications and ensuring compliance with relevant regulations. As a private lender, you would need this software to streamline your operations, improve efficiency, reduce human errors, and maintain accurate records. It helps you stay on top of payments, handle delinquent accounts, and offer a smooth, professional experience for your borrowers.

Q: How does loan servicing software make my life easier as a private lender?

A: Loan servicing software automates many of the tedious and time-consuming tasks involved in managing loans. Instead of manually tracking payments, calculating interest, or sending reminders to borrowers, the software does it for you. It ensures that all loan data is accurate, up to date, and easy to access, which helps you manage a growing portfolio without needing to hire more staff. Plus, it allows you to focus on lending and business growth, rather than getting bogged down by administrative tasks.

Q: Does loan servicing software handle different types of loans, like personal loans, mortgages, or business loans?

A: Yes, most loan servicing software is flexible and can be customized to handle various types of loans, including personal loans, mortgages, business loans, and even more specialized loans like real estate investment loans. For example, if you’re dealing with mortgages, the software can manage escrow accounts, while for business loans, it can handle more complex terms and payment schedules. You just need to choose a platform that offers the features you need for the specific loan types you manage.

Q: I’ve heard about software helping with delinquency. How exactly does it help me manage late or missed payments?

A: Loan servicing software provides automated tools to handle delinquency efficiently. It can send automatic reminders to borrowers about upcoming or missed payments, which helps you reduce late fees or defaults. If a payment is missed, the software can automatically apply late fees and send a notice to the borrower. If the account remains delinquent for an extended period, you can set up payment plans or send accounts to collections directly through the platform, depending on your preferences.

Q: Can loan servicing software help with compliance? What if I’m unfamiliar with regulatory requirements?

A: Yes, one of the major benefits of loan servicing software is that it helps you stay compliant with local, state, and federal regulations. For instance, it can automatically apply fees according to the rules, help you generate reports for regulators, and ensure that interest rates and loan terms are legally compliant. If you’re not familiar with regulatory requirements, many platforms offer built-in compliance features that automatically adjust to your jurisdiction’s rules, making it easier to avoid legal pitfalls.

Q: I’m a private lender just starting out. How much would it cost to get loan servicing software?

A: The cost of loan servicing software can vary, but for a private lender starting out, there are a range of options to consider. Some platforms offer pay-per-loan pricing (i.e., you pay a small fee for each loan serviced), while others have subscription-based pricing, where you pay a flat monthly or annual fee. Prices can range anywhere from $50 to $500 per month depending on the features, number of loans, and the complexity of your needs. Some software providers also offer custom pricing for lenders with larger portfolios or specialized requirements. The good news is, there are affordable options that cater to smaller or newer lenders, so you don’t need a huge budget to get started.

Q: Can loan servicing software integrate with my other tools, like accounting software or CRM?

A: Absolutely! Many loan servicing platforms are built with integration capabilities, meaning they can easily sync with your accounting software (like QuickBooks), CRM systems, and even your bank or payment processing systems.

Q: I’m concerned about security. How safe is my borrower data in loan servicing software?

A: Security is a top priority for reputable loan servicing software providers. Most platforms use encryption to protect sensitive data, both when it’s stored and when it’s transmitted. Additionally, they often implement role-based access control, meaning only authorized personnel can access certain information. Many also adhere to industry standards such as PCI-DSS (for payment security) or GDPR (for data protection in the EU). You can rest assured that your borrower data will be kept safe, but it’s always good to check the specific security features of any platform you’re considering.

Q: I’m managing a small loan portfolio. Do I still need loan servicing software, or can I handle things manually?

A: While you can technically manage a small loan portfolio manually, loan servicing software is still highly beneficial, even for smaller lenders. As your portfolio grows, the complexity of managing multiple loans increases, and software can save you time, help reduce errors, and ensure that payments are tracked accurately. Additionally, it will help you stay organized and prepared if your portfolio expands or if you decide to scale up your operations. Starting with software early can also prevent you from having to transition to more complex systems later when you’re dealing with more loans.

Q: How do I choose the right loan servicing software for my needs?

A: When choosing loan servicing software, start by identifying the specific features you need. Consider whether you’re managing consumer loans, business loans, or a mix, as different platforms offer different functionality based on loan types. Look for software that offers customizable loan terms, automated payment processing, and reporting capabilities. It’s also a good idea to choose a platform that offers customer support and is easy to use, even if you’re not tech-savvy. Finally, ensure that it fits within your budget and can scale as your portfolio grows.

Q: What if my borrowers have questions or issues? Can the software help with customer service?

A: Yes, most loan servicing software includes features for managing borrower communication. This might include automated reminders about upcoming payments, the ability to view payment history, or even integrated support channels like chat or email. Many platforms also allow you to set up self-service portals, where borrowers can log in, view their loan details, make payments, and ask questions.

Q: What if I want to handle certain tasks manually, like setting up payment plans or modifying loan terms?

A: Many loan servicing platforms offer flexibility, allowing you to manually override certain settings or make adjustments when necessary. For example, if you need to set up a custom payment plan for a borrower, most platforms will give you the option to do so manually, and then it will recalculate future payments based on those changes.

Loan servicing involves managing the day-to-day operations of a loan, from payment collection and customer support to ensuring compliance and managing delinquency.