Many organizations face significant challenges to managing their fixed assets, particularly if using spreadsheets or an outdated legacy system and asset volumes are high. Specialized fixed asset management software is a reliable solution.

A dedicated system will integrate every aspect of fixed asset management, incorporating functionality to manage depreciation, federal and state tax, asset budgeting and forecasting, lease accounting, asset tracking and maintenance.

In today’s highly internationalized and competitive world, fixed asset management has become a business imperative, significantly reducing cost of ownership and providing that all important competitive edge.

Eliminate spreadsheets and save time on data entry

Spreadsheets are a common fixed asset management tool among many large organizations but they are labor intensive, do not trap errors and do not easily track the location, quantity, condition, and depreciation status of items. Additionally, in many organizations several people in one department will access the same spreadsheet, thereby increasing the risk of error and placing the integrity of important financial data at risk.

With specialized fixed asset management software, your organization will be able to automate the entire process, from data recording and accounting system integration, to reports and forecasts, saving a significant amount of valuable time.

Risk-free physical audits

Periodic physical audits are important for improving the management of the asset register. Physical audits will clean up inconsistencies between what is being financially accounted for on a register and what is actually present. Benefits include better control over asset use, the ability to track and plan for software and equipment upgrades and a reduction in unnecessary equipment purchases.

Fixed asset management software that also incorporates options for using either barcode or RFID (Radio Frequency Identification) technologies will make physical audits quick and simple, providing the finance team with more time to focus on their many other responsibilities.

Secure data

Secure data is critical to complying with corporate governance regulations, including Sarbanes-Oxley, IFRS, IAS, and GAAP. Benefits of fixed asset management software include: individual or group access rights designated according to an organization’s specific requirements, as well as security defined at user level to protect restricted information.

Comply with corporate governance regulations

With corporate governance regulations, such as Sarbanes-Oxley (SOX) in the corporate sector and GASB in the government sector, now demanding ever-increasing levels of accountability from finance departments, it has never been more important to have dedicated fixed asset accounting software that can assist in meeting these regulations.

More accurate budgets with asset reporting and forecasting

Composing reports and forecasts can be a lengthy and costly process that is often subject to human error if conducted manually. Utilizing the reporting function within a specialized fixed asset system can ensure the creation of accurate and timely asset reports, and can often include templates for the following:

- Fixed asset balance sheet report – consolidates starting points and ending points of a time period (month, quarter, year) and displays all activities

- Events report – displays all transfers, disposals, relifes, and revaluations that have occurred within a given time period

- Audit history report – a full audit trail of acquisitions, disposals and value adjustments

- Budget forecasts – projected capital expenditure and depreciation charges to semi-automate budget planning

Internal control

When conducting an initial audit, many organizations find that their assets, as represented on the books, may not be physically in existence – such items often being referred to as ‘ghost assets’. Similarly, assets will be encountered that are not on the books – ‘zombie assets’. The existence of ghost and zombie assets is the first evidence of the need for better internal controls.

Increasing internationalization within the global marketplace indicates that the internal control of fixed assets will receive a great deal of attention from auditors, the SEC, and the PCAOB. With tighter restrictions coming down the pipeline, stringent control over fixed assets and their physical locations will remain a necessary business practice.

You can decrease your organization’s chance of encountering zombie and ghost assets with dedicated fixed asset management software that will keep an accurate track of changes and retired assets.

ROI (Return on Investment)

The overall health of an organization benefits from accurate fixed asset management, but investing in specific fixed asset management software could potentially save hundreds of thousands of dollars per year by removing errors, lowering insurance premiums and reducing the time spent on managing fixed assets.

Option of hosting services

Running your fixed asset management software on a hosted service can deliver great performance and reliability, along with very high levels of IT infrastructure security. With a hosted service, the datacenter and network services provide customers with a fully-managed hosted solution and will help eliminate up-front capital expenditure and reduce internal maintenance and support costs.

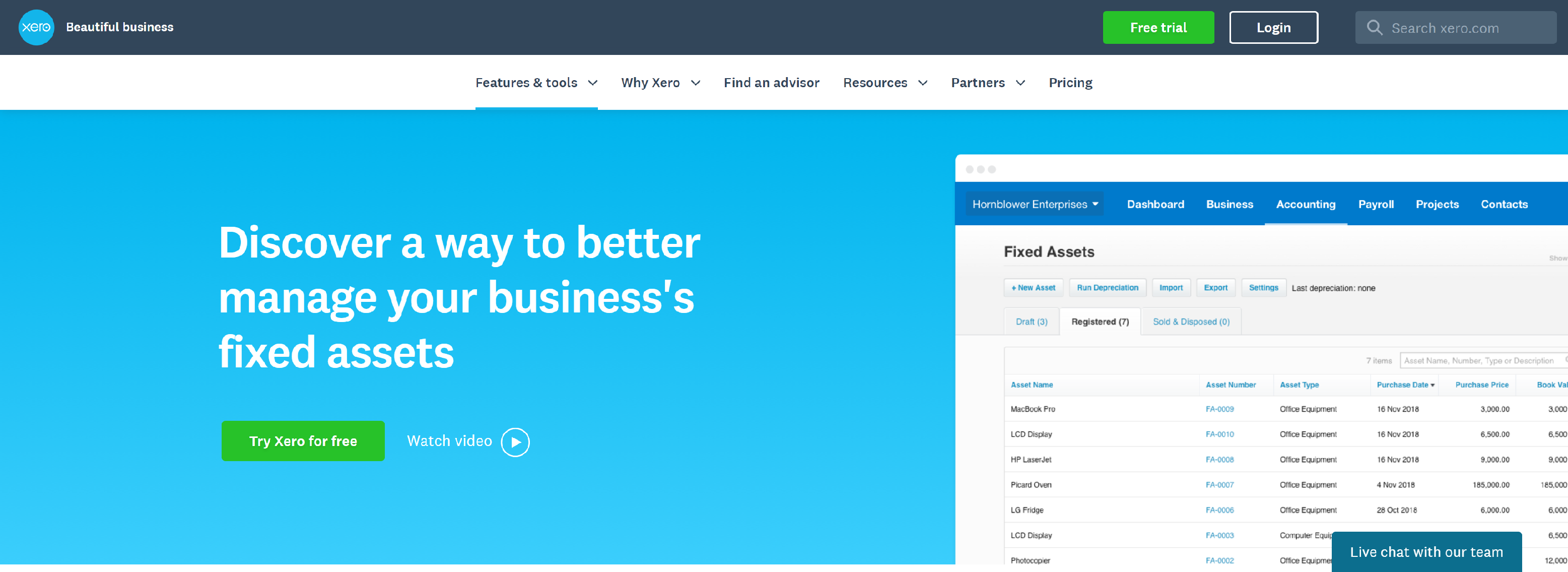

XERO

Xero connects you to all things business. Its online accounting software connects you to accountants and bookkeepers, your bank, and a huge range of business apps. Start a free trial today.

- Record and update your assets

- Manage depreciation and disposals

- Get a full picture of your finances

- Try tracking fixed assets free for 30 days

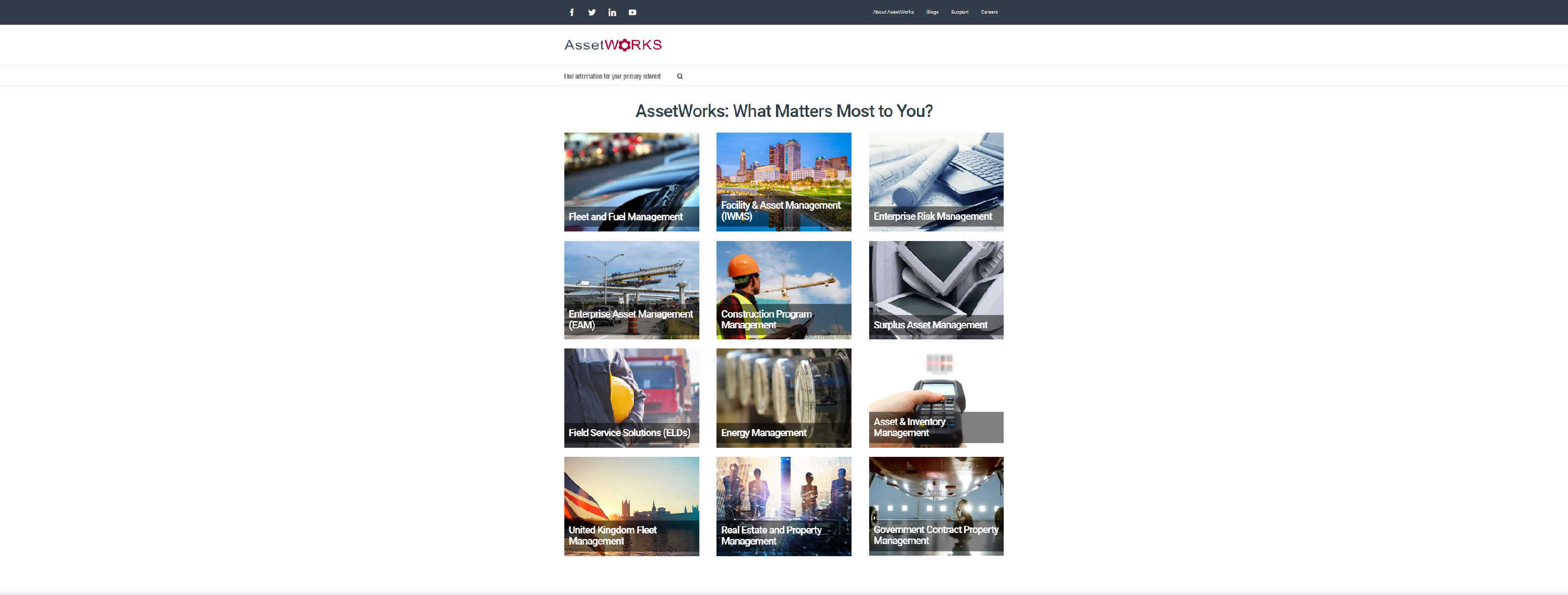

ASSETWORKS

AssetWorks delivers world-class Asset Management Solutions that help asset & infrastructure intensive organizations eliminate waste, redundancy & inefficiency.

- Automated transfer management

- Change request management

- Multiple methods of depreciation

- Asset maintenance & calibration

- Mobile inventory capabilities

- Dynamic reporting utilities

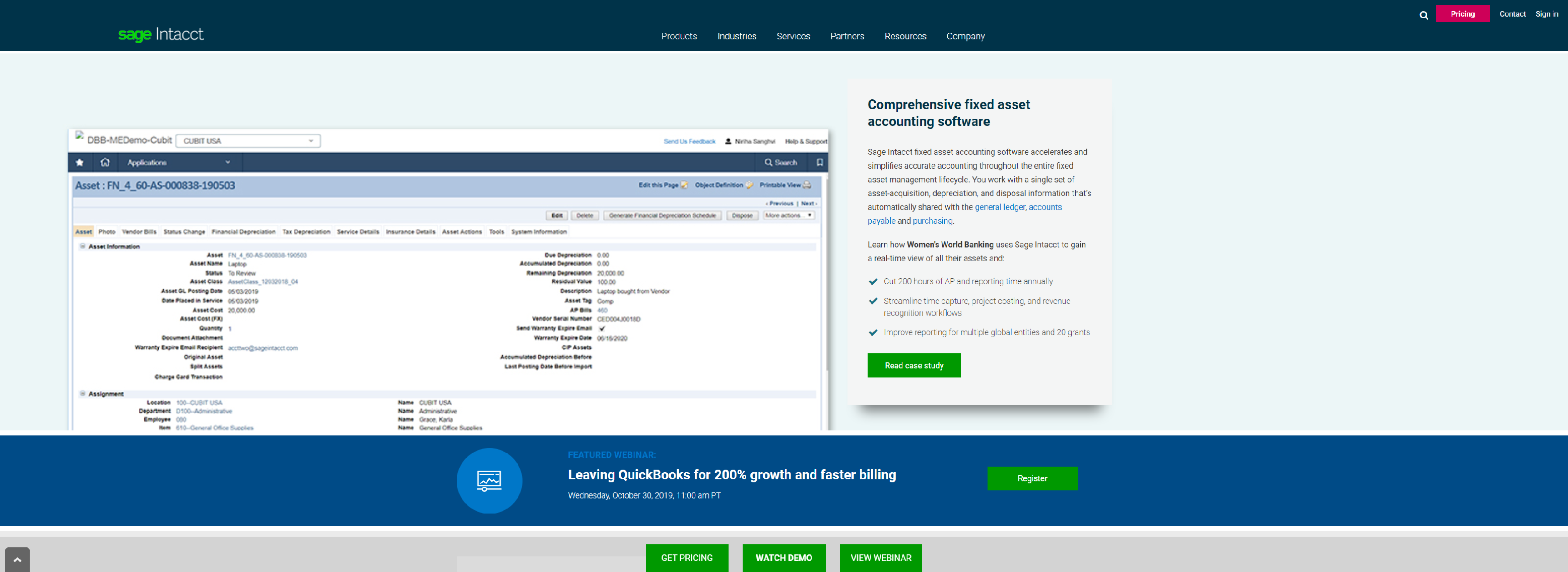

SAGEINTACCT

Sage Intacct is the leading accounting software for companies of any size. Increase ROI and transform your organization with the first and only preferred provider of the AICPA.

- Comprehensive fixed asset accounting software

- Track accounting and tax depreciation

- It’s easy to gain control of fixed assets

- Better reporting, better visibility, better decisions

- Automation and productivity

WASPBARCODE

![]()

Wasp Barcode manufactures inventory software & systems, asset tracking, barcode scanners, barcode printers, and time & attendance solutions for small businesses.

- Easy-to-Use Interface

- Centralized Role-Based Security

- Eliminate Manual Tracking

- Data Customized for Your Context

- Easily Build Reports

MYOB

Business software that sets you up for success. Try our online accounting solutions for tax, payroll, super and invoicing.

- Multiple Depreciation Books

- Fixed Asset Reports

- Multiple Asset Types

- Fixed Asset Classes

- Asset Management

- Fixed Asset Types

TRACET

Enterprise Fixed Assets Management – Track, manage and comply your enterprise fixed assets across group companies or individual branches along with asset verification.

- Responsive UI

- Scalable Cloud

- Secure & Role Based

- Document Management

- BPM / Workflow

- ERP & Device Integrations

ACCOUNTSIQ

AccountsIQ’s Fixed Asset Register allows you to record, manage and report on your company’s fixed assets in a time-efficient and orderly way.

- One database to store all your company and group assets

- Use our approval workflow and App to approve fixed asset POs or invoices

- No more need for Excel

- Full document management for purchase invoices, warranties and contracts

- Scheduled dates for maintenance or renewal

- Link assets to leases or loans

- Automated depreciation journals

- Fixed Asset schedule and note for your auditors

- CapEx forecasting

Essential Features and Benefits of Fixed Asset Accounting Software

Effective fixed asset accounting can only be achieved through the use of a fully-comprehensive solution. Dedicated fixed asset software will support the entire asset accounting lifecycle, encompassing depreciation processing and forecasting, Federal and State tax compliance, lease accounting, monitoring capital expenditure, and physical auditing. Specialized fixed asset software should also simplify compliance, impose financial control, improve forecasting, and fully integrate with other vital management tools.

Key features to assess when selecting fixed asset accounting software include:

- The capability to control and track changes of an asset throughout its life-cycle from the moment it is entered into the system

- A single input screen that enables additions and updates to be made quickly

- The inclusion of transaction types, such as full and partial disposals, transfers, relifes, revaluations, and splits

- An audit file which will hold a history of all user actions and show which records were affected, with before and after detail

- User-definable depreciation methods by asset, asset group, and period of account

- Many levels of user-defined analyses for comprehensive inquiries and reporting.

- Integration with spreadsheet packages, general ledgers, ERPs, and management reporting tools

- The ability for assets to be arranged in hierarchies, identifying parent/child relationships and dependencies

- An asset register which can utilize asset tracking facilities, incorporating the leading bar-code and RFID scanning technologies

- A comprehensive range of standard reports, including a full audit trail, depreciation summary, asset register list, disposed asset summary, depreciation forecast, period transfers, period acquisitions, and physical audit report

- Powerful user reporting features that include data selection options for accounting periods and asset location/category

- Access to customized and managed hosted services

With dedicated fixed asset accounting software, your organization will benefit from:

- Better control over fixed assets

- The ability to track and plan for software and equipment upgrades

- Improved financial management

- Instant asset analysis reports

- Compliance with the latest corporate governance regulations including Sarbanes Oxley (SOX), IFRS, US GAAP, and GASB

- Simplified physical audits

- Decreased manual labor by automating the entire fixed asset management process

- Streamlined cross-departmental asset communication

- Guaranteed information security with defined security levels within an organization’s departments

- The ability to use different depreciation calculations for book and tax

- More accurate budgets with asset reporting and forecasting

- Total user definition of reporting to meet corporate needs

- Parent/Child IT associations

- Detailed IT equipment register

- Automated asset tracking for register updates

- Comprehensive user audit trail

- The option to choose a hosted service that will eliminate the need to purchase, install, test, and launch back-end server hardware, therefore making ongoing operating costs manageable, predictable, and affordable

Choosing a Fixed Asset Software Provider

An organization should be diligent when searching for a fixed asset software provider. With the number of fixed asset accounting software companies growing worldwide, it is important to choose a reputable supplier that is able to tailor its fixed asset solutions to your needs. A dedicated fixed asset software company should be able to assist you throughout the entire process and:

- Will have software that has reference sites and can perform across all market sectors, including both private and public entities. Whether a company is multi-national (multi-location) or single site, your fixed asset software provider should be able to simplify your fixed asset management and accounting practices

- Will give your organization access to unlimited demonstrations of the software in action

- Maintain high standards in the software industry, and have current professional accreditations

- Provide a totally integrated asset life-cycle solution that combines a powerful asset register, asset tracking, and maintenance management for enterprise-wide visibility

Below is a list of what to expect from your fixed asset software provider during implementation and beyond:

- A well-documented project plan with agreed-upon timelines for phases such as implementation, data import, training, and consultancy

- A detailed and documented service level agreement (SLA), as well as a standard Statement of Work

- The option for a fully-managed data conversion service, including multi-book conversion and historical data

- Peace of mind in knowing that the fixed asset software is continually updated to meet the latest corporate and government regulation developments

- Consistent delivery of software that keeps customers ahead of emerging technological innovations

- A variety of support and services, including: data conversion, auditing, consultancy, cloud services, technical support, training, cost segregation

- Open post-implementation communication with the fixed asset software provider

- Access to a technical support helpline

How to Implement a Fixed Asset Accounting Solution

A dedicated fixed asset software company should be equipped to assist clients through the process of implementing a new system, from start to finish. Most fixed asset management software companies will provide the consultancy, training, and assistance required to get the asset management solution up and running successfully. However, it is important to seek out a provider that goes beyond the bare minimum.

Below is a list of the most important factors to consider before implementing a new fixed asset management system:

1. Make sure the project specifications and details are documented

Clear communication with your fixed asset software provider beforehand will ensure that both organizations have agreed upon the project deliverables. Some companies find out too late that they are not actually receiving the products and services for which they have paid. Finalize the details with your provider and create a list of everything that your organization will receive. This list should include pricing for training, support and consultation, as well as the actual software. Be sure to check that there are no hidden fees or costs.

2. Involve all users

During the early stages of selecting a fixed asset management solution, many organizations will involve all personnel who will use the software; this is also common during the implementation phase. Involving end-users from the start will help familiarize them with the software and assist the training process.

3. Clean up your data

Cleaning up the data at the start of the project helps to ensure a smoother implementation process. Data that is incorrect or expired will only hinder the actual implementation, making reports and feedback much more difficult.

4. System testing

All users, especially the main users, should test the system and be required to report on any issues.

5. Reporting issues and getting questions answered

It is important to familiarize yourself with your fixed asset software provider’s process for reporting issues or answering questions regarding the system. Generally, a help line or point of contact should be assigned to the purchaser, and a service level agreement (SLA) should be provided by the supplier.

6. Knowledgeable project manager

Most providers will assign an in-house project manager who can help with implementation and assist in the use of the fixed asset management system. An in-house project manager will have the knowledge and experience to help all users navigate the system.

7. Make regular reviews part of your routine

Regular reviews of the fixed asset software system will help to detect any issues the users are facing. With regular reviews, users are able to report any issues or questions to the project manager, ensuring that the organization is getting the most out of the system.

8. Proper training

Training and support to clients should be given both during and after the implementation. Whether you have chosen online or onsite implementation, a team of consultants from your fixed asset software provider should be prepared to train users on how to get the most out of the system. Comprehensive user guides should also be supplied.

Key Features & Services to Look for in a Comprehensive Cloud Solution

Many fixed asset management software suppliers are now providing the option of a hosted cloud solution. Hosted solutions can offer uncompromised security for all information relating to an organization’s fixed asset register. Data can be stored on dedicated servers, offering regular back-ups and active operating time. Additionally, hosted solutions can help eliminate up-front capital expenditure, reduce internal maintenance and support costs, and save time.

How hosting solutions work

A hosted infrastructure managed by a software provider will reside within a data center facility. This facility provides a managed internet platform for your internet-delivered solution. Most data centers will include physical security, managed data backup services, and various administrative services.

Benefits for hosted services include:

Simplified application management: Application experts provide ongoing support and administration of your hosted solution – application, system and security patches/fixes are applied for you.

Lower up-front capital costs and ongoing operating costs: Eliminating the purchasing, installation, testing and launching of back-end server hardware lowers up-front costs, making your ongoing operating costs manageable, predictable, and affordable.

Focus on core competencies: Entrusting your provider with the ongoing management and administration of the solution allows your organization to focus on its core mission instead of managing production IT systems.

Improve service levels: With professional application knowledge, you will be able to enhance system uptime and application security, support, and upgrades.

Physical Security: Many data centers have security policies and practices, and have specific operating procedures for the management of the datacenter. Climate control, fire detection/suppression, and power back up should also be included in the data center’s physical security.

Options for hosted services include:

- Windows dedicated server hosting

- Windows terminal server hosting

- Microsoft SQL server hosting

- Microsoft SQL server cluster hosting

- Oracle hosting

- Microsoft ASP.net hosting

- Multiple network connections to the Internet

- SSAE 16 or SAS 70 certified datacenter facilities

- Highly-secured network and physical

- Security technology and procedures

- 24/7 on-site security guards and monitoring

- Data backup with secure off-site storage

Key Areas to Consider When Converting Data into a Fixed Asset System

A data conversion service is offered by many fixed asset management software suppliers. This service is usually a fully-managed process that involves converting existing asset data, via a common file format (e.g. xls, txt, or csv) to create an asset register in the new system.

Within the timescales agreed for the implementation in the project plan, your fixed asset software provider should work with you to complete a data conversion document; this is a detailed record that clearly defines the structure and content of the data that are to be supplied.

One of the most important initial steps in the data-conversion process is to confirm the following figures:

- Gross Book Values (GBV) and Net Book Values (NBV) at a specific point in time

- Exact number of items to be converted

- The number of accounting books to be converted

The next important phase of the data conversion process is to populate the new fixed asset accounting system with the correct data. The quality of the data provided for the conversion is paramount to the quality of future reporting. A good fixed asset system will be able to store a wide range of values, dates, and other fields per asset record.

Below is a sample of fields that your organization may wish to store within the new system:

- Asset Type (Sometimes referred to as Asset Class or Asset Category)

- Sub-Type

- Operating Division

- Cost Center

- Company / Entity

- Building

- Floor Number

- Room Number

- State / Province

- Country

- Custodian (Manager Responsible i.e. Mr. Jon Smith, Mrs. Kate Jones, etc.)

- Condition (ie. A1 New, A2 Slight Damage, A3 Heavy Damage)

- Funding Source

- Asset Ownership Status (i.e. purchased / leased)

- Asset Tag/Barcode reference

- Manufacturer

- Model Number

- Serial Number

- Service Tag Number

- Supplier

- Purchase Order Reference

- Supplier Invoice Reference

- Asset Number

- Quantity

- Insurance Renewal Date

- Insured For Amount

- Lease Reference Number (only for leased items)

- Lease Break Clause Date (only for leased items)

- Lease Expiry Date (only for leased items)

- Period Depreciation

- Project Reference

- Year-To-Date Depreciation

- Grant Value

Additional items that are important to the data conversion process include:

Data Integrity: Quality data is critical. Any major errors or omissions (e.g. capitalization dates, values, incorrect balances, etc.) may prevent the conversion from being completed on time.

Timeline: It is important to have a standard data conversion timeline agreed upon with your chosen fixed asset management software supplier. Conversions that involve complex rules or an unusually large number of files or records can take longer than a standard conversion.

Multi-Book Conversions: The fixed asset software supplier should provide guidance on defining the essential (one-on-one) relationships between each asset and its associated accounting and tax information. If multiple books are being converted, most fixed asset management software suppliers will require that all books be at the same point in time (year/period) when the conversion commences.

Historical Data: Some fixed asset accounting software suppliers will include the direct conversion of any historical data (e.g. previous years’ depreciation charges) that can be supplied by the client.

Fixed Asset Management and Understanding Compliance

As a result of global economic crises, organizations of all sizes are subject to increased scrutiny by government agencies and regulatory boards which demand higher standards of accountability and transparency. With corporate governance regulations, such as Sarbanes-Oxley (SOX), IFRS, US GAAP and GASB now demanding ever-increasing levels of accountability, companies are finding it prudent to put in place the appropriate processes and tools to manage their fixed assets. A fixed asset management system helps an organization eliminate cumbersome procedures when complying with corporate governance regulations.

Benefits include:

- Improved internal control

- Enhanced security features

- Automated reporting and forecasting

- True representation of fixed assets on balance sheet

- Accurate financial statements

- Reduced audit costs

- Aiding in procedural processes

Making sense of corporate governance regulations:

GAAP: Generally Accepted Accounting Principles: GAAP is a standard structure of guidelines for financial accounting (most often used in the U.S.) consisting of rules that accountants are required to follow when recording transactions and preparing financial statements.

GASB: Governmental Accounting Standards Board: GASB is a private, non-governmental organization tasked with establishing and improving standards of state and local governmental accounting and financial reporting, as well as educating the public, auditors, and users of financial reports.

IFRS: International Financial Reporting Standards: IFRS are standards adopted by the International Accounting Standards Board (IASB). IFRS are designed to apply to the general purpose financial statements and other financial reporting of all for-profit entities.

Sarbanes-Oxley (SOX): The Sarbanes-Oxley Act of 2002, commonly referred to as SOX or Sarbox, is a United States federal law enacted in response to several major corporate accounting scandals. This legislation establishes enhanced standards for all U.S. public company boards, as well as management and public accounting firms. The Act requires the Securities and Exchange Commission (SEC) to implement rulings on requirements in compliance with the new law. In summary, SOX covers issues such as auditor independence, corporate governance, internal control assessment, and increased financial disclosure.