In Malaysia, a variety of accounting software is available to help businesses manage their finances, from small startups to large enterprises. Software solutions typically cater to features like invoicing, financial reporting, payroll, taxation, and GST compliance, among others.

Here are some popular accounting software options commonly used in Malaysia:

Qne

QNE has the most advanced search engine and report writer for users to generate unlimited customized reports! What’s more, this accounting software is updated from time to time to accommodate user’s needs!

- The QNE modules are seamlessly integrated, ensuring smooth data flow across the system

- QNE is a client-server-based accounting software that communicates with the server exclusively through SQL queries

- With a SQL client-server database, QNE can manage significantly larger data volumes compared to traditional file-based systems

- By hosting your database on Microsoft Azure, your data is fully secured, benefiting from an automated backup system that creates copies across two separate Azure servers

- QNE also offers the ability to schedule data backups at predetermined times, allowing users to back up their data without requiring them to log out of the system

Financio

Financio is designed for small business owners and non-accountants in Malaysia. Financio helps reducing the time & money you spent on accounting and tax (GST) related tasks.

- Financio Accounting is fully compliant with E-Invoice regulations, enabling seamless e-invoice management for Premium users. You can easily send, receive, and track e-invoices with LHDN

- The platform automatically generates all bookkeeping entries and tax records, reducing human errors and ensuring accurate financial management

- Stay on top of your tax obligations with Royal Malaysian Customs by effortlessly managing and submitting your SST returns in just a few clicks

- Access your accounting data anytime, anywhere through our mobile apps for ultimate flexibility

- The A.I. Scan feature, powered by advanced Optical Character Recognition (OCR) technology, allows for easy document upload and management, enhancing data entry efficiency and accuracy

- With Financio’s bank integration, you can sync transactions effortlessly and make direct payments to suppliers, streamlining your financial processes

Info-tech

Info-tech – Accounting Software for businesses in Malaysia to ease accounting processes, inventory, and customise quotations & invoices to issue to suppliers.

- Reduce manual processes and improve accuracy

- Eliminates additional fees with automatic updates and processes

- Retrieve and access data stored in the Cloud anytime, anywhere

- Easily scales up to the business’ size and needs

- Encrypts data for extra layers of security for higher protection

- Simplify bookkeeping, tax filings, and financial reporting

Theaccessgroup

Theaccessgroup advanced accounting software is crafted to meet the demands of intricate enterprises, providing comprehensive efficiency and valuable insights for driving strategic expansion.

- Track outstanding client payments with accounts receivable

- Monitor supplier bills with accounts payable

- Direct Pay enables your customers to pay you easily via online digital payment modes

- Analyse business performance with reports insights

- Monitor stocks and goods with inventory management

- Simplify the sales-to-cash process – create sales invoices easily and quickly

Bukku

Bukku is a cloud accounting software designed for SMEs and accountants in Malaysia to track and manage sales, expenses, and cash-flow efficiently.

- Knowing your business better

- Always stay on top of your sales

- Customers & suppliers simplified

- Track expenses effortlessly

- Comprehensive inventory system

- Staying in compliance

- Comprehensive multiple currencies

- Your back-office powerhouse

- The very flexible Bukku

- Also worth mentioning

- Having a piece of mind

Autocountsoft

AutoCount is a Technology Solutions Provider who develop and provide high quality Accounting Software, Point of Sale System & HRMS.

- 28 Years of Experience

- Affordability, Flexibility & Extensibility

- Guaranteed Customer Support

- Extensive Service Network

- Continuous Development

- Advanced Technologies

Quickbooks

QuickBooks small business accounting software helps track expenses, manage cash flow and create custom invoices and reports.

- Gain business insights to make smarter decisions

- Access your business data all in one place, anytime, anywhere

- Security you can trust

- Ready for tax filing

- Easy Collaboration

- Say goodbye to manual data entry

- No Installation Needed

- Join our QuickBooks Community

Sage

Whether you starting up or managing an enterprise, Sage Business Cloud has trusted, innovative solutions for managing your money, accounting, payments, and so much more.

- Perfecting the tools that help businesses like yours succeed

- Allowing us to deliver exceptional customer support

- Use Sage software products in 26 countries

- For customer support, software innovation, and more

Sql

SQL Account is an accounting software that is suitable for all businesses, from small businesses to large organizations.

- Access Anytime, Anywhere

- Batch Emails Statements

- Special Industries Version

- Real-Time CTOS Company Overview Reports

- Advance Security Locks

- Intelligence Reporting

Synergysoftware

Accounting Software from Synergy Software is designed for small businesses, focusing on user-friendliness, performance, and security.

- Scalable Accounting Software solution for Business Growth

- Streamlined Financial & Business Management Processes

- Enhanced Decision-Making Capabilities

- Improved Efficiency and Productivity

Simpankira

SimpanKira is a cloud accounting software for Malaysia small businesses. Has complete features from invoicing, payment tracking, GL management, financial reports and many more.

- Double entry Accounting Software

- Generate Professional Invoice in Seconds

- Get Paid Faster with Online Banking or Credit Card

- HR Tools for growing Small Business

- Manage Your Payroll in less than 10 minutes

- Receipt Scanning for Zero Data Entry

- Tracking Inventory for Your Product

- Track Project with Ease

- Fixed Asset Register and Depreciation

- Upload Your Document to Transaction

- Manage Your Contact and Statement of Account

- Automatic Reminder to Overdue Invoices

Biztory

Biztory – cloud based accounting software in Malaysia for SMEs with full-set accounting system and features.

- Manage Your Quotation & Invoice

- Manage Your Cash Flow

- Manage your Inventory

- Simplify Your Accounting & Taxes

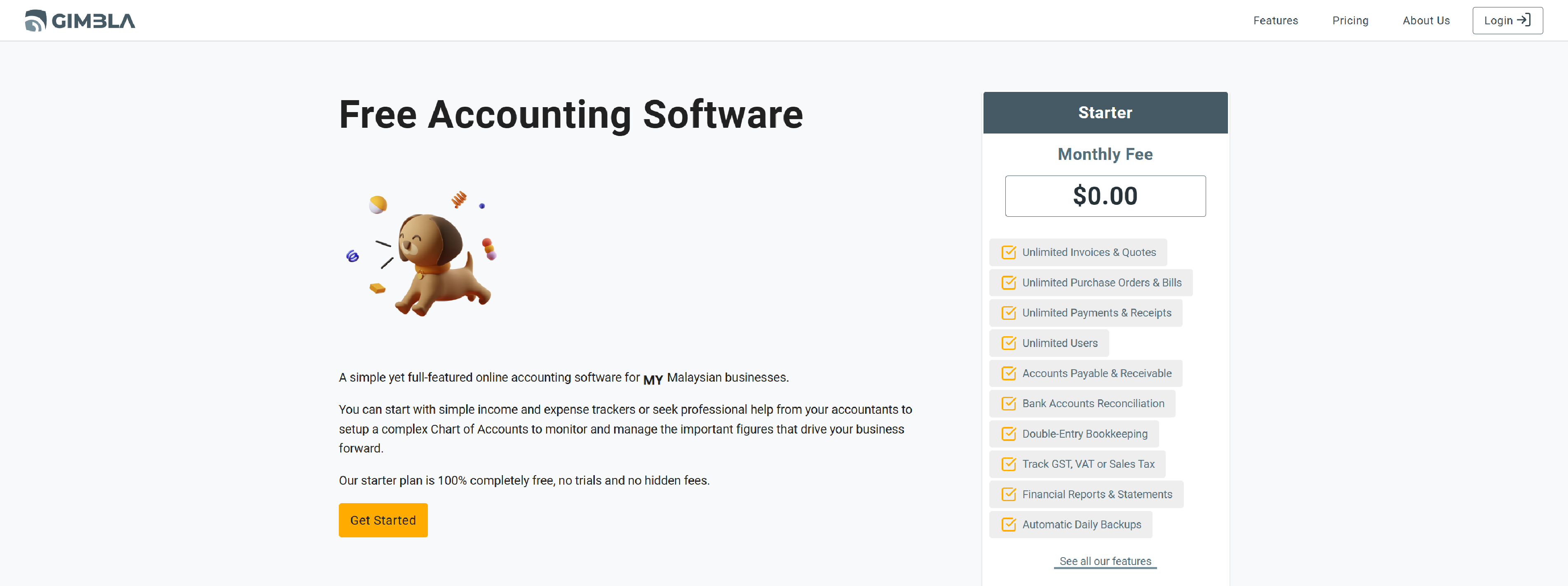

Gimbla

Gimbla – Making it easier to manage your business finances with our free accounting software. Select from our beautiful invoice templates today to start invoicing.

- Schedule recurring invoices to record your weekly or monthly sales

- Issue credit notes to your customer and apply them to their invoices for refunds or returns

- Change the look and feel of your document to match your brand identity

- Our website works on desktop and mobile platforms so no need to install any extra apps

- Set up bank rules for your bank statement imports to automatically create new transactions and categorize them

- Help is here when you need it with our free email support for all customers

What is Accounting Software

Accounting software is a type of software application designed to assist businesses in managing and automating their financial operations. It helps businesses track and manage their financial transactions, including sales, expenses, payroll, taxes, and other accounting activities, efficiently and accurately. Accounting software is commonly used by businesses of all sizes, from small startups to large enterprises, to ensure that their financial records are accurate and up to date.

Why is Accounting Software Important?

Accounting software is important for businesses of all sizes because it simplifies, streamlines, and automates the critical financial processes that are essential to running a successful business.

1. Accuracy and Reduces Human Error

- Eliminates Manual Calculations: Accounting software reduces the risk of manual errors such as miscalculating numbers, misclassifying transactions, or forgetting entries.

- Consistent Data Entry: With predefined templates and formats, accounting software helps standardize data entry, reducing inconsistencies and inaccuracies that could arise from manual bookkeeping.

2. Time-Saving and Efficiency

- Automation of Routine Tasks: Many time-consuming tasks, such as invoicing, payroll, bank reconciliation, and tax calculations, are automated in accounting software.

- Faster Reporting: Generating financial reports, such as income statements, balance sheets, and cash flow statements, is much quicker with accounting software, providing instant access to key financial data.

- Real-Time Data: Cloud-based accounting software provides real-time access to financial data. Business owners and managers can track transactions as they occur, ensuring up-to-date financial records at all times.

3. Better Financial Management and Control

- Cash Flow Management: Accounting software provides businesses with tools to track cash flow and manage finances efficiently. It helps businesses identify potential cash shortages or surplus funds, and plan for the future by forecasting cash flow.

- Expense Tracking: With accounting software, businesses can easily track and categorize expenses, helping to monitor costs and ensure that spending aligns with budgets and goals.

- Increased Visibility: Accounting software offers real-time insights into financial health, helping business owners to make informed decisions and avoid potential pitfalls like overspending or underinvestment.

4. Improved Decision-Making

- Access to Key Financial Metrics: Accounting software generates detailed financial reports and dashboards, providing insights into revenue, expenses, profitability, and financial trends.

- Customizable Reports: Most accounting software allows users to customize reports to fit their business needs, enabling management to focus on the most relevant financial data and key performance indicators (KPIs).

- Forecasting: Many accounting solutions include forecasting tools that help predict future trends based on historical data, aiding in long-term planning and strategy.

5. Compliance with Tax and Regulatory Requirements

- Tax Compliance: Accounting software helps ensure that businesses remain compliant with local tax laws and regulations.

- Automated Tax Calculations: Many accounting systems come with built-in features that automatically calculate sales tax (e.g., SST in Malaysia, GST in countries like India and Australia), VAT, and other relevant taxes.

- Audit Trails: Accounting software maintains a clear audit trail of all transactions, which is crucial for tax reporting, internal audits, or external audits by regulatory authorities.

6. Cost-Effective

- Reduced Operational Costs: By automating routine tasks like invoicing, payroll processing, and financial reporting, accounting software reduces the need for manual labor, potentially lowering operational costs.

- Affordable for Small Businesses: Many accounting software solutions are available on a subscription or pay-per-use basis, making them affordable even for small businesses or startups.

- Eliminates the Need for Paper-Based Systems: By moving away from paper-based accounting systems, businesses can save on printing, storage, and filing costs, while also minimizing the environmental impact.

7. Improved Collaboration

- Multi-User Access: Accounting software, especially cloud-based solutions, allows multiple users to access the system simultaneously.

- Role-Based Permissions: Businesses can assign specific access levels to different users based on their role (e.g., accountants, HR staff, managers), ensuring sensitive financial data is kept secure.

8. Scalability

- Grows with Your Business: As your business expands, accounting software can scale to meet the increasing complexity of your financial operations. You can add more features (such as advanced payroll, inventory tracking, or multi-currency support) or increase the number of users without the need for a complete system overhaul.

- Customizable Features: Many accounting software solutions offer additional modules and integrations that allow you to tailor the system to your specific business needs (e.g., adding e-commerce integrations, CRM, or project management features).

9. Security and Data Protection

- Data Backup: Cloud-based accounting software usually comes with automated backups, ensuring that your financial data is securely stored and can be recovered if anything goes wrong (e.g., system crashes or accidental data loss).

- Encryption and Security Protocols: Modern accounting software often uses encryption and other advanced security measures to protect sensitive financial data from hacking or unauthorized access.

- Access Control: Business owners and managers can control who has access to financial data, and set restrictions based on user roles, minimizing the risk of fraud or internal data breaches.

10. Better Customer and Supplier Relationships

- Quick Invoicing and Payment Tracking: Accounting software allows businesses to generate and send invoices to customers promptly, track unpaid invoices, and set up automated reminders for overdue payments, improving cash flow.

- Order and Inventory Management: With inventory tracking features, businesses can efficiently manage product stock levels, reduce stockouts or overstocking, and enhance customer satisfaction by ensuring product availability.

11. Mobility and Remote Access

- Access from Anywhere: Cloud-based accounting software allows business owners and financial managers to access their accounts from anywhere using a smartphone, tablet, or computer.

- Mobile Apps: Many accounting software providers offer mobile apps that enable businesses to view reports, approve invoices, or even input transactions while on the go.

12. Audit Support

- Clear Documentation: Accounting software helps businesses maintain clear records of all transactions and financial activities, which is essential during audits.

- Efficiency in Handling Audits: During audits, accounting software can speed up the process by providing easy access to relevant financial documents and reports.

Accounting software is indispensable in modern business management. It not only helps ensure accuracy, efficiency, and compliance but also provides valuable insights that drive better decision-making.

How much does accounting software cost in Malaysia?

The cost of accounting software in Malaysia is relatively flexible and depends on your business’s size and needs. For small businesses or startups, cloud-based software can be very cost-effective, with basic plans starting as low as RM 30 – RM 100 per month. For larger businesses or those requiring more advanced features, pricing may range from RM 100 to RM 500 per month.

If you have specific needs (such as multiple users, payroll processing, or advanced financial reporting), it’s important to review the features included in each plan to ensure you’re selecting the best software for your budget and business needs.

Q&A on Accounting Software in Malaysia

What is accounting software, and why is it important for businesses in Malaysia?

Accounting software is a digital tool designed to automate financial management tasks such as bookkeeping, invoicing, tax calculation, payroll processing, and generating financial reports. For businesses in Malaysia, it is important because it streamlines operations, reduces errors, ensures compliance with local tax laws (like SST), and provides real-time financial insights.

How does accounting software help Malaysian businesses with tax compliance, especially SST?

Accounting software plays a significant role in ensuring tax compliance by automating the calculation of the Sales and Service Tax (SST), which businesses in Malaysia are required to adhere to. It helps in generating accurate invoices with correct tax rates, tracking sales and purchases subject to SST, and producing detailed tax reports.

How does accounting software improve financial reporting and decision-making?

Accounting software provides businesses with real-time access to financial data, which is essential for making informed decisions. By automating the process of recording and categorizing transactions, it ensures accuracy and consistency. It allows businesses to generate detailed reports like balance sheets, income statements, and cash flow statements at the click of a button. This real-time visibility into the financial health of the business helps owners and managers identify trends, manage cash flow, and make data-driven decisions, whether for day-to-day operations or long-term strategic planning.

What features should Malaysian businesses look for in accounting software?

When selecting accounting software, Malaysian businesses should prioritize the following features:

- GST/SST Compliance: The software should ensure accurate tax calculation and produce reports in compliance with Malaysia’s tax regulations.

- Multi-Currency Support: If your business deals with international clients or suppliers, multi-currency functionality is essential.

- Customizable Reporting: The software should allow you to generate detailed financial reports tailored to your business needs.

- Payroll Management: If you have employees, payroll features that comply with Malaysia’s statutory requirements (EPF, SOCSO, etc.) are a must.

- Bank Integration: The ability to link your bank accounts to automate transaction reconciliation.

- Cloud-Based Access: This ensures that the software can be accessed from anywhere, promoting flexibility, especially if you have multiple locations or work remotely.

- User-Friendly Interface: It should be easy to use, with minimal learning curve, especially for those without a background in accounting.

What are the advantages of cloud-based accounting software over traditional desktop-based options for Malaysian businesses?

Cloud-based accounting software offers several advantages over traditional desktop-based options. First, it enables real-time updates, meaning you can access your financial data anytime and from anywhere, as long as you have an internet connection. This is particularly helpful for businesses with multiple branches or those that require remote access. Second, cloud-based software typically includes automatic updates, ensuring that your system is always compliant with the latest tax laws and features. Lastly, cloud solutions often have lower upfront costs since they are subscription-based, while desktop software usually requires a one-time purchase, and additional costs may arise for updates or multiple users.

Can accounting software help small businesses in Malaysia manage their finances effectively?

Yes, accounting software is extremely beneficial for small businesses in Malaysia. Many accounting software options are designed specifically for smaller enterprises and provide an affordable, easy-to-use solution for managing finances. Features like invoicing, expense tracking, and tax calculations can help small business owners stay organized and comply with regulations, without needing to hire a full-time accountant. Cloud-based options allow small businesses to access their financial data anytime, which can be particularly helpful for owners who need to track finances on the go.

How do I ensure the security of my financial data when using accounting software in Malaysia?

Security is a major concern when it comes to accounting software, especially since you’re dealing with sensitive financial data. Cloud-based accounting software typically uses advanced encryption and secure data centers to store your information. Look for software that provides multi-factor authentication (MFA), regular data backups, and SSL encryption for secure data transmission. If you’re using desktop-based software, ensure that the system is protected by strong passwords, and that regular backups are performed to safeguard data in case of hardware failure.

Is it difficult to migrate financial data from traditional bookkeeping systems to accounting software?

Migrating data from traditional systems to accounting software can be challenging, especially if the previous system was entirely manual. However, many modern accounting software solutions offer migration tools or assistance to simplify the process. The process usually involves transferring existing financial records such as account balances, transaction histories, and tax details into the new system. If your business has been using spreadsheets for bookkeeping, most accounting software can import data from CSV or Excel files.

How does accounting software help businesses handle audits in Malaysia?

Accounting software can significantly simplify the auditing process. It maintains a comprehensive and transparent record of all financial transactions, making it easier to trace and verify data. The software automatically generates reports required for audits, such as trial balances, ledgers, and tax reports, ensuring they are accurate and up-to-date. Many accounting solutions also offer an audit trail feature, which logs all changes made to financial records, making it easier to track discrepancies or unauthorized adjustments.

Can accounting software support multiple users in Malaysia?

Yes, many accounting software platforms in Malaysia allow for multi-user access. This feature is useful for businesses that need several employees to collaborate on financial data, such as accountants, finance managers, and business owners. The software provides role-based permissions, so you can control who has access to specific features or financial data. For instance, the accounting team may have access to all the financial data, while a manager might only have access to sales reports or invoices. Multi-user support enables better collaboration and streamlines the management of finances in a team environment.

Is accounting software suitable for businesses with international operations in Malaysia?

Yes, many accounting software solutions are designed to handle international operations. For businesses in Malaysia that operate across borders or deal with foreign clients, accounting software can support multi-currency transactions, track foreign exchange rates, and generate reports in different currencies.