If you have investigated debt solutions before, then you have probably seen some mention of the “top” debt settlement companies out there. The challenge is in defining what exactly a top company is. Is a top company one that serves more customers than any other company? Is a top company one that has the highest customer satisfaction ratings? Is it the company with the best peer reputation? The answer is that a “top” company is really a combination of these things. The best companies out there are the ones that have a comprehensive, solid reputation to offer consumers.

Top settlement companies get rave reviews from people who have used them before. You can often find this information out by simply searching for reviews online. Consumers are more than happy to provide insights on debt settlement companies and how effective they happened to be. A top company will have excellent reviews across the board, since they get the job done for clients and provide adequate levels of customer service.

The best companies are also those that have experience. The thing about settling debt is that it requires both skill and connections. Good companies use their long-standing relationships with companies to work out great deals for clients. These people get used to working together and it makes the negotiation process that much easier. This is truly where the top companies separate themselves from those on the bottom rung.

When seeking to understand the top settlement companies, one needs to also consider the alternative. The “bottom” companies are those that don’t work closely with customers and don’t come up with results. They don’t have the relationships to bring about positive settlements and they don’t employ people who inspire confidence. When you have worked with a top of the line negotiation group, you will know the difference. You will see it in their professionalism and their approach each and every day. This is something to keep in mind for those people who choose a company to help them settle their outstanding debts in the not so distant future.

Top 5 Best Debt Settlement Companies:

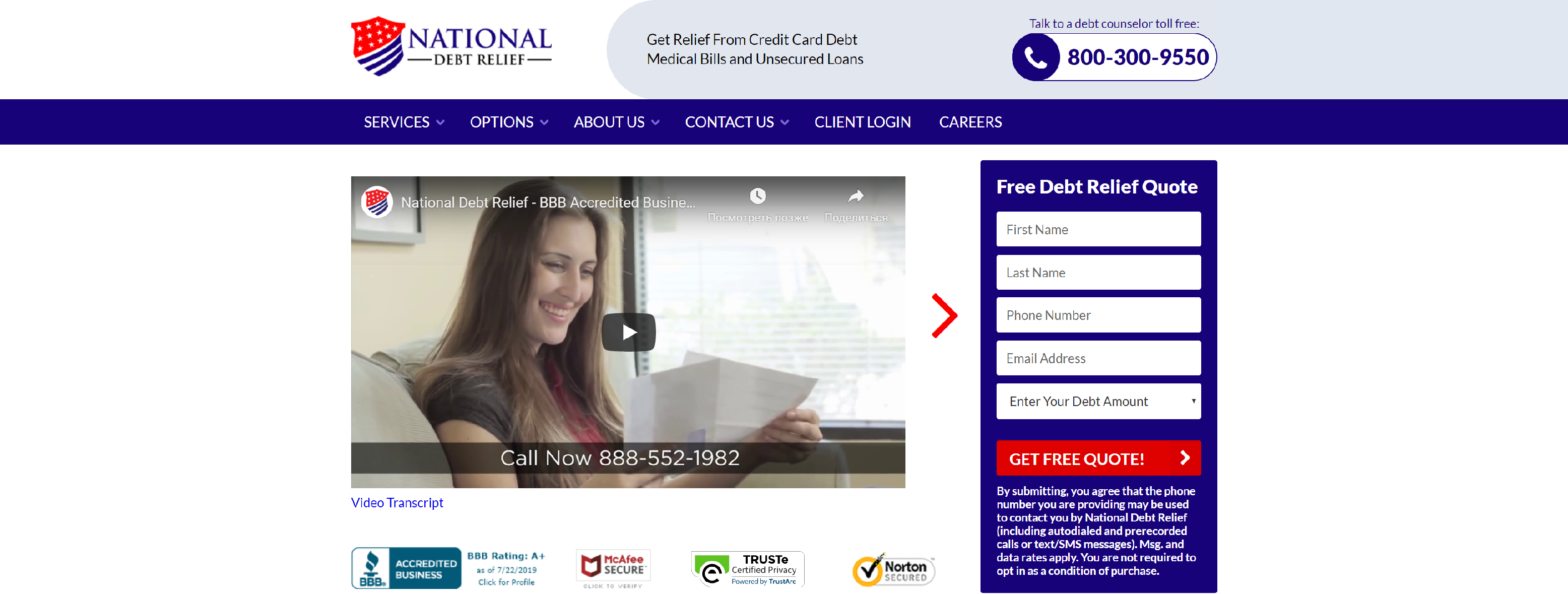

NATIONALDEBTRELIEF

National Debt Relief is a BBB A+ accredited business that helps consumers get out of debt without loans or bankruptcy.

- Get financial counseling and guidance from experts

- Be helped with a budget plan that addresses your bad spending behavior

- Have a lower monthly payment that will better fit your tight budget

- Get payment charges and fees waived

- Have a sizable portion of your debt forgiven

- Focus on one payment alone that funds your FDIC-insured account, which is where National Debt Relief will get the money to pay off your debts

- Settle your debts without compromising the other financial obligations that are needed for your basic necessities.

- Live a less stressful life that is free from harassing creditors

NEWERADEBTSOLUTIONS

Credit counseling, debt management, and debt consolidation programs to help you get out of debt.

- Provides an ethical and honorable alternative for those who face bankruptcy

- Debt settlement allows you to maintain privacy over your financial affairs (unlike bankruptcy, where everything becomes a matter of public record)

- Lets you take charge of the program and control your own destiny (unlike bankruptcy, where the courts decide everything)

- Gets you debt free faster. Typical debt settlement programs have a duration of only 2-3 years versus 5-9 years or more for Debt Consolidation or Credit Counseling

- Debt settlement ultimately requires the lowest total payout versus debt consolidation or credit counseling

- Provides the most flexibility of any program in terms of monthly budgeting. If you have to miss a month your only penalty is that the program may take longer to complete. You can also “make it up” down the road by funding over and above your basic level

GUARDIANDEBTRELIEF

Guardian Debt Relief is a BBB accredited business that has helped thousands of people lower their debt through debt negotiation.

- You don’t pay a thing until we lower your debt

- We can help you reduce your unsecured debt in as little as 24 months

- Get debt relief options that fit your budget

- Get comprehensive resources for smarter spending and saving

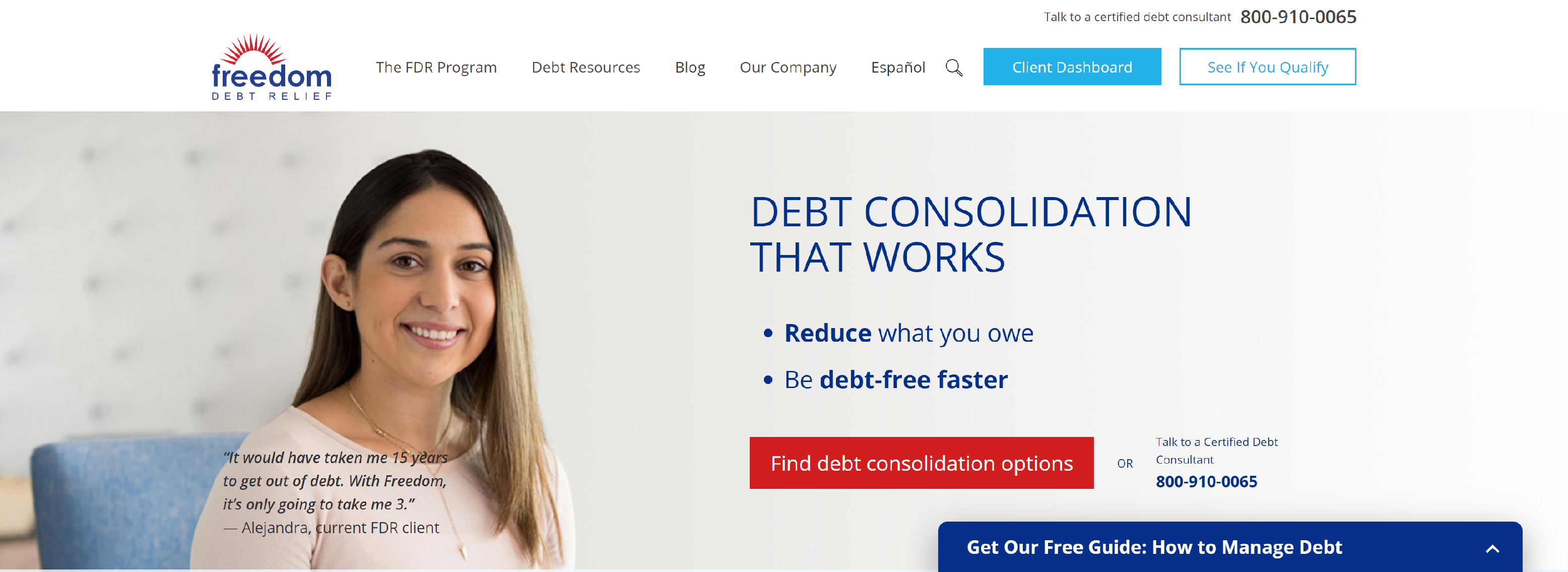

FREEDOMDEBTRELIEF

Freedom Debt Relief is America’s leader in debt relief and debt settlement which helps customers resolve over $10 billion with our debt settlement program.

- Free debt evaluation

- Customization

- Your FDR program

- Debt freedom

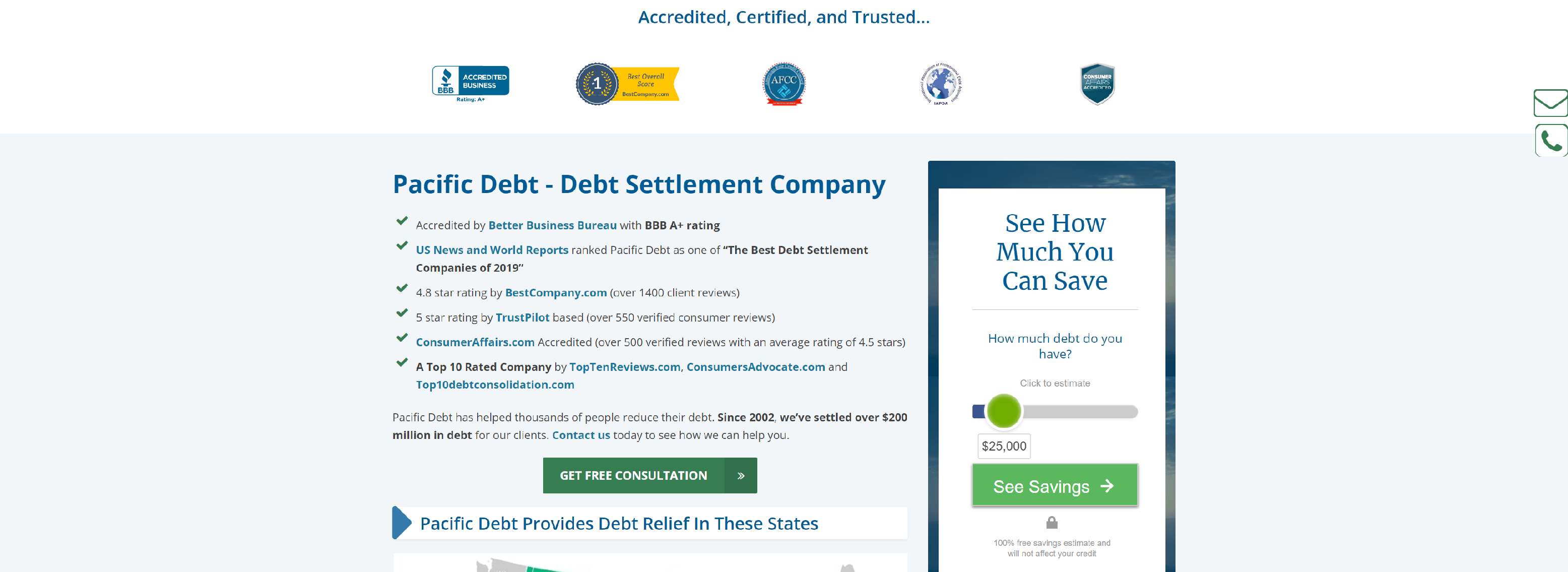

PACIFICDEBT

Pacific Debt is a national debt relief and debt settlement company located in San Diego, California with an A+ BBB rating and Accredited AFCC member.

- Debt Settlement Option

- Qualifying for Debt Settlement

- Client Care

- Personal Account Management

What Is Debt Settlement and Does It Work?

Debt settlement, which is also commonly called debt negotiation, is when a debtor negotiates with their creditors in order to reduce the amount that they owe. When done correctly, many people are able to reduce their debt to a fraction of what it was originally.

Debt settlement does work, but its effectiveness depends on three main things, which are:

1. The Creditor(s)’ willingness to negotiate

2. The debtor’s ability to pay

3. The negotiating ability and persistence of the debtor

If a creditor or debt collector believes that he or she will be able to recover a debt from a consumer, they will be unwilling to negotiate. Creditors will only be willing to negotiate with debtors that can no longer afford to pay their bills. The older the debt gets, the less likely it is that the creditor will recover any repayment. This makes them desperate to settle, even if they must settle for less.

Creditors will also be willing to settle with consumers that are facing bankruptcy. This is because if a consumer files for bankruptcy, the creditor will receive no payment. Creditors would rather receive a lesser payment, than no payment at all.

Debt settlement can be very effective. However, most consumers don’t know how to really negotiate with their creditors and receive the lowest settlement possible. Debt collectors can be tough negotiators. They are trained to recover as much as they can from debtors and will not be willing to let consumers off the hook very easily.

This is why many consumers seek out professional help. There are debt settlement agencies that will work with consumers to help them negotiate with their creditors. This makes it possible for many debtors to reach a settlement around 40% to 60% of their original balance.

Professional agencies may also help customers and creditors reach realistic payment plans. These professionals know what paperwork must be filed and signed, and how the process works. Having the help of a trained professional greatly increases a consumer’s chance of a beneficial settlement and repayment plan that they will be able to afford.

Is Debt Settlement a Good Idea? Unbiased Analysis

Getting an unbiased analysis on debt settlement can sometimes be difficult because many people have a vested interest in this subject. Reading reviews may not be helpful when those reviews are clouded by people who have agendas. With that in mind, this will hopefully answer the question on debt settlement in a manner that is helpful. Is it a good idea? There is no way to give an answer to every possible situation without having all of the information on hand, but the general consensus is that settling your debts is smart. For most people, it will pay off in the end.

When considering whether debt settlement is a good idea, one must first take a hard look at what it can do for them. A consumer that settles his or her debts gets a great discount on those debts. How much of a discount can happen in these situations? That depends upon the age of the debt and total amount, but it will usually be in the thousands of dollars. You might get away with paying only 25% to 30% of your total owed balance if you can negotiate the debt down appropriately. This kind of money can do a lot for you and it can set you up for success in the future.

Likewise, settling a debt gets things over with quickly. Instead of having to go through a process that is lengthy and drawn out, you destroy the debt right on the spot. This takes less of your time and allows your energy to go into things that are more important. Likewise, it will help you move on to a new part of your financial life while not having to dwell on the past. Things will fall off of your credit report after seven years, so starting this clock earlier is a good idea if you can swing it.

The last thing to consider is how hard settling is. With the good help of solid debt settlement companies, it is very easy to knock things out in this day and age. All signs point to this being a good idea in the majority of cases.

How Does Debt Settlement Affect Credit? If So, Any Tips?

Similar to most major financial decisions, debt settlement will have both short and long term effects on a consumer’s credit. When deciding whether settlement is a beneficial option, consumers will want to consider both the positive and negative effects, in order to make an informed decision.

If a consumer has been diligently paying their bills each month and maintaining a good credit score, debt negotiation and settlement will have a negative affect on their credit. This is because during negotiations, consumers will generally stop making payments on the debt they are trying to reduce. If a consumer is working with a settlement agency, they will usually be making payments to the agency, who will then pay the agreed upon sum to the customer’s creditors. However, while making payments to the settlement agency, a person’s creditors may not be receiving payment, which will show up on their credit report.

If a consumer is already behind on payments, settlement will not have as big an impact on their credit. If a person is really struggling, their credit score shouldn’t be the first thing on their mind anyway. Bankruptcy will have a more negative impact on one’s credit than settling their debts. If settlement is a consumer’s last chance to avoid bankruptcy, the negative impact on their credit is certainly worth the benefits of settling.

The long term effects of debt settlement are much more positive. Since a consumer will no longer be struggling to pay their bills each month, they will be much more likely to pay on time. This will make it possible for a person to rebuild their credit and offset any damage that was caused during the settlement process.

Consumers that want to rebuild their credit as quickly as possible can also take additional steps to do so. Obtaining a prepaid credit card or opening and maintaining new lines of credit are easy ways for consumers to increase their credit score. While it is true that debt settlement can lower a consumer’s credit score initially, it actually helps most people maintain a good score in the future. In many cases, settlement is a beneficial option that helps consumers improve their current and future finances.

Lump Sum Debt Settlement – What Is It?

Debt happens to people of all ages and backgrounds. After all, credit cards are used as much as candy, and all it takes is one lost job or a cut in hours for people to fall behind on monthly bills. Once behind, the overcharge and late fees makes it hard to catch up. This is why debt settlement should be considered if a person is months behind on such payments. The following includes some basic information about what settlement means.

It is important to take charge once a person has gotten him or herself into debt. This means talking to credit card companies or lenders. Though the conversation may be hard and uncomfortable, this will make a company more likely to work with the individual. While talking to the lender, it is important to explain that one wants to pay off this debt but have limited means. It’s okay to explain why one fell behind.

From here, the company may offer a lump sum debt settlement. This means that in exchange for a lump sum, the company will consider the account settled and dealt with. This means that bills will stop slipping through one’s mailbox and that collectors will stop calling. Often, the company will settle for less than the amount due. However, it’s important to be smart about the negotiated amount.

Before calling the group up, it is important to think about how much of a settlement one could make on a debt. Sometimes, this lump sum situation will be offered in a single payment and some companies will allow a person to divide the lump sum into two payments. The company wants as much as possible, so it’s important to try to give between 50 and 75% of the balance.

A lump sum can really get a company off one’s back and help eliminate one less bill or debt. This is important for people trying to rebuild their financial situation. A settlement is a chance to make things right. This is why it is important to be smart and honest with the company.

Sample Debt Settlement Letter – An Effective One

The right debt settlement letter can help an individual secure an amazing deal with one of their lenders. However, these letters need to be approached in the right manner. The right wording and information can help a person negotiate his or her way out of some serious debt. Having all of this in writing is important so that there is a paper trail that protects each party. This is where composing such a letter comes into play. The following includes some tips for how to craft an effective debt settlement letter that will get lenders to sit up and listen.

First, it is very important to have all of the right information included in such a letter. This means including one’s name, address, the date of the letter, the collector or lender’s name and address, and the account number. If possible, it is important to address the letter to a specific customer representative, specifically a staff member that has spoken to the letter writer.

The first paragraph should be short and should explain the purpose of the letter. An example includes: Hello, my name is [Insert Name] and I am writing to settle the outstanding debt with [Name of Creditor]. Recently, I have fallen behind on payments because [Insert Reasons]. However, despite this, I am committed to paying back this debt.

The second paragraph should talk about the specific balance and the amount one wishes to settle for. Example: My current outstanding balance is [Insert Amount]. At this time, I am able to settle this account for [Insert Settlement Amount]. In return for settlement, I ask the following:

1. Any and all litigation and debt collection is ceased.

2. My account is shown to be fully paid.

3. Negative listings to the three main credit bureaus – Equifax, Experian, and TransUnion – are removed.

The third paragraph explains the results of acceptance of this settlement. Example: If the terms of this settlement are accepted by [Insert Creditor’s Name], I will mail a money order or check in the amount of [Settlement Amount] paid to [Creditor’s Name]. In exchange for this payment, [Creditor’s Name] agrees to forward this letter to the credit bureaus listed above and agrees to send me documentation closing my account. Thank you for your time.

The closing of the letter should list your name and address and should include a signature. It will help, too, to have a witness sign this letter and to have it notarized. Doing all of this protects the individual and ensures this debt will be settled.

Best Debt Settlement Company – What Makes A Service “Good”?

When you are looking for a debt settlement company, you will run into plenty that are bad and plenty that are good. The challenge, of course, is knowing the difference between these two types of companies. Debt settlement is an important thing that can save you thousands of dollars if you choose the right company and work with them appropriately. With this in mind, it pays to have a good approach for selecting the best possible company. A “good” service will be one with an established reputation, experienced individuals, and a customer-centric approach.

Finding a company with a good reputation is important for a number of reasons. First and foremost, this will ensure that you aren’t being scammed. Additionally, these settlement professionals will have relationships with the creditors. A good company will command respect when it speaks, and this will go a long way as you work toward a solid settlement.

You also want to find a company with experienced professionals. Negotiation is something that is difficult and has lots of twists and turns. There are little nuances that only an experienced pro will understand. If a company has been through the wars before, they stand a better chance of negotiating a great deal for you. This is something that you have to take very seriously because it will matter in the end. Bad companies employ people who are learning on the job. Good companies have professionals who rarely make the big mistakes.

Likewise, you will want to work with a company that is all about you. The customer is important and they need to understand what you can do in terms of settling. They also should keep you in the loop throughout the process. This separates the good companies from the bad. A bad company will provide a low level of customer service and will conduct business without first checking with you. A good company will understand that you are the lifeblood of the operation and that your opinion is the only one that matters. They will also help explain to you the process and what you can do to make it easier.

Does Debt Settlement Work? The Final Answer

Debt settlement is something that is talked about a lot and different people have opinions on its effectiveness. Some will tell you that settling debts is a good thing while others will say that settlement is a bad idea. Does it really work for consumers out there? The final answer is that in most cases, it works. This is, of course, dependent upon your situation and exactly what you have going on. For some people, it is a better option. For others, there might be things like consolidation that will provide better relief.

So why does settlement work in the majority of cases?

Really it comes down to the large amount of money that is saved in the process. There are a few negatives that must be considered, but these are typically outweighed by the thousands of bucks that you can pocket by settling. When you settle a debt, you end up paying somewhere in neighborhood of 25% to 50% of what you owed to the creditor. If your debts are large, this can mean a savings of many thousand dollars.

Likewise, settling a debt cuts off the bleeding and starts the clock toward a better financial future. When you go through some debt programs, your credit is killed over a long period. You have to work hard to get out of debt and you then have to wait for your credit to improve. When you make a lump sum payment to get rid of the debt, you are starting that credit removal clock and those items will be off of your credit report much more quickly.

There is also the peace of mind that must be taken into account. When you get rid of the debts, you can sleep easy knowing that there are not more collection calls coming. In terms of improving your health and making you a happier person, this will go a very long way. You will be able to answer the telephone without wondering which creditor is on the other end this time. Likewise, you are satisfying the creditors, so you can walk away feeling good about yourself.

Do not forget the check the chosen debt settlement company against the Better Business Bureau before making any decision.