The small business payroll softwareis a useful tool designed to help you keep track of the financial part of your business.

It comes in the form of a computer software and it targets most of the money issues a small business manager has to deal with. Being specifically created for the smaller businesses out there, the small business payroll software will help you avoid the other complicated types of software available on the market and will also neutralize the necessity of creating your own software.

The small business payroll software usually has a simple interface and can be used even by persons without any accounting experience. Still, it is better to have it used by someone who knows what to do, so that the software can reach its true potential. While large companies have an entire department to deal with the financial issues, smaller businesses usually give this task to a single person. The volume of work may not be as large, but having only one person looking over a multitude of aspects can be disturbing. That’s why it is best that the person responsible gets all the help available. And with the small business payroll software the work will not be as tough as it used to.

The small business payroll software allows you to calculate someones payroll just by pushing some buttons. Making payroll is not an easy task, as you have to keep in mind stuff like hours worked, absences, performance and quality and also taxes.

Probably the most important part of the small business payroll software is the fact that it helps you keep track of the actual time your employee has worked. When it comes to calculating the payroll, you will have the exact data and your employee won’t have any reason to complain. You can record the normal work hours, the overtime, the under time or the absences for any employee. The software will calculate the cost for all those items and will give out the sum that has to be paid. You don’t have to do all that manually from now. Just enter the numbers and let the small business payroll software work its magic.

But that’s not everything a small business payroll software can do. It also keeps track of all the tax obligations. So when you calculate the paycheck for your employees, the software will automatically calculate the taxes that need to be subtracted.

In general, most small businesses choose to hire these type of financial services and just pay a specific amount. But if you decide you want to do that stuff on you own, start researching the small business payroll software. You need to be careful, as you don’t want to waste your budget on a software that won’t get the job done.

All in all, the small business payroll software is useful for any small business, as long as you have someone well trained to use it.

PATRIOTSOFTWARE

Fast, inexpensive, and accurate online accounting and payroll software for small businesses.

- Payroll Register

- Check/Deposit Payment Detail Report

- W-2 Preview

- Contribution History Report

- Paycheck History Report

- To-Date Entries Report

- Deduction History Report

- Assigned Deductions Report

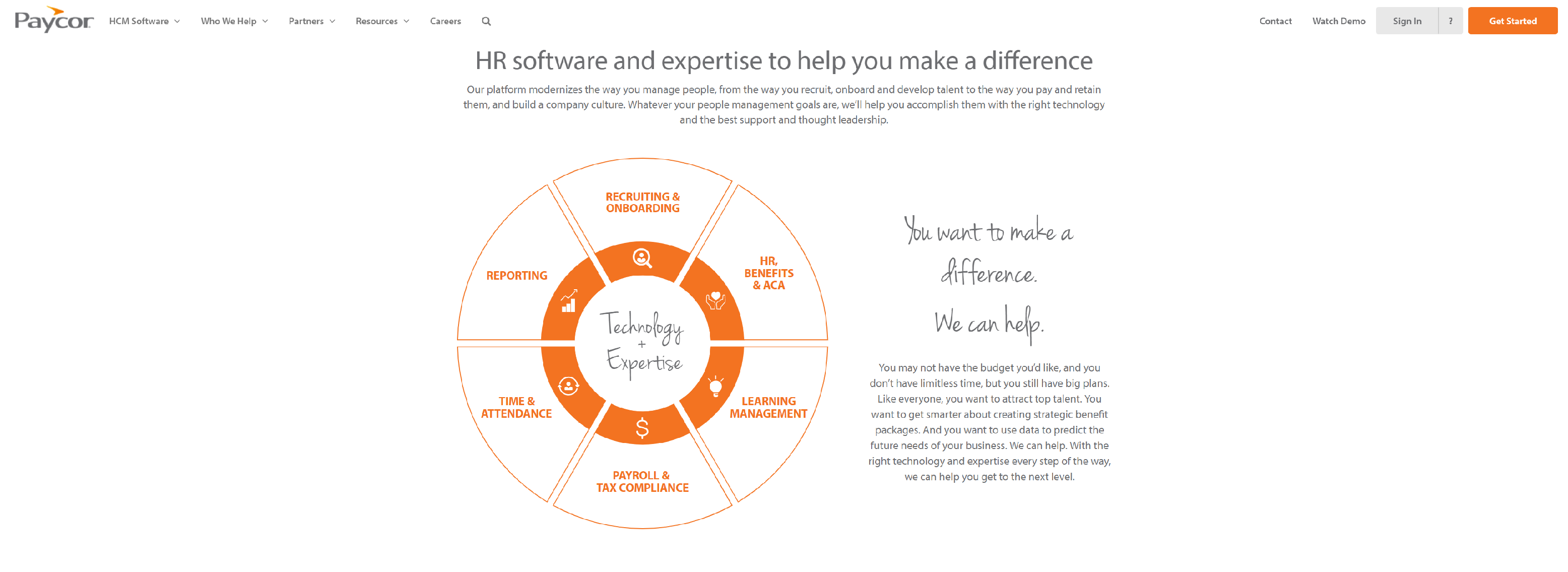

PAYCOR

Streamline processes by using an HR software integrating recruiting, payroll, time and attendance, benefits admin and more! Trusted by over 30,000 organizations.

- Support Your Most Valuable Assets: Your People

- Get Your Small Business Payroll Needs Completed as Quickly as Possible

- Tax and Compliance Expertise Is a Must-Have

SAGE

Streamline and automate your payroll processes with HMRC supported cloud-based software from Sage.

- Take the headache out of compliance

- Cut down time spent on payroll admin

- Pay your people accurately every time

- Manage your payroll on the go 24/7

- Automatic enrolment for your employees

- Use it on a Mac, PC or mobile

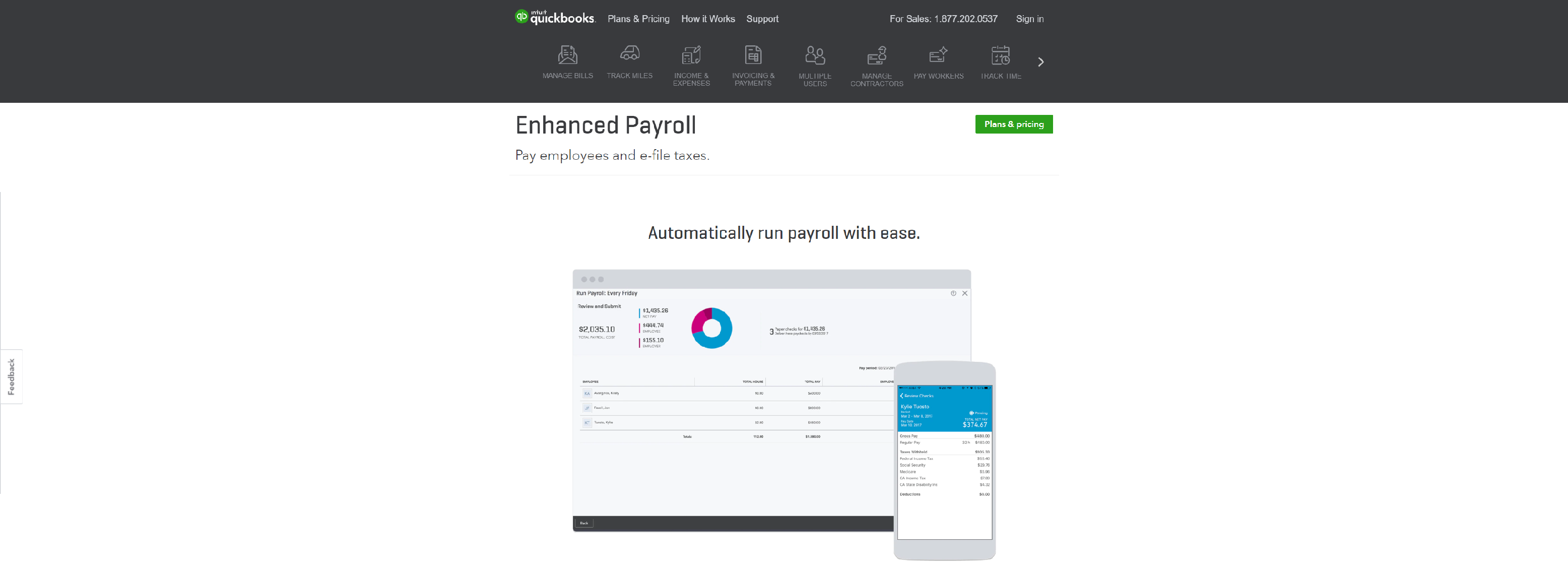

QUICKBOOKS

Easy setup and automated payroll software with free e-file and e-pay for payroll taxes. We take care of tracking taxes and compliance.

- Automatically run payroll with ease

- Automatically track and pay taxes

- Easily manage employee payroll

WAGEPOINT

Pay your employees, contractors, and stay government compliant with Wagepoint, the best automated small business payroll service.

- Set up your company in a matter of minutes

- Invite your employees to access their paystubs

- Process your hourly & salaried payroll quickly

- Take a vacation with our auto-approve feature

- Support ticketing right within the app

ADP

ADP Vista HCMSM – an adaptable and scalable solution that has been custom-made for small businesses.

- Create Multiple Pay Structures

- Address Complex Payroll Calculations

- Auto-Generate Reports

- Automate Your Payroll

- Automate Your Taxes

- Master HRIS Management

SOLUTIO

Solutio is a payroll software company. Our cloud-based payroll technology helps umbrella companies & recruitment agencies save time & money.

- Worker Engagement

- Real Time Visibility

- Proven Compliance

- Automated Payroll

KNITPEOPLE

Knit is Canada’s leader in payroll, HR, and benefits by weaving online payroll software with HR software into a beautiful easy-to-use platform.

- Time-off Scheduling

- ROEs

- Time sheets

- Tax filings and payments

- Paperless paystubs

- Customizable payroll reports

SIGMAHRIS

HR & Payroll Software Indonesia | All-in-One HRIS Solutions to Manage HR, Attendance, Payroll, Tax PPh 21 & BPJS, Integrated with Strategic HR.

- Fast Processing Speed

- Analytical Dashboard

- Easy Integration

- Secure & Encrypted

- All-In-One HRIS Solution

- Application Flexibility

GUSTO

Gusto offers fully integrated online payroll services that includes HR, benefits, and everything else you need for your business.

- Gusto is about as easy as payroll’s ever going to be

- Full-servicepayroll

CLOCKON

Australia’s most powerful Rostering, Attendance and Payroll system, especially popular within the pharmacy, medical, retail and hospitality industries.

- STP and ATO compliant

- Powerful award interpreter

- Sophisticated allowance / deduction calculator

- Automated rate updates

- Payslips available via email or mobile app

- Precise leave accrual

- Multiple entity, location or department costings

- 250+ reports

- Industry endorsed

PRIMEPRO

The latest cloud based recruitment CRM and payroll software designed for temp agencies with low start-up costs.

- Timesheets and worker records are imported from PrimePro cutting down double input and errors.

- Once imported payroll can be calculated in one go for all branches or by the branches of your choosing giving you the flexibility to run the payroll as you wish

- Exception reporting warns of any overpayments or other issues to help prevent errors and corrections

- Doing as many trial runs as you like allows you to be absolutely certain of accuracy before pushing payroll to ‘live’

RAMCO

Ramco Systems offers cloud, mobile, chatbot and Voice-ready ERP, HR, Global Payroll, Logistics, EAM and Aviation M&E MRO Software. Focused on building Active ERP infused with AI & ML.

- Create organization-specific rules

- Define your business logic for Earnings, Deductions, Bonus, Arrears, Leave and Attendance

- Stay compliant to standardized practices across geographical locations

- Take into consideration variances within individual, local geographies

- Deal with multi-element, multi-decimal, multi-currency, and multi-country payroll