Equity Management Software (EMS) is a type of software used by businesses, especially startups, private companies, and venture-backed organizations, to manage their equity ownership and associated processes. It helps track and manage various aspects of company ownership, such as stock options, equity grants, vesting schedules, shareholder information, and other aspects related to the ownership structure of a company.

Discover the top 11 best Equity Management Software for All Sectors

Ledgy

Ledgy – The equity management software platform that streamlines planning, automates financial reporting & cap table management with global compliance.

- Manage equity your way

- Fast and easy migration with Ledgy experts at hand

- Enterprise-ready security

- Best-in-class across every function

Carta

Carta (formerly eShares) is an ownership and equity management platform trusted by thousands of founders, investors, and employees.

- Digital cap table

- Company valuations

- Special purpose vehicles

- Fund admin

Orchestra

Orchestra is trusted by thousands of thriving businesses, investors and employees around the world as the smart way to track equity and streamline investor relations in one intuitive platform.

- Elevate shareholder trust and loyalty

- Manage equity with confidence

- Motivate your team with ownership

- Automate dividend distributions to your shareholders

Clara

Clara – Easy company incorporation, equity management, documents, and data room. Everything you need to manage and grow your business in one place.

- Use Clara’s suite of startup-focused products to form, manage and scale your business

- Support and track your portfolio using Clara’s automated tools making it your central admin platform

- We build bespoke onboarding workflows and dashboard management controls for many of the world’s leading accelerator programs

Cakeequity

Cakeequity – All-in-one system that lets you offer equity, simulate raises, and manage shareholders anywhere in the world.

- Dynamic cap table management

- Issue stock options

- Simulate capital raise and model scenarios

- Automated contract management

- Easy and transparent employee portfolio

- Fast, audit-proof 409A Valuations

Insightsoftware

Insightsoftware – Finance-owned software that leverage your existing financial systems to speed-up processes, increase accuracy,and encourage wider participation. Flexible reporting tools, fast analytics dashboards, and controlled budgeting solutions inside of Excel and on the web.

- Free up time and minimize errors by automating routine data workflows

- Accelerate reporting and analysis templates designed for common ERP use cases

- Access real-time data within applications

Eqvista

Eqvista help business owners to manage cap table and issue shares to founders, employees & investors.

- Manage your equity all in one place

- Set up and register your company

- Handle the complexities of the cap table with ease

- Get a 409A valuation from professionals

- Keep an eye on your company standing

- Share information with others

- Grow your company

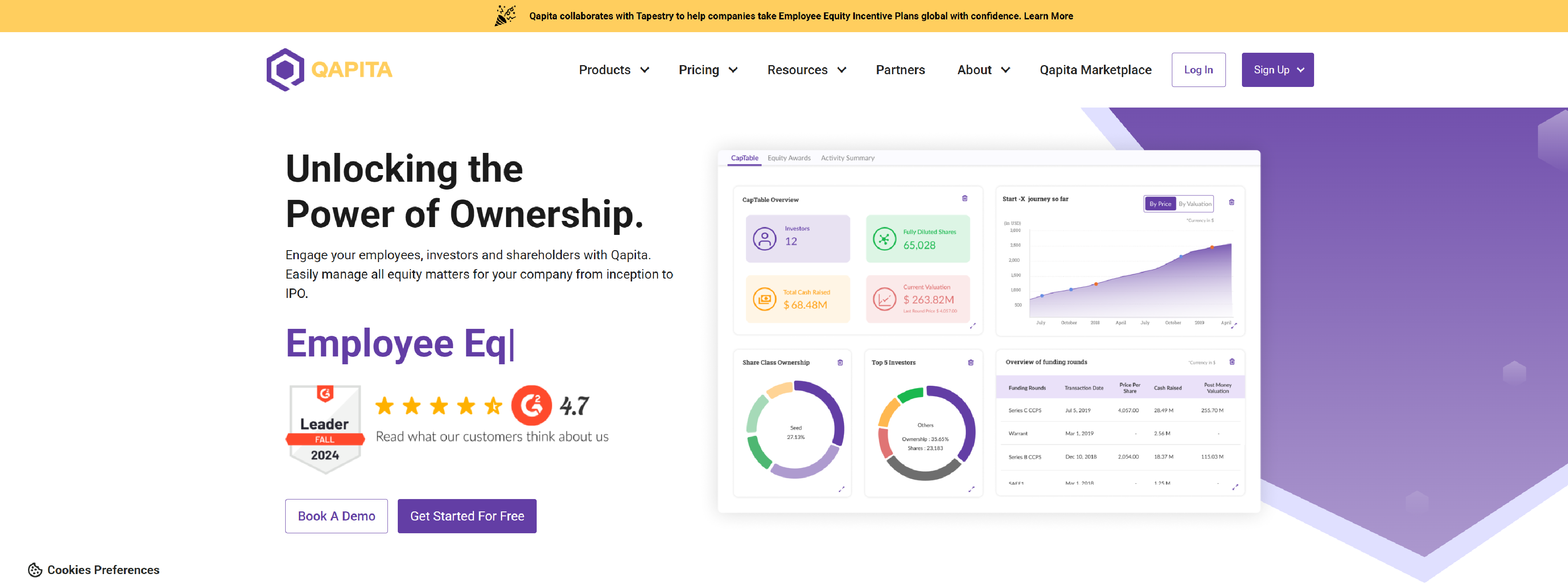

Qapita

Qapita is a market leader in India & SEA built to automate workflows around equity management process for CapTables, ESOPs, Due-diligence, and Transactions.

- Manage all your stakeholders, securities & transactions easily

- Create plans, grant ESOPs easily and digitally

- One stop advisory and administration platform

- Fair valuations & accounting of ESOP expense

- Solutions to monetise ownership in private companies

- Reporting and governance solutions. Shareholder engagement

Vestd

Vestd’s equity management software is a single source of truth for company ownership. Fully synced to Companies House, so accuracy is guaranteed.

- Manage your equity in one place with software, rather than spreadsheets or basic platforms

- Eliminate the risk of losing track of ownership, or having inaccurate shareholder data

- Issue shares instantly and update Companies House, with no forms to complete

- Design, launch and manage company share schemes, with expert guidance and five-star support

Equitylist

EquityList is an equity and shareholder management software for India, Singapore, US, MENA, and other regions.

- Seamlessly issue & track securities from EquityList

- Single source of truth for all transactions & shareholders

- Issue digital share certificates & dematerialize securities

- Upgrade investor relations with dashboards, data rooms & updates

- Manage AngelList India syndicates & RUVs on your cap table

- Cross-border shareholding

Equityeffect

Equityeffect – Diligent Equity enables investors, law firms, and private companies to manage their cap tables, valuations, investments, and overall workflows.

- Your single source for managing cap tables, MIP plans, running waterfalls and more

- Simple Portfolio management software to make fund tracking easy

- Manage your option administration, cap table and ensure you understand how new term sheets impact your future all in one place whether you are a C Corp or LLC

What is an equity management software

Equity Management Software (EMS) is more than just a tool for tracking stock options or cap tables. It’s a comprehensive platform designed to help businesses manage their equity-related activities, ensuring accuracy, compliance, and transparency. Rather than focusing on a typical list of features, let’s discuss what an equity management software really is from a functional and strategic perspective.

- A Platform for Organizational Transparency

- A Tool for Managing Complex Equity Structures

- A Compliance and Regulatory Navigator

- An Investor and Employee Engagement Tool

- A Decision-Making Support System

- A System for Efficiency and Time-Saving

- A Long-Term Value Management Tool

- A Tool for Building Company Culture and Trust

- A Platform for Streamlining Exit and Fundraising Processes

Equity Management Software is more than just a tool for tracking ownership and options. It’s a centralized system for managing complexity, ensuring compliance, engaging employees and investors, and making better strategic decisions.

Who uses equity management software

Equity management software (EMS) is primarily used by organizations, investors, and stakeholders involved in managing company ownership, equity compensation, and corporate governance. The following groups typically use equity management software:

Startups and Early-Stage Companies

- Founders and Co-Founders: Founders use EMS to manage their ownership stakes and equity compensation (e.g., stock options) as the company grows. It helps them understand their ownership percentages and model how funding rounds or stock grants affect the cap table.

- Employees: Employees, particularly those who are granted stock options or equity as part of their compensation, use EMS to track their stock option grants, vesting schedules, and eventual exercises.

- Human Resources (HR) and Talent Teams: HR teams use equity management software to issue, track, and manage employee stock options or equity compensation packages. EMS helps HR teams streamline the process of managing vesting schedules, option exercises, and communicating with employees.

- Founders’ Advisors: Legal and financial advisors who support startups may use EMS to assist founders in maintaining compliance, structuring deals, and ensuring that all equity-related processes are handled correctly.

Venture Capital (VC) Firms & Private Equity (PE) Firms

- Investors: Venture capitalists and private equity firms use EMS to monitor their equity stakes in portfolio companies, track dilution, and manage the allocation of equity as companies raise subsequent funding rounds.

- Investor Relations Teams: VC and PE firms use EMS to maintain transparency with their portfolio companies, share updates on ownership, and model exit scenarios.

- General Partners (GPs): GP teams in venture funds utilize EMS to evaluate and report the value of their investments, including scenarios such as liquidity events (IPOs, M&As).

Public Companies

- Corporate Finance and Treasury Teams: Larger, publicly traded companies often use equity management software to manage their stock options, equity compensation programs, employee stock purchase plans (ESPPs), and shareholder communications.

- Legal & Compliance Teams: Legal teams ensure that equity compensation plans comply with regulatory requirements, such as SEC reporting, stock option reporting, and tax laws. EMS helps in generating and storing the necessary documentation for compliance purposes.

- Investor Relations (IR): Public companies often use EMS to communicate with institutional investors, track shareholder voting, and provide transparent data on company ownership structures.

Law Firms and Corporate Lawyers

- Corporate Counsel: Lawyers working with startups or private companies use equity management software to ensure that the company’s cap table is accurate, that stock options are issued according to legal requirements, and that the company remains compliant with securities and tax regulations.

- Mergers and Acquisitions (M&A) Advisors: Law firms advising on M&A transactions use EMS to evaluate how a potential deal may affect the company’s cap table, shareholder structure, and equity distribution.

Accountants and Tax Advisors

- Tax Consultants: Accountants use equity management software to assess tax implications of stock options, equity grants, or RSUs (restricted stock units). This includes managing issues like 409A valuations, tax reporting for option exercises, and other compliance matters.

- Certified Public Accountants (CPAs): CPAs often assist companies with the financial reporting aspects of equity compensation. EMS can generate tax reports and ensure the company is meeting all tax obligations, particularly with regards to option exercises and employee stock purchases.

Board Members and Executives

- Executive Teams: C-suite executives (CEOs, CFOs, CTOs, etc.) use equity management software to monitor the ownership structure, analyze dilution, and track stock options or equity compensation granted to key employees and executives.

- Board of Directors: Board members and shareholders may use EMS to view the cap table, review funding rounds, and ensure that equity decisions are in the best interest of shareholders and the company. They may also need to sign off on stock options or other equity grants, making the transparency provided by EMS crucial.

Equity Compensation Administrators

- Stock Plan Administrators: Large companies or firms with extensive equity compensation plans rely on EMS to manage stock options, grants, and other equity-related programs. These administrators ensure that employee equity compensation is properly tracked, administered, and reported.

Third-Party Valuation Providers

- Valuation Firms: Firms that provide 409A valuations and other types of corporate valuations often integrate their services with equity management software to provide real-time fair market value (FMV) assessments, which are critical for pricing stock options.

Corporate Development and Strategy Teams

- Corporate Strategy and M&A Teams: These teams use EMS to assess potential mergers, acquisitions, or strategic partnerships. They rely on equity management tools to understand ownership distributions and the impact of potential deals on the company’s cap table.

Family-Owned Businesses

- Family Offices: Family offices, which manage the wealth and investments of high-net-worth families, may use equity management software to track family-owned company equity stakes, dividends, and other ownership matters.

- Legacy Planning Advisors: These advisors might use EMS to structure family wealth, equity transfers, and other estate planning processes, especially when shares are passed down to heirs or distributed among family members.

Public Sector or Non-Profit Organizations (Rare)

- Foundations or NGOs: Although uncommon, certain foundations or non-profit entities that have a form of ownership or equity in a for-profit venture may use equity management software to track investments or holdings.

What are the benefits of an equity management software

Beyond the core benefits typically highlighted in equity management software (EMS), there are several additional advantages that users may experience. These benefits often relate to less obvious but equally important aspects of operational efficiency, strategic decision-making, and risk management.

How to know when you need an equity management software

To help you identify when equity management software (EMS) is needed without simply listing factors, let’s dive deeper into the indicators and symptoms that might suggest you need a solution, and frame them as practical, real-world situations.

You’re Spending More Time Managing Equity Than Running Your Business

If you and your team are increasingly spending more time managing cap tables, tracking stock options, handling investor reports, or dealing with shareholder communications instead of focusing on core business activities, it’s a sign that you need EMS.

Real-life symptom:

- You’re always behind on maintaining updated cap tables because you’re juggling multiple spreadsheets, which causes delays in crucial decisions (like issuing new options, accepting investor money, or understanding how dilution will impact founders).

- You’re forced to spend valuable executive time responding to investor or employee queries on the status of their shares.

You’re Dreading or Avoiding Key Equity-Related Decisions

When the prospect of managing a new funding round or issuing stock options starts feeling like a daunting task, that’s an indicator of growing complexity in your equity management. If you find yourself procrastinating or overly relying on external consultants to handle these tasks, EMS can take over the repetitive, complex work.

Real-life symptom:

- You delay sending out option grants to employees because it’s too much hassle to ensure that all data is accurate or up-to-date.

- You feel anxious when needing to communicate with investors because you aren’t confident in your cap table’s accuracy.

You’re Getting More Complaints or Confusion from Stakeholders

As your company grows, it becomes increasingly difficult to maintain clarity and transparency for all stakeholders involved (employees, investors, advisors, etc.). If you’re regularly fielding questions or complaints about equity, vesting schedules, or dilution effects, it’s a sign your system is inadequate.

Real-life symptom:

- Employees are confused about the status of their stock options, the value of their shares, or how their options are vested, which causes frustration.

- Investors constantly ask for updated cap tables, and the time it takes you to provide them creates tension.

You Have Equity Complexity but Lack a Clear Picture of Ownership

As your business scales, ownership and equity compensation structures become more complex. If you can’t easily answer fundamental questions about who owns what, what percentage dilution you’re experiencing, or how many outstanding options exist, this is a crucial moment when EMS can be a game-changer.

Real-life symptom:

- You struggle to accurately calculate or explain dilution when new investors come on board.

- You can’t easily understand how a new employee stock option grant will affect the ownership balance or if it’s worth doing given the dilution impact.

You’re Not Sure If You’re Compliant With Regulations

As your company grows and hires more employees or raises more rounds of funding, staying compliant with the IRS, securities regulations, and tax authorities becomes more complex. If you’ve been relying on manual methods or third-party accountants to ensure compliance with regulations like 409A valuations or local securities laws, it’s time to think about automated solutions.

Real-life symptom:

- You feel uneasy or uncertain about your company’s compliance with stock option tax regulations and filing deadlines (e.g., 409A).

- Your company is expanding internationally, but you don’t have a solid understanding of how equity compensation should be treated across various jurisdictions.

Your Company Is on the Verge of a Major Growth Spurt

If you’re planning to scale up quickly, raise more capital, or recruit a larger team, the complexity of your equity management will grow exponentially. EMS helps companies proactively address these challenges, preventing the manual processes from becoming a bottleneck as your company expands.

Real-life symptom:

- You know your company is poised for rapid growth, and you’re anticipating more funding rounds, employee stock options, and an influx of new shareholders, but you’re unsure how to scale your equity management to keep pace with this growth.

- You’re about to launch an employee stock option plan (ESOP), but you aren’t sure if your existing system will be able to handle the increase in activity.

You’re Experiencing Increased Stress or Anxiety Over Equity Data

The risk of making mistakes grows as the complexity of your equity structure increases. If you’re feeling stressed or anxious about the possibility of errors (whether it’s a miscalculation of dilution or a missed deadline for a stock option grant), it’s time to explore a solution that can alleviate that burden and automate the process.

Real-life symptom:

- You lose sleep at night worrying that a mistake in the cap table or a missing vesting schedule might result in serious financial or legal consequences.

- You feel pressure from investors or employees who are counting on you to manage equity accurately and transparently, but the current system feels inadequate to meet these expectations.

You Can’t Keep Up with Reporting Demands

Investors, board members, and stakeholders regularly request updated equity data or reports. If you’re struggling to generate or keep up with these reporting demands — whether for internal purposes or to present to investors or auditors — EMS can significantly streamline and simplify these processes.

Real-life symptom:

- You have to spend hours or days preparing detailed reports (e.g., cap table summaries, stock option grants, vesting status), leading to bottlenecks and delays in meeting reporting deadlines.

- You’re struggling to quickly generate equity reports when an investor requests them, which results in lost trust or potential investment delays.

Your Equity Records Are Not Well-Documented

When equity is tracked manually, there’s a real risk of missing critical details (like the exact terms of an employee’s stock option grant or the ownership rights of investors). If you realize that there are inconsistencies or gaps in your equity documentation, it’s time to adopt software that ensures everything is captured correctly, in real time, and with a clear audit trail.

Real-life symptom:

- You have difficulty tracking the historical changes to the cap table (e.g., who owned what and when) because records are either incomplete or stored across multiple files and systems.

- You’re unsure about past decisions, such as whether the company’s stock options were correctly priced, whether vesting schedules were followed, or if past funding rounds were accurately captured.

You’re Preparing for an Exit Event

Whether you’re planning for an IPO, an acquisition, or any significant exit event, having a clean, accurate, and up-to-date cap table is essential. If your equity structure has become so complicated that it’s not clear who owns what, or if you find it difficult to model how an exit event would affect your shareholders, EMS can provide the clarity and accuracy needed for a smooth transaction.

Real-life symptom:

- You are concerned that your cap table isn’t ready for the due diligence process involved in an M&A or IPO.

- You can’t quickly simulate how an acquisition or IPO will affect the distribution of equity between employees, founders, and investors.

Ultimately, the need for equity management software is about managing complexity more effectively and avoiding errors that could have far-reaching consequences for your company’s equity, finances, and stakeholder relationships.

Equity Management Software FAQs

When considering Equity Management Software (EMS), it’s important to address some common questions that many companies have about these tools.

How can Equity Management Software help me avoid mistakes in my equity records?

One of the biggest challenges for growing businesses is ensuring that equity records remain accurate and up-to-date. As your equity structure gets more complex, it becomes easier to make errors, especially with manual processes like spreadsheets.

Solution: EMS platforms automate the process of updating cap tables, tracking stock option grants, managing vesting schedules, and recording investor transactions. Automation reduces the chance of errors because data is updated in real-time, and multiple stakeholders can collaborate on the same platform without duplicating efforts or making mistakes. The software also provides features like audit trails, which allow you to track changes and see who made what modifications, further ensuring accuracy.

What happens if I choose the wrong equity management software?

Selecting the wrong software can lead to several issues, especially if it doesn’t align with your company’s needs or if it’s not scalable. These can include managing incorrect cap tables, compliance issues, or even errors in equity grants that affect your employees’ compensation and tax filings.

Solution: To avoid the negative impact, it’s crucial to carefully evaluate software based on factors like scalability, ease of use, customer support, and specific features that align with your company’s equity management needs. Choosing a system that’s too complex or not flexible enough for your growth stage can create more work than it solves. However, well-chosen software grows with you, adapting to your needs while providing robust compliance and reporting features.

Can equity management software really reduce the workload for my finance team?

Managing equity manually can be very time-consuming. Finance teams often spend countless hours updating cap tables, handling shareholder communications, processing stock option grants, and ensuring compliance with tax and regulatory standards.

Solution: Yes, EMS can significantly reduce this workload. Many of these systems automate repetitive tasks like generating reports, updating ownership records, tracking stock option vesting schedules, and calculating dilution. This frees up the finance team to focus on strategic tasks and decision-making, rather than spending time on manual data entry or correcting errors. With integration capabilities, EMS can sync with other tools like accounting software to streamline workflows further.

How does Equity Management Software ensure compliance with regulations?

Compliance is a critical concern for businesses issuing equity, especially with different regulations for stock options, tax filings, and securities laws. Missing a deadline or filing the wrong form can result in significant financial or legal penalties.

Solution: EMS helps ensure compliance by automating regulatory tasks and providing real-time updates on key filing dates. For example, the software can help you generate IRS-required forms like 409A valuations for stock options, ensuring that you’re in line with tax regulations. For companies with employees in multiple countries, an EMS solution designed for international compliance can automate the calculation of local taxes, stock option valuations, and other regulatory needs. Additionally, many platforms offer integrations with third-party services that handle complex valuations, securities filings, and tax reporting.

Will my employees understand and use the equity management software?

One of the potential challenges with equity management software is ensuring that your employees understand how to use the system and can easily track their equity and vesting schedules. Confusion around stock options or the value of equity grants can lead to dissatisfaction or questions that HR or finance teams need to answer repeatedly.

Solution: Many modern EMS platforms provide an employee self-service portal where employees can access and view their stock options, understand vesting schedules, and calculate the value of their equity. These portals often include educational resources to help employees better understand how their equity works. Additionally, the software typically features a user-friendly interface designed for employees who may not be familiar with equity compensation. By empowering employees to track their equity, you can reduce the burden on HR or finance teams and improve transparency.

What if my company is planning an exit, like an IPO or acquisition?

Companies planning an exit event, such as an Initial Public Offering (IPO) or merger and acquisition (M&A), need to have their equity records perfectly in order. Inaccurate or outdated cap tables, stock options, or investor records can delay the process and potentially harm the deal.

Solution: EMS is particularly beneficial for preparing for an exit event. It can generate clean and accurate cap tables that show ownership percentages, dilution, and the full distribution of equity. This level of clarity is essential for due diligence during an IPO or M&A process. Many EMS platforms are specifically built with exit-readiness in mind, offering tools for valuation modeling, scenario planning, and due diligence that allow you to assess the impact of an exit on shareholders and employees.

How can I track stock options for a large, growing team?

As your company grows, so will the number of employees who hold stock options or equity compensation. Tracking the vesting schedules, exercises, and tax implications of each grant manually or through spreadsheets can quickly become unwieldy.

Solution: EMS simplifies this by automating the tracking of stock option grants and exercises, as well as ensuring that vesting schedules are followed properly. The software allows you to monitor when options will vest, how they can be exercised, and the tax consequences of each action. For large teams, the software can send automatic reminders to employees and HR, reducing manual follow-ups. It also provides centralized reports on stock options that give you visibility into your company’s total outstanding options and exercises.

What should I do if my company’s equity structure is too complex for a basic EMS?

Some companies, particularly those that have raised multiple rounds of funding or are dealing with multiple classes of stock, find that their equity structure is too complex for basic EMS solutions. These situations can include managing preferred stock, convertible notes, SAFEs, and other hybrid securities, which may not be easily tracked on simpler platforms.

Solution: If your equity structure is particularly complex, you need an EMS that is designed to handle intricate cap tables and multiple classes of equity. Look for advanced modeling capabilities, such as scenario planning, which can show how future events (like a funding round or acquisition) will impact ownership distribution and dilution. Many EMS platforms support complex structures and provide customizable fields for tracking preferred stock, warrants, and other specialized securities. Customizable reporting will also help you keep track of complex shareholder rights and obligations.

What if I don’t have in-house expertise to manage equity?

Small businesses, startups, and even mid-sized companies often don’t have dedicated teams to handle equity management, which can create confusion about stock options, tax compliance, and shareholder communications. This could be particularly problematic as you scale quickly or engage with more investors.

Solution: Many EMS platforms are designed with non-experts in mind. They offer intuitive user interfaces and step-by-step guidance for tasks like issuing stock options, updating cap tables, and calculating dilution. Moreover, some platforms offer outsourced advisory services or integrate with third-party experts (such as accountants, attorneys, or financial advisors) to provide additional support when needed. This ensures that you don’t need in-house expertise to manage your equity effectively, as the software itself guides you through complex processes and offers additional professional help if necessary.

Can I share equity data with investors or board members?

Investors and board members often require up-to-date information on the company’s equity structure. If you’re managing everything manually, preparing these reports on-demand can be slow and error-prone.

Solution: One of the major advantages of EMS is that it allows you to generate detailed, real-time equity reports at the click of a button. Most platforms provide customizable report templates that can be shared directly with stakeholders, including investors, auditors, or board members. These reports often include cap tables, stock option details, dilution projections, and any other relevant equity data. By offering transparent and easily accessible information, EMS platforms foster trust and confidence with your investors and board, as they can instantly access updated data without you having to manually compile reports each time.

What if my company’s equity is constantly changing?

As your company grows, you might be constantly issuing new stock options, conducting funding rounds, or changing the equity distribution. Keeping everything aligned manually can result in confusion and errors.

Solution: EMS platforms are designed to handle constant changes seamlessly. They allow for real-time updates to cap tables and equity records as new transactions occur, whether it’s a new stock option grant, a funding round, or a share buyback. These updates are automatically reflected across the platform, ensuring that everyone, from HR to finance, has access to the most current data without the need for manual updates. Real-time updates reduce errors and improve coordination across departments.